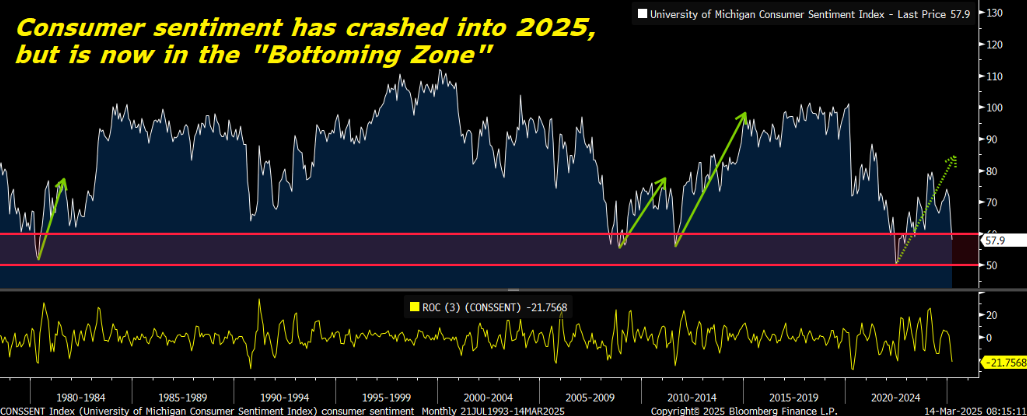

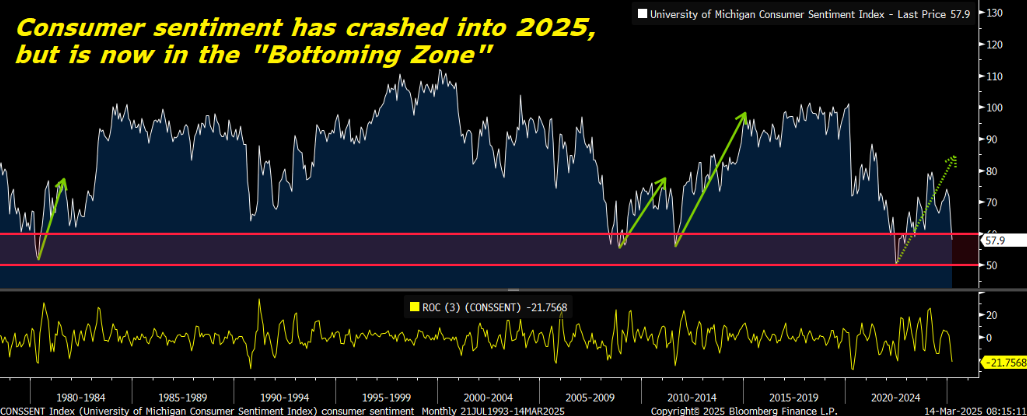

Editor’s Word: Over the previous three months, shopper sentiment has dropped by 21%, its largest three-month crash because the depths of the COVID-19 pandemic in summer time 2020.

As my InvestorPlace colleague Luke Lango places it… we’ve reached the bottoming zone.

Nonetheless, huge shopper sentiment rebounds out of the bottoming zone can coincide with main market rebounds; this implies this might really be a good time to purchase shares.

Luke is becoming a member of us at the moment to inform us why, regardless of the info, shopper sentiment may rebound over the subsequent few months – and why shares may, too…

Take it away, Luke…

Customers are feeling gloomy concerning the economic system proper now… and the College of Michigan’s terrible Client Sentiment Report reveals that the outlook is just getting worse.

There’s no different approach to put it – shopper sentiment is crashing. The college’s headline index dropped from 64.7 in February to 57.9 in March, its lowest stage since November 2022.

The Present Circumstances Index dropped to 63.5, its lowest since September 2024. And the Expectations Index dropped to 54.2, its lowest since July 2022.

