ChronoVolume Out there right here:

https://www.mql5.com/en/market/product/146081

It’s a sophisticated quantity evaluation indicator.

Overview:

ChronoVolume analyzes quantity knowledge in MetaTrader 4 by changing primary tick quantity into significant buying and selling insights.

Since MT4 solely supplies tick quantity (variety of value modifications), this indicator makes use of algorithms to estimate shopping for and promoting strain, supplying you with a clearer image of market sentiment.

It gives 3 ways to calculate quantity (varieties) and 3 ways to show it (modes), permitting you to research from completely different views.

Quantity Calculation Strategies

1. Worth Motion Quantity Sort

Analyzes the place the closing value falls inside every bar’s vary to estimate shopping for vs promoting strain.

The way it works:

If excessive → Extra shopping for strain

If shut is close to the low → Extra promoting strain

If shut is within the center → Balanced exercise

Purchase Quantity = Whole Quantity × (Shut – Low) / (Excessive – Low)

Promote Quantity = Whole Quantity × (Excessive – Shut) / (Excessive – Low)

Finest for: Conventional breakout evaluation, development affirmation, divergence recognizing

2. Bull/Bear Energy Quantity Sort

Makes use of deviation from a 13-period transferring common to measure institutional shopping for and promoting energy.

The way it works:

EMA13 = 13-period transferring common of closing costs

Bull Energy = Excessive – EMA13 (how far excessive extends above common)

Bear Energy = Low – EMA13 (how far low extends under common)

Distribution based mostly on absolute values of Bull Energy vs Bear Energy

Finest for: Momentum evaluation, institutional move detection, EMA-based methods

3. Tick Quantity Sort

Enhanced processing of uncooked tick quantity with out directional bias.

The way it works:

