Unlock the White Home Watch e-newsletter free of charge

Your information to what Trump’s second time period means for Washington, enterprise and the world

US shares jumped on Wednesday after Donald Trump mentioned he had no plans to fireside Federal Reserve chair Jay Powell, easing worries in regards to the independence of the American central financial institution that had rocked markets this week.

The S&P 500 climbed 3.2 per cent in morning commerce, whereas US Treasuries and European equities additionally made robust features.

The strikes constructed on Tuesday’s rebound for the Wall Road benchmark, which rose 2.5 per cent as Trump indicated a possible easing of commerce tensions with Beijing, saying that tariffs on Chinese language items would “come down considerably”.

The president additionally reiterated his frequent criticism that the Fed wanted to chop borrowing prices, however added: “I don’t need to speak about that as a result of I’ve no intention of firing [Powell].”

“Markets will welcome his (begrudging) vote of confidence, however the harm to Fed independence has been performed,” mentioned Dario Perkins, of consultancy TS Lombard, in a notice to shoppers. “Trump needs charge cuts, however his vicious assaults on Powell have made it more durable for the central financial institution to ship.”

The broad Stoxx Europe 600 index rose 2 per cent on Wednesday, and Germany’s Dax index prolonged current features with a 3.2 per cent rise.

The ten-year US Treasury yield fell 0.06 share factors to 4.33 per cent, persevering with a current decline after sharp will increase earlier this month. Bond yields transfer inversely to costs.

The US greenback gained 0.5 per cent towards a basket of friends, though the foreign money continues to hover round multiyear lows having dropped greater than 8 per cent this 12 months thus far.

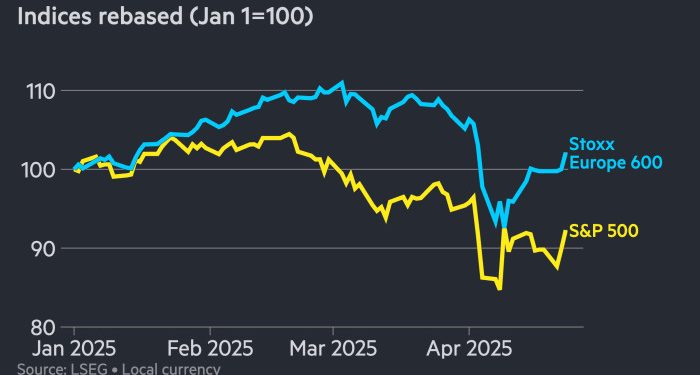

Wednesday’s strikes come after a risky month for monetary markets following Trump’s so-called “liberation day” tariff bulletins triggered a pointy hunch in US equities. The S&P 500 stays greater than 7 per cent decrease thus far this 12 months regardless of rebounding this week.

Know-how shares have been hit even more durable, with the Nasdaq Composite index shedding greater than 12 per cent because the starting of the 12 months. The Nasdaq climbed 4.2 per cent on Wednesday.

Markets had been additional rattled final week after Trump, who has been a persistent critic of Powell, signalled he believed he might dismiss the Fed chair earlier than the top of his time period in Could 2026.

Salman Ahmed, international head of macro and strategic asset allocation at Constancy Worldwide, described the confrontation between the White Home and the Fed as “a manifestation of a elementary pressure” within the financial system.

He mentioned Trump’s tariff insurance policies had “put strain on the twin mandate of the Fed” by rising inflationary pressures whereas additionally hurting development.

“That pressure just isn’t going to go away basically till we all know the place the tariffs are going to settle,” Ahmed mentioned. “The day-to-day newsflow goes to result in elevated volatility.”

Extra reporting by Ray Douglas