Throughout the board, shopper sentiment is collapsing. However this isn’t a brand new pattern; it’s been occurring all 12 months lengthy.

Over the previous three months, shopper sentiment has dropped by 21%, its largest three-month crash because the depths of the COVID-19 pandemic in summer time 2020.

That’s ugly knowledge.

Nonetheless, as everyone knows, there’s notion, and there’s actuality.

In actuality, are issues actually that dangerous?

At 2.3%, gross home product (GDP) development remains to be constructive. Client spending is regular. Unemployment is low at 4.1%. Inflation is falling, at the moment hovering round 2.8%. At about 4.3%, based on the Federal Reserve Financial institution of Atlanta, wage development is robust and operating above inflation. And because the fourth-quarter earnings season illustrated, company earnings are nonetheless rising, with greater than 75% of the S&P 500 exceeding consensus estimates.

Positive, we have now ongoing tariff drama and coverage uncertainty. However the economic system nonetheless stays on strong footing.

So, whereas sentiment is within the basement proper now, the actual economic system seems to be doing simply superb.

That might change, in fact. However as of proper now, financial situations are fairly regular.

That’s why we expect shopper sentiment will rebound over the subsequent few months – and as that happens, stocks should, too…

Is the Backside Close to?

Client sentiment is at the moment being walloped by tariff drama, federal spending cuts, and coverage uncertainty. However we expect all these dynamics will ease within the coming months.

In our view, the Trump administration is front-loading these strikes so it could pave the way in which for different issues – like a giant tax lower bundle and extra deregulation – which ought to increase shopper sentiment.

That’s, we imagine briefly dangerous coverage developments are weighing on shopper sentiment. However because the administration shifts focus within the coming months, shopper sentiment ought to rebound.

The information appears to agree with this thesis.

The College of Michigan’s Client Sentiment Index has crashed to ranges which are traditionally thought of the “bottoming zone.”

Since 1980, shopper sentiment has oscillated violently between actually low and actually excessive readings. But it surely has persistently bottomed within the 50 to 60 vary.

In 1980, amidst the Federal Reserve’s aggressive rate-hiking cycle, it bottomed at 52. In 2008, it bottomed at 55 through the monetary disaster. It bottomed at 56 in 2011 through the European sovereign debt disaster and at 50 within the thick of 2022’s inflation disaster.

The buyer sentiment index simply dropped beneath 58. Traditionally talking, we’ve reached the bottoming zone.

If this really is the underside, then this could possibly be a really good time to be buying stocks…

As a result of huge shopper sentiment rebounds out of the bottoming zone – like we noticed within the early Eighties, popping out of the GFC, in 2012/13, and in 2023/24 – coincided with main market rebounds.

The Closing Phrase on Client Sentiment

Wall Road is in turmoil proper now.

This week, the S&P 500 fell into correction territory – dropping 10% from current highs – in one in all its quickest crashes of all time. Equally, the Nasdaq has crashed 15% from current highs, and the Russell 2000 has plunged virtually 20%.

But when we’re proper about shopper sentiment knowledge discovering a backside quickly… then shares ought to do the identical… that means Wall Road’s current volatility is definitely creating an amazing shopping for alternative.

That’s why we’re telling our subscribers to again up the truck and purchase shares proper now.

However the place ought to of us search for the perfect shopping for alternatives?

It’s no secret that we’re bullish on AI – the best technological revolution in three many years. This breakthrough has already created fabulous funding alternatives, permitting buyers to lock in ~990% features in Palantir (PLTR) and 400% earnings in Nvidia (NVDA) over the previous two years. And a lot extra is but to come back.

However right here’s the problem: the broader AI commerce is crowded. That’s why we’ve been trying to find the subsequent huge business breakthrough…

And we’ve discovered it in what I name AI 2.0 – a growth that could possibly be an order of magnitude larger than something we’ve seen within the AI Growth to date.

Sincerely,

Luke Lango

Editor, Hypergrowth Investing