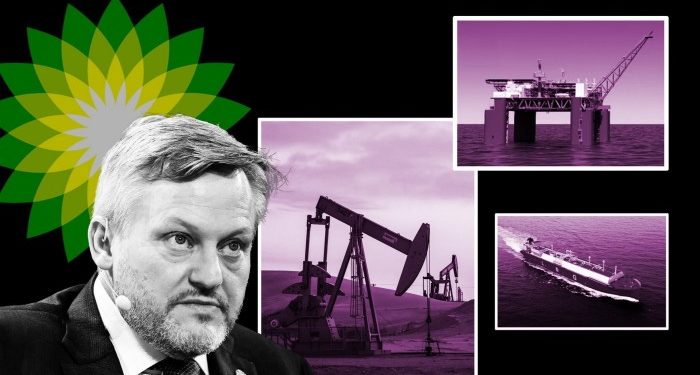

BP chief government Murray Auchincloss batted away the query when requested this yr if every little thing on the struggling oil firm was up on the market. “I don’t know,” he responded. “No person ever comes up with the correct worth.”

His efforts to revive the fortunes of the 116 year-old group and protect its independence obtained a lift this week when its UK rival Shell declared it had “no intention” of pursuing a deal that may have created a supermajor to rival ExxonMobil.

But whereas Shell is now barred from making a brand new provide earlier than Christmas, except BP initiates talks or one other suitor emerges, the respite for the embattled Auchincloss and his fellow executives is prone to be quick lived.

BP’s future has been an open query for months, and specifically since February when it deserted the multibillion-dollar push into renewable power that had angered some buyers. Even a vow to refocus on its core expertise in oil and fuel couldn’t halt the slide in its share worth, down an additional 14 per cent since.

Advisers to rival power teams mentioned the strain on BP to take motion to reverse the fast erosion of shareholder worth will solely enhance within the coming months. “If the oil worth stays at this stage for a yr, BP will likely be in a determined state,” was the view of 1 veteran funding banker working within the power sector.

Benchmark crude, which spiked this month throughout the battle between Israel and Iran, was buying and selling at $68 per barrel on Friday, and most analysts count on it to development decrease after the top of the height summer season driving season.

But one impediment to a full takeover of BP is that few potential patrons — even Shell — would actually need to buy all the firm, bankers say. Abu Dhabi’s nationwide oil firm Adnoc, for instance, which has an in depth relationship with BP and has appeared throughout its portfolio, is eager to develop in fuel however not in oil.

BP has already pledged to promote $20bn of belongings by 2027 because it seeks to bolster its steadiness sheet, together with its worthwhile lubricants arm Castrol.

However Auchincloss — a 54-year-old Canadian introduced in to switch Bernard Looney, architect of the corporate’s inexperienced push, in 2023 — has to this point tried to ringfence what he sees as BP’s core belongings. These are its intensive oil and fuel manufacturing, the refineries that feed its profitable buying and selling enterprise, and its remaining clear power belongings.

The query is whether or not BP will now be pressured to go additional than Auchincloss needs. “It doesn’t assist that everybody is aware of BP desires to promote issues,” mentioned Josh Stone, a UBS analyst who covers the sector. “So it doesn’t shock me that you just’re seeing some opportunistic bids coming in.”

Most oil trade consultants imagine that BP trades at a big low cost to the sum of its components. Financial institution of America estimates that the oil firm’s fairness worth is at the least $5bn larger than its present market capitalisation of just below £60bn.

A senior government at one massive oil buying and selling agency pinpointed what he mentioned had been BP’s 5 nice companies. These are its deepwater oil operations within the Gulf of Mexico, its US shale arm BPX, its oil and fuel companies in Abu Dhabi and Azerbaijan, and the corporate’s liquefied pure fuel belongings.

“Every part else they’ve is costing them cash,” the manager mentioned.

The Gulf of Mexico is extensively thought-about BP’s crown jewel. The corporate is working to lift manufacturing there to 400,000 barrels of oil per day and can be now drilling a brand new technology of tasks which have been lengthy dormant as a result of the expertise to extract oil at such depth and strain has solely not too long ago been developed.

BPX in the meantime, may attraction to US bidders in search of acreage within the big shale basins in Texas. European and Center Jap producers, together with Shell, Adnoc and TotalEnergies of France, have publicly declared ambitions to develop within the US, though Shell left the Permian basin in 2021 in a $9.5bn sale to ConocoPhillips.

“There’s a massive urge for food for North American shale belongings,” mentioned Andrew Dittmar, an analyst at Enverus. He mentioned BP’s Haynesville holdings can be particularly engaging to LNG-focused corporations, and that BP may even think about spinning BPX right into a individually listed US entity.

However carving out these companies would disrupt BP’s more and more built-in enterprise mannequin, the place its buying and selling arm sources crude for its refineries earlier than then promoting petrol, diesel, jet gas and different merchandise. The lack of any core belongings would weaken this chain, which delivers at the least $4bn of annual earnings, in response to analysts.

“The great upstream [oil and gas] belongings are the center of BP [and] you don’t need to be promoting your coronary heart,” mentioned Stone, the UBS analyst. “The remainder is integral to buying and selling, which is a really vital contribution to earnings, so it isn’t straightforward to disentangle.”

He added that BP has already assessed what it may safely promote because it tries to chop its debt and placate activist investor Elliott, which holds a 5 per cent stake within the firm. “It settled on Castrol, which was out there,” he mentioned.

Elliott has urged BP to exit renewables solely, following years of funding in wind, photo voltaic and biogas, as the corporate scales again its clear power ambitions. However with an enterprise worth of $14bn, Stone mentioned BP’s renewables unit could also be too massive for a single purchaser. Market hypothesis has in latest days widened to counsel that patrons may crew as much as choose up their favoured belongings.

Nevertheless massive offers within the sector have slowed this yr after oil market volatility first triggered by a rise in manufacturing by Opec+ and extra not too long ago by the Israel-Iran battle.

“It’s very troublesome to promote something if you happen to have no idea what your oil worth is wanting like,” mentioned Stone.