Pure tick quantity with superior smoothing and scaling

No assumptions about shopping for vs promoting

Finest for: Total market participation, quantity spikes, impartial evaluation

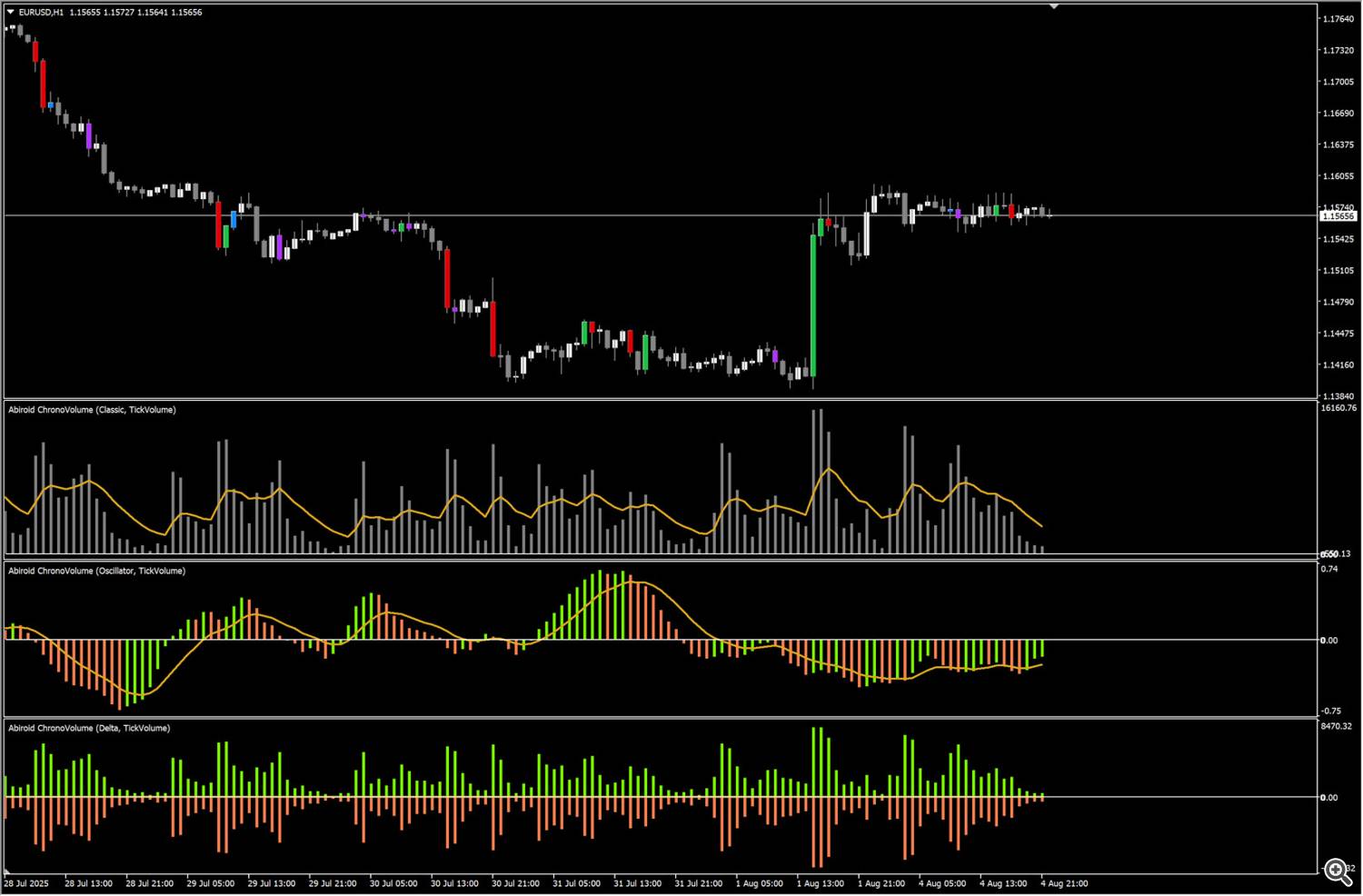

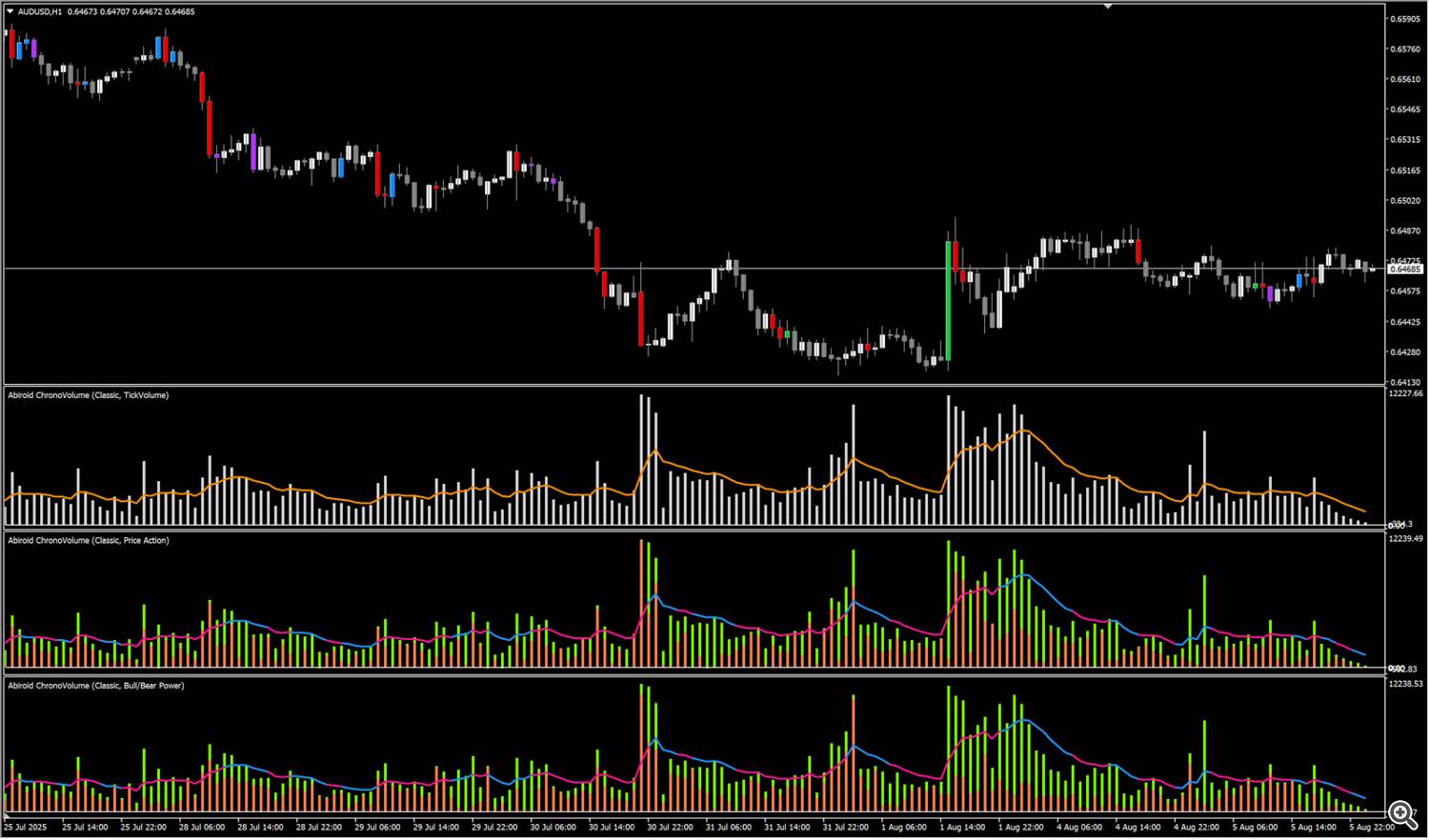

Show Modes:

a) Basic Mode

Exhibits quantity relative to current averages, good for figuring out uncommon exercise.

