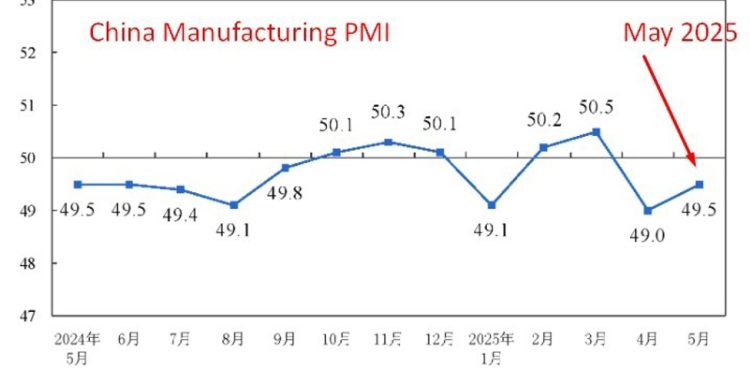

Information from China’s Nationwide Bureau of Statistics (NBS) launched on Saturday, Could 31, 2025, official Could 2025 PMIs

Manufacturing Sector

-

PMI: Rose to 49.5 (anticipated 49.5 and from 49.0 in April); nonetheless under the 50 threshold, indicating contraction for a second month. The advance in Could is probably going reflecting some thawing within the icy commerce battle that chilled once more this week. Buying managers however took a cautious method, evidenced by the index remaining in contraction, amid lingering, and proved justified, uncertainties.

-

Massive enterprises: PMI at 50.7 (increasing, +1.5 pts).

-

Medium-sized: 47.5 (contracting, -1.3 pts).

-

Small enterprises: 49.3 (contracting, however improved +0.6 pts).

-

-

Sub-indices:

-

Manufacturing: 50.7 (increasing, +0.9 pts).

-

New orders: 49.8 (contracting, however rebounding +0.6 pts).

-

Uncooked materials inventories: 47.4 (nonetheless weak, however decline narrowing).

-

Employment: 48.1 (barely improved, however under threshold).

-

Provider supply occasions: 50.0 (impartial).

-

Non-Manufacturing Sector

-

Headline PMI: 50.3 (anticipated 50.6 and barely down from 50.4 in April, however nonetheless increasing).

-

Development exercise: 51.0 (average development, down 0.9 pts).

-

Providers exercise: 50.2 (marginal development, up 0.1 pt).

-

Excessive-performing industries: Rail, air transport, postal, telecoms, IT (all above 55.0).

-

Weak sectors: Actual property and capital markets (under 50).

-

New orders: 46.1 (rising, however nonetheless weak).

-

Enter costs: 48.2 (nonetheless declining, however at a slower tempo).

-

Promoting costs: 47.3 (decline narrowing).

-

Employment: 45.5 (unchanged, stays weak).

-

Enterprise expectations: 55.9 (barely down, however nonetheless optimistic).

—

I posted on Friday on guarantees of extra stimulus incoming:

As I mentioned within the submit:

- What number of occasions have we been promised large financial bulletins from China … solely to be disenchanted with incremental change?

I think as that date approaches pleasure and pumping will construct, solely to be dashed. Sufficient whining, its the weekend! Have good one and do not forget to hitch early on Monday for the market response to all of the information the weekend will convey.

ForexLive.com

is evolving into

investingLive.com, a brand new vacation spot for clever market updates and smarter

decision-making for traders and merchants alike.