Bitcoin has produced a range-bound motion just lately, with costs oscillating between $83,000 and 86,000. Apparently, fashionable crypto analyst Burak Kesmeci has recognized the essential value ranges for any short-term motion.

Assist At 82,800, Resistance At 92,000 – However The place Is Bitcoin Headed?

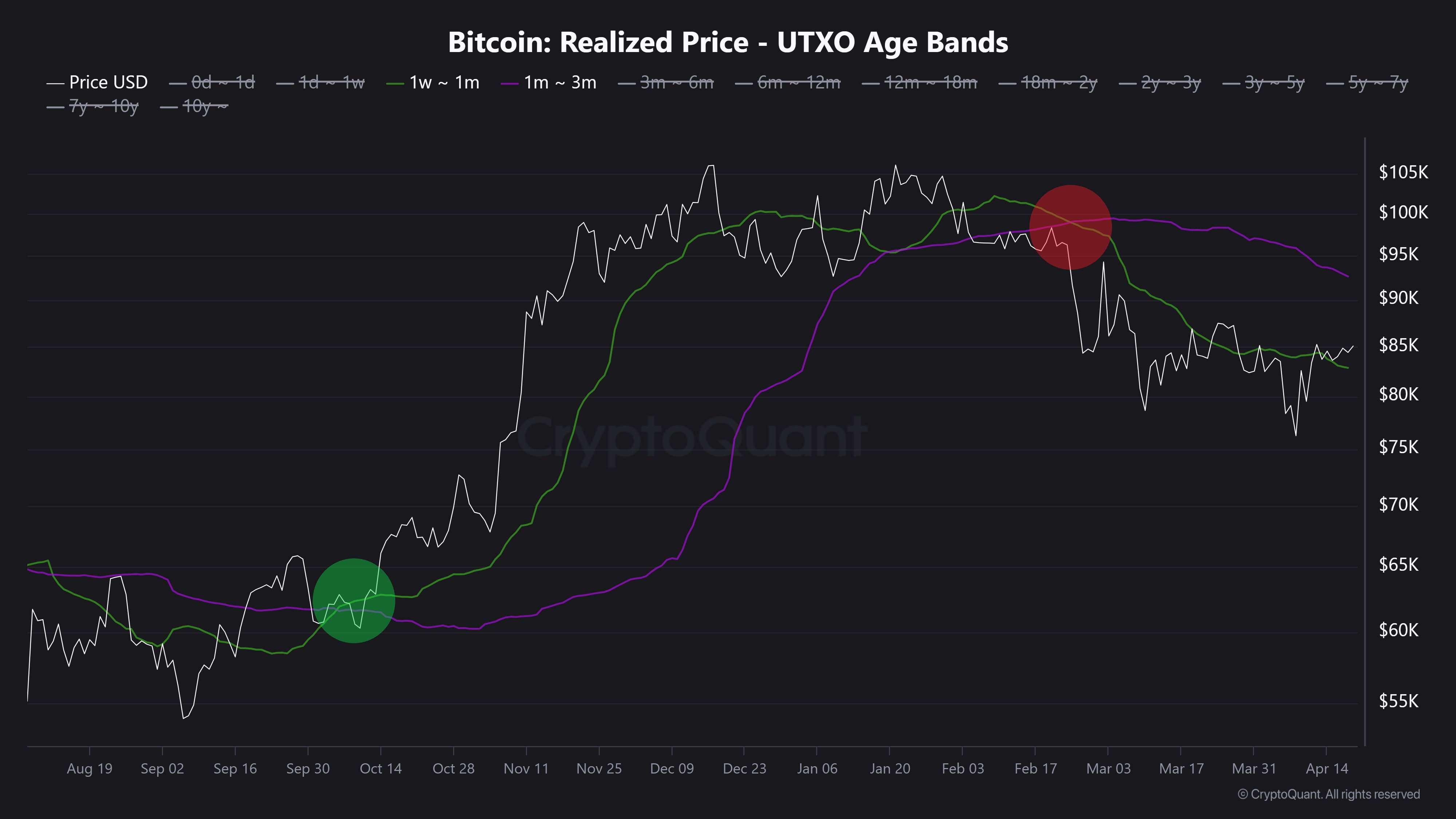

In a new post on X, Kesmeci shared an fascinating on-chain evaluation of the Bitcoin market. Utilizing the short-term investor price foundation, the analyst recognized two key value ranges that might show important to Bitcoin’s subsequent main transfer.

Firstly, Burak Kesmeci focuses on the typical price costs of recent merchants over the previous 1-4 weeks, that are doubtless essentially the most reactive to cost adjustments. The realized value for these merchants at the moment stands at $82,800, forming a near-term assist that signifies many latest patrons are nonetheless in revenue and should defend this degree as a psychological flooring.

In the meantime, Kesmeci additionally highlights the $92,000 value degree, which marks the typical price foundation for BTC holders for 1-3 months. This value level has emerged as an essential resistance zone, as traders are prone to exit the market as soon as they break even. Moreover, the $92,000 value degree can be marked by a confluence with numerous technical indicators.

The interaction between these two ranges is critical. Traditionally, short-term bullish developments in BTC have a tendency to start when the associated fee foundation of more moderen traders, 1–4 weeks, crosses above that of the 1–3 BTC holders. This shift alerts elevated confidence and willingness to purchase at larger ranges, which frequently fuels broader rallies.

Nevertheless, that dynamic stays to play out within the present market. As of now, Bitcoin is buying and selling round 85,000, positioning it above its assist on the 1–4 week common of $82,800 however nonetheless under the 1–3 month resistance of $92,000. Moreover, each price foundation ranges have been declining over the previous two months, reflecting hesitation or a scarcity of aggressive shopping for from new entrants.

Notably, Kesmeci states that BTC should surge above $92,000 to verify a powerful bullish momentum for a value reversal.

Bitcoin ETFs Offload 1,725 BTC

In different information, Ali Martinez reports that the Bitcoin ETFs have suffered withdrawals of 1,725 Bitcoin, valued at $146.92 million, over the previous week. This improvement illustrates a excessive degree of destructive sentiment amongst institutional traders, including to market uncertainty across the BTC market.

In the meantime, Bitcoin trades at $85,249 following a value change of 0.89% up to now day. The premier cryptocurrency additionally displays a 0.58% loss on the weekly chart and a 1.06% acquire on a month-to-month chart.

Characteristic picture from Adobe Inventory, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.