- Rising change whale ratio and hike in put choices instructed Bitcoin might face promoting strain quickly

- Bitcoin’s Choices market revealed heightened demand for draw back safety

Bitcoin [BTC] could also be heading into turbulent waters. A pointy uptick in change whale exercise and rising warning within the Choices market are flashing early warning indicators.

Because the change whale ratio climbs to its highest stage in over a 12 months and put choices outpace calls in each volumes and premium, merchants seem like bracing for potential draw back.

The shift in sentiment means that a few of the market’s greatest gamers could be making ready to promote, elevating the opportunity of better volatility within the days forward.

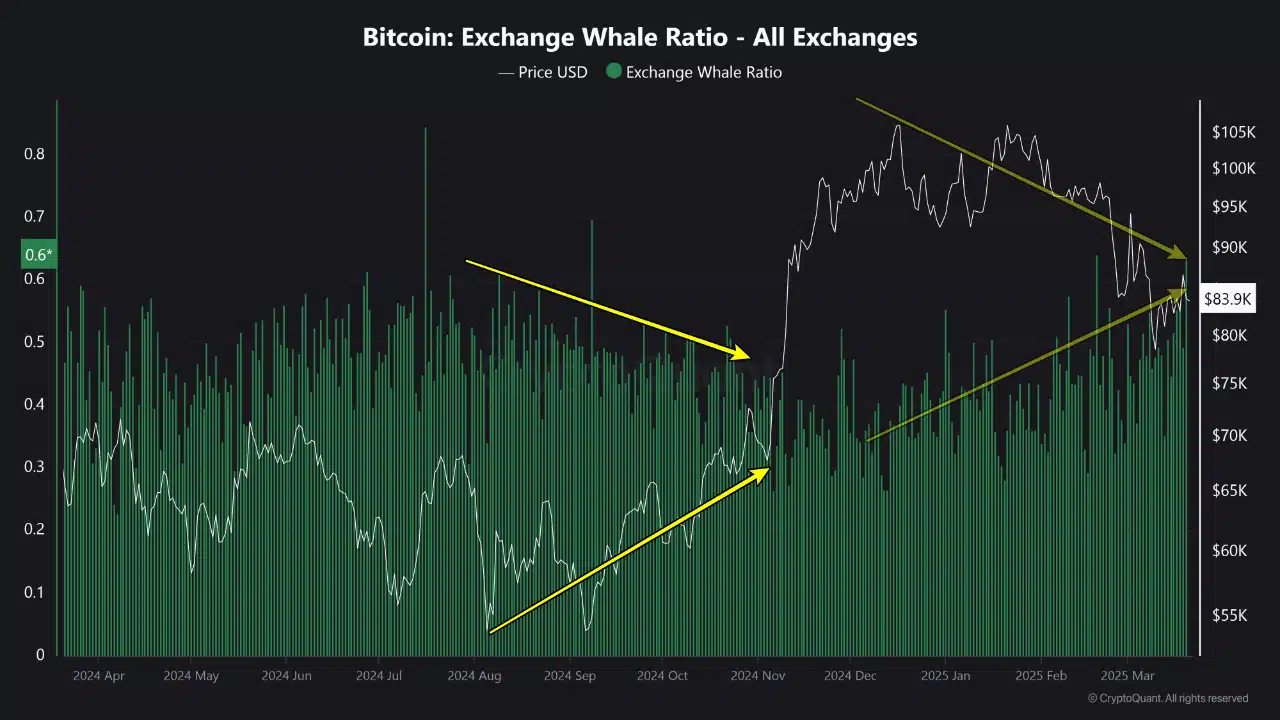

Alternate whale ratio – A sign of potential promoting strain

The Exchange Whale Ratio climbed to 0.6 – Its highest studying in over a 12 months.

This spike indicated that giant holders, or whales, are actually answerable for a major share of Bitcoin getting into exchanges. Traditionally, such conduct tends to precede main market strikes, usually hinting at a hike in promoting exercise.

As is evidenced by the chart, comparable spikes in mid-2024 had been adopted by notable worth declines.

The newest hike coincided with Bitcoin’s current worth retracement from its all-time excessive – An indication that whales might as soon as once more be reallocating property in anticipation of market weak point. If previous developments maintain, elevated whale ratio ranges might spell volatility forward.

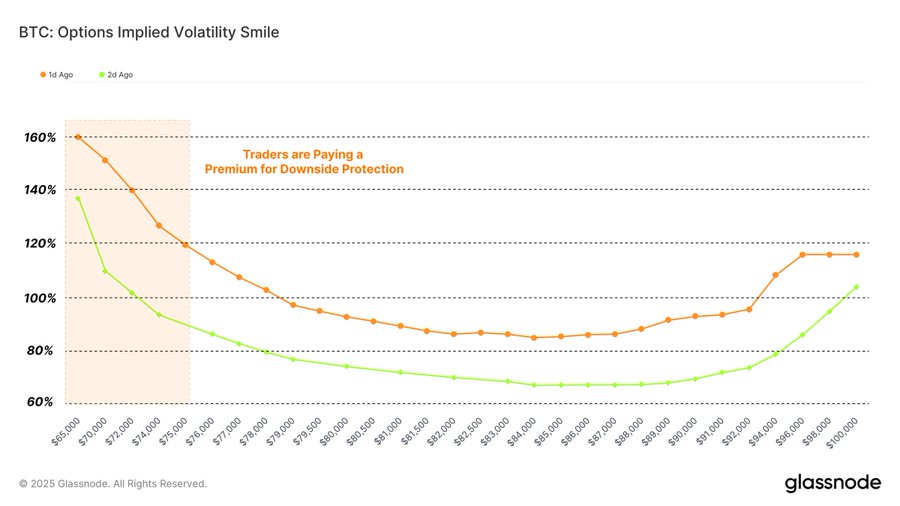

Bitcoin Choices market – Rising demand for draw back safety

Bitcoin‘s Choices market has been flashing indicators of warning too.

Choices enable traders to hedge in opposition to worth swings, and the press time positioning revealed a transparent tilt in the direction of threat aversion. The implied volatility smile chart highlighted that merchants are paying a premium for put choices, in comparison with calls, particularly for strike costs beneath $80,000.

This pattern might be interpreted to allude to rising demand for draw back safety as traders brace for potential declines.

The steep leftward skew on the chart hinted at heightened worry of short-term volatility and appeared to bolster the broader market’s shift towards defensive methods. This surge in put premiums can also be an indication of investor sentiment turning cautious, aligning with on-chain whale exercise whereas pointing to a extra cautious outlook for Bitcoin within the close to time period.