The Kalman Filter is an optimum algorithm used for smoothing knowledge by balancing predicted values and precise measured values. On this indicator, the Kalman Filter is utilized to clean worth knowledge, with the flexibleness to decide on the enter knowledge (e.g., shut, open, excessive, or low costs). This customization permits customers to tailor the evaluation to their particular wants.

1. Total Goal

The first objectives of the Kalman Filter are:

- Cut back noise in worth knowledge: Eradicate random fluctuations to provide a extra secure sign.

- Detect tendencies: Spotlight market tendencies by combining predictions (from dynamic fashions) with precise measurements (customizable enter knowledge).

2. Step-by-Step Course of

Step 1: Initialization

The Kalman Filter begins with the next preliminary values:

- Estimate (Present State): The preliminary state is about to the primary worth within the knowledge collection (e.g., the primary closing worth or any user-selected enter).

- Prediction Error: Initialized with a excessive worth, reflecting the preliminary uncertainty of the system.

- Measurement Error: Proportional to the smoothing interval. An extended interval implies higher measurement error, reflecting that the info is much less dependable.

Step 2: Predict the Subsequent State

On this step, the Kalman Filter predicts the subsequent state primarily based on the present state:

- Predicted Worth: Derived from the present estimated state.

- Prediction Error: Stays largely unchanged at this stage, as no new knowledge has been launched but.

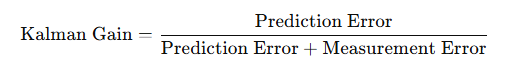

Step 3: Compute the Kalman Acquire

The Kalman Acquire is a weight that determines the affect of the expected worth versus the measured worth. It’s calculated utilizing the formulation:

- Significance:

- If Measurement Error is small (dependable knowledge), the Kalman Acquire is excessive, which means the measured worth has a higher affect.

- If Prediction Error is small (correct prediction), the Kalman Acquire is low, which means the prediction carries extra weight.

Step 4: Replace the Estimate

Utilizing the Kalman Acquire, the expected worth is adjusted primarily based on the discrepancy between the precise measurement and the expected worth:

- Measurement Distinction: That is the distinction between the precise enter worth (e.g., the chosen worth kind) and the expected worth.

- Kalman Acquire: Determines how a lot the prediction ought to be corrected by the measurement.

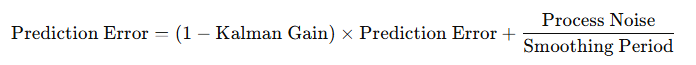

Step 5: Replace the Prediction Error

The prediction error is up to date and progressively decreases over time, reflecting growing confidence within the estimate:

- Course of Noise: Displays the uncertainty within the dynamic mannequin and is adjusted primarily based on the smoothing interval.

- The result’s a steadily reducing error, bettering the steadiness of the output sign.

3. How Kalman Filter Smooths Information within the Indicator

The Kalman Filter balances two sources of data:

- Predicted Worth: The worth derived from the earlier state, representing a secure pattern.

- Measured Worth: The precise enter knowledge, which displays the most recent market situations (e.g., user-selected worth kind).

- When the measured worth is noisy (excessive Measurement Error), the smoothed worth is much less influenced by the measurement.

- When the measured worth is secure (low Measurement Error), the smoothed worth rapidly adapts to the modifications.

4. Particular Purposes within the Indicator

- Customizable Enter: Customers can choose the enter knowledge kind (e.g., shut, open, excessive, low, hl2, hlc3, ohlc4, … costs) relying on the evaluation wants.

- Brief- and Lengthy-Time period Indicators: Two Kalman Filters are utilized concurrently for brief and lengthy smoothing durations:

- Brief-Time period: Reacts rapidly to short-term market fluctuations.

- Lengthy-Time period: Detects extra secure, long-term tendencies.

- Development Detection: The comparability between the 2 Kalman Filter outputs determines the market pattern:

- If the short-term sign is above the long-term sign, the pattern is upward.

- If the short-term sign is beneath the long-term sign, the pattern is downward.

5. Benefits of Kalman Filter within the Indicator

- Efficient Smoothing: Reduces random noise in worth knowledge, producing a extra secure output sign.

- Versatile Customization: The power to decide on enter knowledge enhances evaluation versatility.

- Development Detection: Combining short- and long-term alerts supplies a transparent identification of upward or downward tendencies.

- Fast Adaptation: Steady updates with new knowledge make sure the smoothed sign displays latest market modifications.

6. Logic Abstract

The Kalman Filter on this indicator works by balancing predictions (stability) and precise measurements (sensitivity to alter). With customizable enter choices, customers can optimize the pattern detection course of to swimsuit their particular necessities. The Kalman Acquire acts as a dynamic weight, making certain that the output is each secure and responsive. The ensuing smoothed sign supplies a dependable basis for figuring out tendencies in monetary markets.

—

Obtain the Kalman Development Ranges Scanner indicator utilizing the Kalman Filter logic above with built-in Scanner of foreign money pairs, time frames right here:

– for MT5: Kalman Development Ranges MT5 Scanner

– for MT4: Kalman Development Ranges MT4 Scanner