- Bitcoin ETF outflows and miner exercise sign warning regardless of a bullish breakout try.

- Bitcoin Obvious Demand exhibits early rebound, however sentiment stays under the impartial threshold.

After weeks of suppressed curiosity, Bitcoin’s [BTC] 30-day obvious demand metric has lastly rebounded from its March-April lows, hinting at a possible market shift.

The 30-day metric, which had plunged to -200,000 BTC—its lowest degree since early 2023—has begun edging upward.

Naturally, this delicate rebound hinted at renewed purchaser curiosity. Nevertheless, demand nonetheless lingered within the crimson, displaying the restoration remained fragile.

With out a clear push into constructive territory, investor confidence was unlikely to return with full power.

Market sentiment dips under impartial as volatility returns

In fact, demand wasn’t the one shaky pillar. Sentiment had additionally turned cautious.

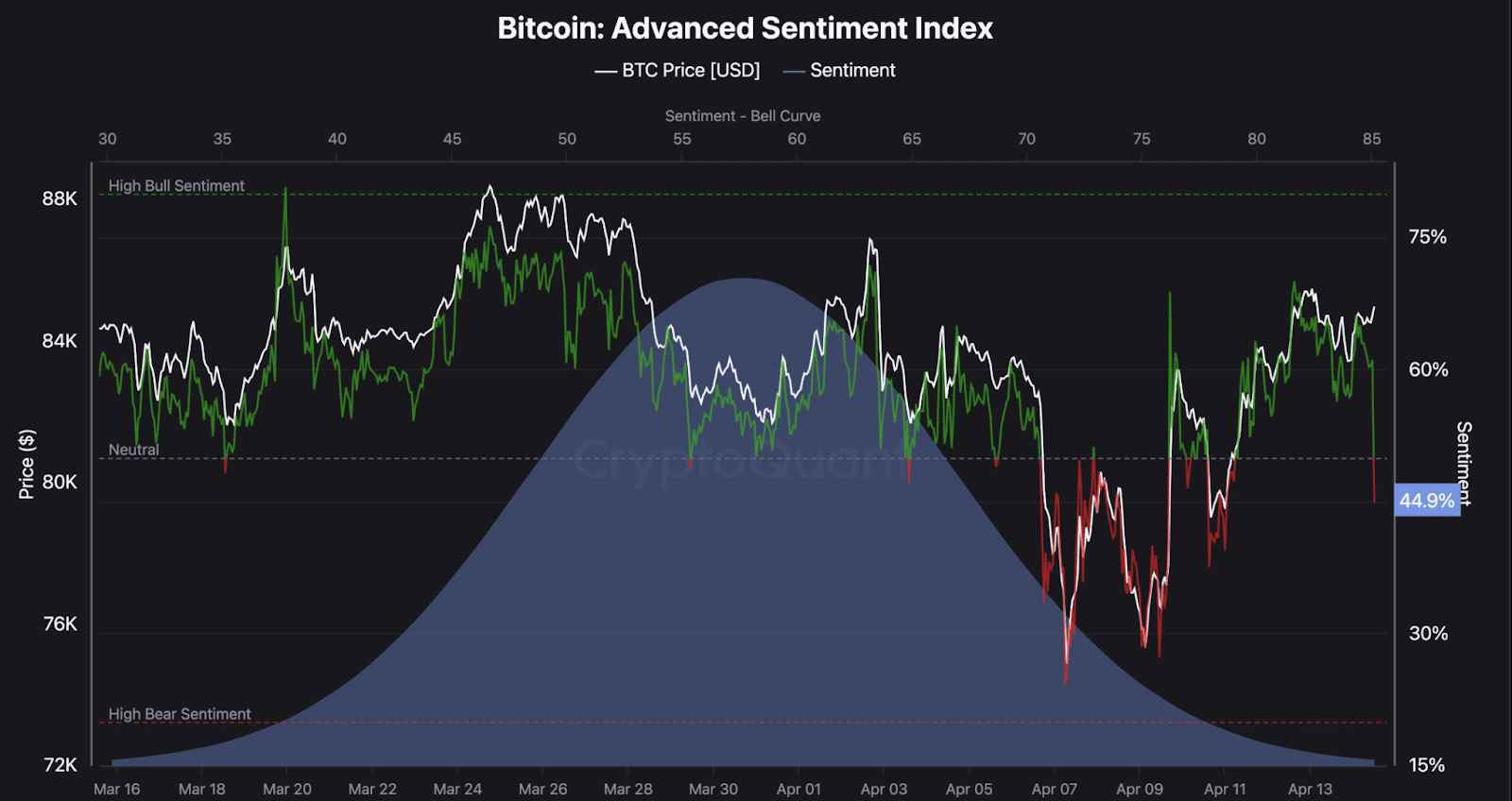

By the point of writing, the Bitcoin Superior Sentiment Index hadvert fallen to 44.9%, dropping under the impartial zone and nearing bearish situations.

Sentiment had hovered round 70% in mid-March however deteriorated alongside elevated market volatility.

Bitcoin briefly touched $88,000 on the 2nd of April, earlier than falling sharply to as little as $75,000 throughout the first half of April.

Though worth motion has since stabilized, the drop in sentiment has mirrored the uneven restoration, additional reinforcing the market’s hesitance to decide to a robust bullish narrative.

Establishments retreat as Bitcoin ETF inflows decline

Institutional flows, as soon as a key pillar of Bitcoin’s power, have begun to weaken.

Spot ETF holdings dropped from 1.19 million BTC in March to simply 1.115 million BTC in early April. This determine broke under the alert threshold of 1,116,067 BTC, triggering warnings of a major institutional pullback.

Extra importantly, this marked a break from the regular ETF accumulation pattern that had dominated most of 2024.

With establishments now pulling again, long-term confidence seemed to be eroding, regardless of some indicators of retail curiosity returning.

On the identical time, miner exercise has shifted towards a probably bearish stance. The Miners’ Place Index (MPI) surged practically 40% in 24 hours, reflecting an elevated outflow of BTC relative to its one-year common.

Traditionally, such an increase signifies that miners are making ready to promote a portion of their reserves—both to safe income or in anticipation of additional draw back.

When mixed with ETF outflows and weakening sentiment, this miner conduct provides one other layer of stress to Bitcoin’s restoration path.

BTC breakout affords hope, however…

On the technical entrance, Bitcoin has damaged out of a descending trendline, sparking optimism for a bullish reversal. Finally examine, BTC hovered round $83,946—up 0.29% up to now 24 hours.

Furthermore, a visual double-bottom sample emerged in current classes, reinforcing bullish potential. BTC now trades between $76,572 assist and $87,889 resistance—each key short-term ranges.

For bulls to regain management, a clear break above $87,889 is critical, which might open the trail towards the $98,825 degree.

Till this resistance is decisively flipped, the broader market restoration stays tentative and extremely reactive to macro and on-chain developments.