Unlock the White Home Watch publication without cost

Your information to what Trump’s second time period means for Washington, enterprise and the world

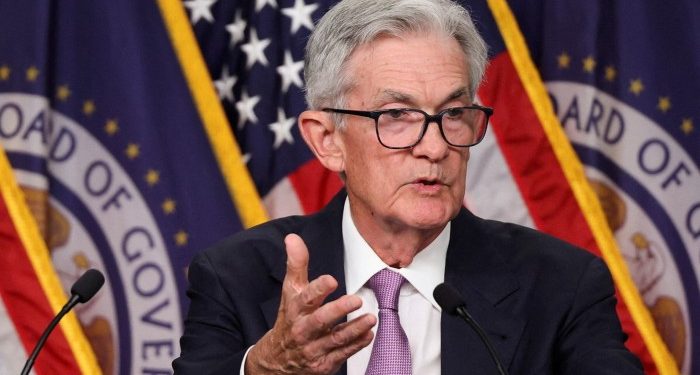

The US Federal Reserve is broadly anticipated to maintain rates of interest at their current stage when it meets subsequent week, with chair Jay Powell’s press convention possible to be traders’ primary focus following a unstable month for monetary markets.

Donald Trump’s erratic tariff bulletins have buffeted US shares, Treasuries and the greenback in current weeks whereas fanning considerations about slower progress and better inflation on the earth’s greatest economic system. The president has repeatedly signalled that he thinks rates of interest needs to be lowered to stimulate the economic system.

But information launched on Friday exhibiting the US added 177,000 jobs in April, greater than economists had anticipated, bolstered traders’ conviction that the Fed will stay on maintain. Merchants in swaps markets are at present pricing in near a 97 per cent likelihood that charges will stay between 4.25 and 4.5 per cent.

Wednesday’s central financial institution assembly “seems like a placeholder: coverage charges on maintain and no change in Chair Powell’s tone from his current speeches,” stated Financial institution of America strategists led by Aditya Bhave.

“We predict the bar for a June minimize is excessive, however Powell is unlikely to rule it out at this stage,” he added.

Trump final month renewed his criticism of the Fed chair, claiming he has the proper to fireplace Powell, who he has lambasted for being “too sluggish” to decrease charges. Requested whether or not he would sack the central banker, Trump stated: “If I would like him out, he’ll be out actual quick, consider me.”

US shares and the greenback offered off sharply on the feedback as traders frightened that the central financial institution’s independence was below risk solely to rebound after Trump rowed again.

Powell is prone to sidestep any questions on his relationship with Trump, however his views on the potential influence of the president’s tariffs on inflation and employment will probably be scrutinised. George Steer

Will the Financial institution of England sign extra cuts?

Merchants are absolutely anticipating the UK’s central financial institution to cut back its coverage charge by 1 / 4 level to 4.25 per cent at its assembly on Thursday, in accordance with ranges implied by swaps markets. Most count on three extra cuts of the identical magnitude to comply with earlier than the top of the yr.

What the Financial institution of England indicators on the inflationary outlook will probably be essential as to if these expectations maintain. Analysts at Barclays expect the financial institution to chop its inflation forecast, “signalling that the stability of dangers has shifted to a much less inflationary outlook”. That can “open the door to a June minimize with out explicitly referencing it, to retain optionality”, they argue.

Like different main central banks, the BoE is caught between the expansion impacts and inflationary results of Donald Trump’s stop-start commerce struggle, making any resolution to regulate financial coverage in response fraught with issue. Latest UK financial information has been blended, with higher than anticipated retail gross sales in March however weak readings of enterprise exercise.

BoE governor Andrew Bailey has warned that the central financial institution should “take critically” the dangers to progress from the tariff surge. The hawkish charge setter Megan Greene, has stated that the impact of worldwide tariffs will in all probability be disinflationary for the UK.

JPMorgan’s Allan Monks is anticipating a “dovish shift” from the BoE on the influence of tariffs. “Whereas potential provide chain impacts stay one consideration, weaker progress and an extra provide of Chinese language items might show extra dominant,” he argues, saying foreign money strikes haven’t added to the inflationary pressures as would have been anticipated. However he expects the financial institution to be “cautious” in placing a lot weight on this disinflationary view. Ian Smith and Valentina Romei

Have shares handed peak anxiousness over tariffs?

This week’s rally in international shares noticed Wall Road’s blue-chip S&P 500 recoup all of its sharp losses since Donald Trump’s April 2 announcement of so-called “reciprocal” tariffs roiled markets.

After a dramatic 9 per cent drop within the first week of April, US shares began to regain floor after the president introduced a 90-day tariff pause on April 9. David Lefkowitz, Head US Equities at UBS World Wealth Administration stated the U-turn “gave us the boldness to re-upgrade equities”.

Final week, traders have been additional cheered by progress in the direction of US-China commerce talks, as effectively robust earnings studies from US tech giants, and inspiring information on the American economic system. However the coverage setting stays removed from sure, with little tangible progress in the direction of commerce offers secured. That leaves many analysts feeling nervous about piling again right into a market that noticed such dramatic falls so just lately. The query for fairness traders is: is the worst over, or is it nonetheless but to come back?

The rally is “fairly astonishing contemplating the massive shake up of worldwide commerce that has occurred within the span of 4 weeks,” stated Elyas Galou, senior funding strategist at Financial institution of America, including that it “reveals that traders stay basically bullish on the outlook for US equities, charges and the greenback”.

“The technique of the Trump administration was to frontload the unhealthy information,” he stated “Now the market is frontloading the subsequent 100 days. I believe this era will give attention to decrease taxes, decrease tariff charges,” he defined.

Others are extra cautious. “We predict the rally off the lows is extra a operate of place capitulation than an ‘all clear’ sign for threat,” learn a BNP Paribas evaluation be aware, including that earnings downgrades “might see equities re-test year-to-date low”. Emily Herbert