Unlock the Editor’s Digest without spending a dime

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

Monday was the tip of the quarter, and you understand what meaning! That’s proper: Trillions of {dollars} can be barely rejigged due to an arbitrary date in an arbitrary calendar in response to arbitrary guidelines of thumb.

Most huge institutional traders and quite a lot of extraordinary ones have some form of asset allocation framework that divvies up their cash into varied markets. A typical one is a 60/40 mannequin, the place 60 per cent goes into equities and 40 per cent into bonds, however they arrive in many various flavours.

Many traders usually rebalance their portfolios to convey allocations again to the goal. For instance, if shares have carried out phenomenally you then’ll find yourself obese equities. So on the finish of the month, quarter or yr you would possibly due to this fact promote some shares and purchase bonds. Or vice versa if bonds have outperformed shares. It’s a easy, rules-based buy-the-dip technique.

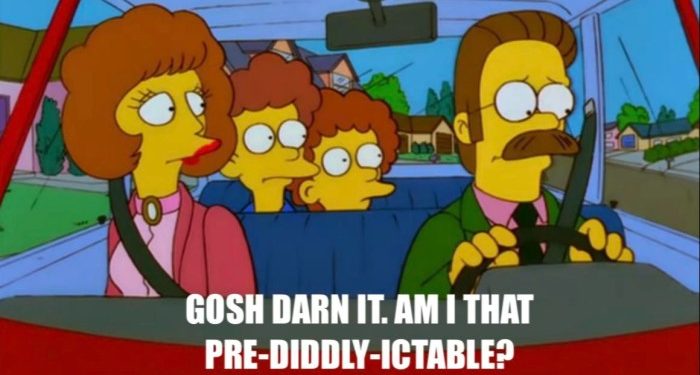

Nonetheless, there’s lengthy been a suspicion that that is so predictable — and the ensuing flows so gargantuan — that hedge funds and prop buying and selling companies can profitably front-run these common rebalancing flows.

A brand new NBER paper written by Campbell Harvey, Michele Mazzoleni and Allesandro Melone backs this up. They estimate that the “unintended penalties of rebalancing” prices US traders alone about $16bn a yr.

A back-of-the-envelope calculation utilizing our predictability outcomes estimates that the rebalancing prices borne by institutional traders can exceed 8 bps per yr. For a market probably exceeding $20 trillion in measurement, rebalancing pressures may translate into an annual value of $16 billion, or about $200 per U.S. family every year.

To place these numbers in perspective, these prices are increased than these institutional traders pay to take a position passively throughout fairness and bond markets. In different phrases, rebalancing a balanced fairness/bond portfolio may cost a little greater than the charges to entry these markets within the first place. Additional, since rebalancing prices recur yearly, their true current worth is considerably bigger.

The economists modelled two of the most typical rebalancing approaches, 1) a less complicated, calendar-based method of rebalancing on the ultimate buying and selling day of every month; and a pair of) a barely extra refined one the place traders enable some drift inside a variety, and solely rebalance regularly as soon as it crosses preset thresholds.

The paper discovered that the fashions have been predictive of what really occurred across the finish of quarters: When shares had carried out nicely and bonds badly, rebalancing funds bought shares and purchased bonds, resulting in a short lived decline in fairness returns of 16 foundation factors and a 4 bps uplift in bond returns. When bonds had outperformed shares the other impact occurred.

Furthermore, the affect pale in lower than two weeks, “suggesting that rebalancing trades carry restricted informational content material about asset fundamentals”.

The economists constructed a pattern portfolio that used these predictive alerts, which generated common annualised returns of about 9.9 per cent throughout the 1997-2023 pattern interval. This equates to a reasonably sharp Sharpe Ratio of greater than 1, and the technique carried out “notably nicely” when markets have been particularly turbulent, and rebalancing flows might be extra significant.

Nonetheless, the paper’s most important level was that huge, lumbering institutional traders are collectively letting merchants scalp them for billions of {dollars} a yr. Common rebalancing stays necessary, but it surely simply shouldn’t be so dang predictable, Harvey et al argued:

. . . Rebalancing stays a basic software for guaranteeing portfolio diversification, managing liquidity, and producing utility features for mean-variance traders in comparison with a non-rebalanced portfolio. Due to this fact, designing simpler rebalancing insurance policies that protect the advantages of rebalancing whereas minimizing its prices looks like a precedence for future researchers and traders.

Alphaville’s understanding has lengthy been that institutional traders ARE conscious of the hazards, and there may be because of this pretty little homogeneity in relation to the hows and whens of rebalancing.

However these outcomes counsel that collectively these efforts nonetheless quantities to a blob of capital shifting in predictable style. And apparently, Elm Analysis just lately discovered that common rebalancing doesn’t really matter as a lot as you would possibly assume, a minimum of for particular person traders.