What you see:

- Histogram bars displaying present quantity in comparison with common

- Optionally available easy line for development identification

- Coloration coding based mostly in your chosen quantity calculation methodology

Calculations:

– Calculate relative quantity: Present Quantity/Common of final 6 bars

– Apply smoothing: Recognizing quantity spikes, confirming breakouts, figuring out divergences

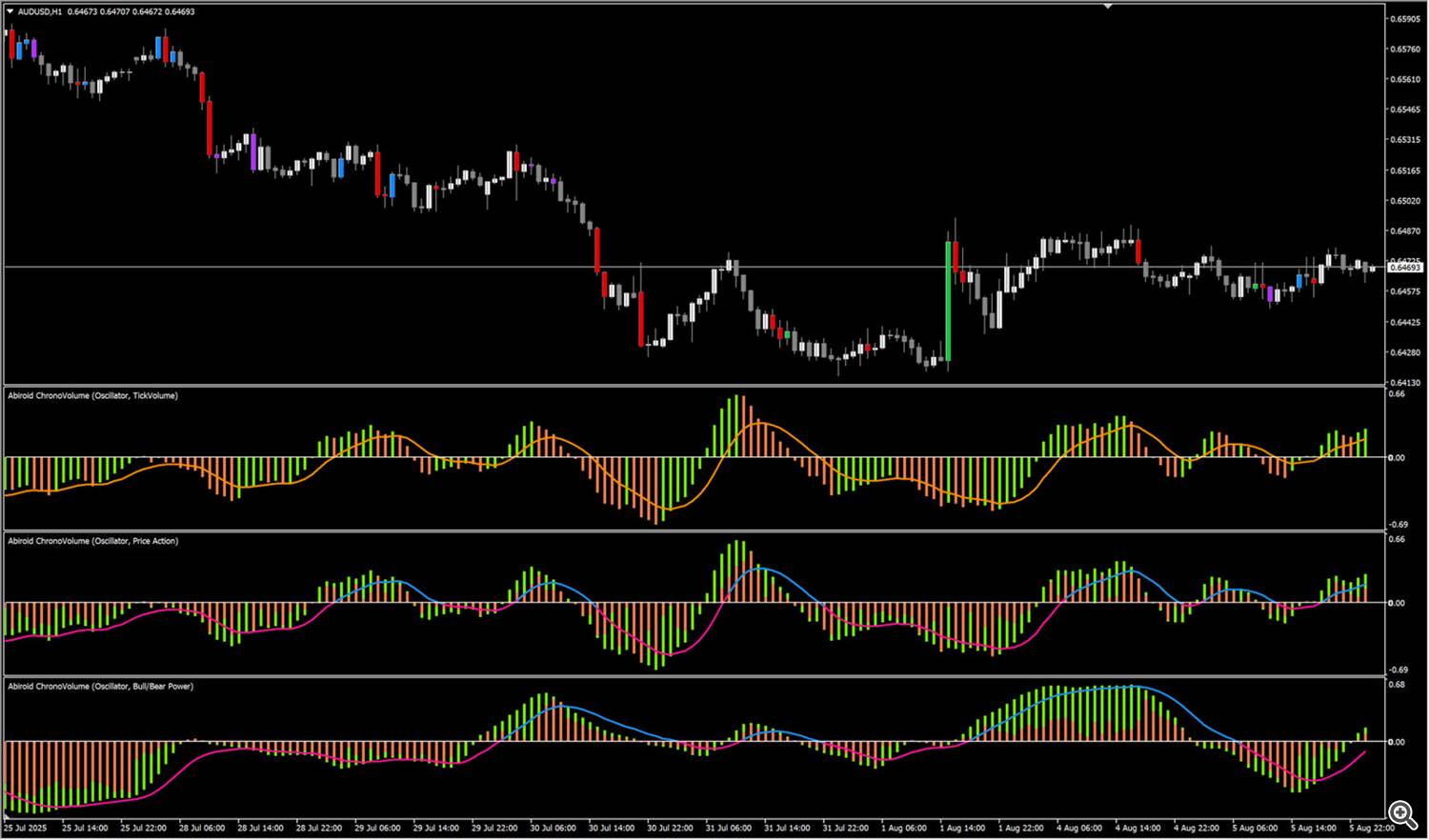

b) Oscillator Mode

Transforms quantity into momentum format, oscillating round zero to indicate directional strain.

What you see:

- Values above zero = Internet shopping for strain

- Values under zero = Internet promoting strain

- Optionally available easy line displaying momentum course

Calculations:

– Calculate shopping for vs promoting distinction

– Apply two EMAs (21 and 36 intervals) to easy the information

– Take distinction between quick and gradual EMA4. Normalize utilizing sigmoid operate for bounded oscillator

Use for: Momentum shifts, overbought/oversold situations, zero-line crosses

c) Delta Mode

Exhibits internet shopping for vs promoting strain, revealing institutional order move.

What you see:

- Constructive bars = Shopping for dominance

- Detrimental bars = Promoting dominance

- Magnitude reveals energy of internet move

Mathematical course of:

1. Begin with shopping for vs promoting distinction

2. Scale by quantity context (× 200-period common × 20)

3. Apply EMAs (21 and 36 intervals) to scaled values

4. Easy the distinction with adjustable smoothing issue

Use for: Institutional move evaluation, early reversal detection, internet strain evaluation

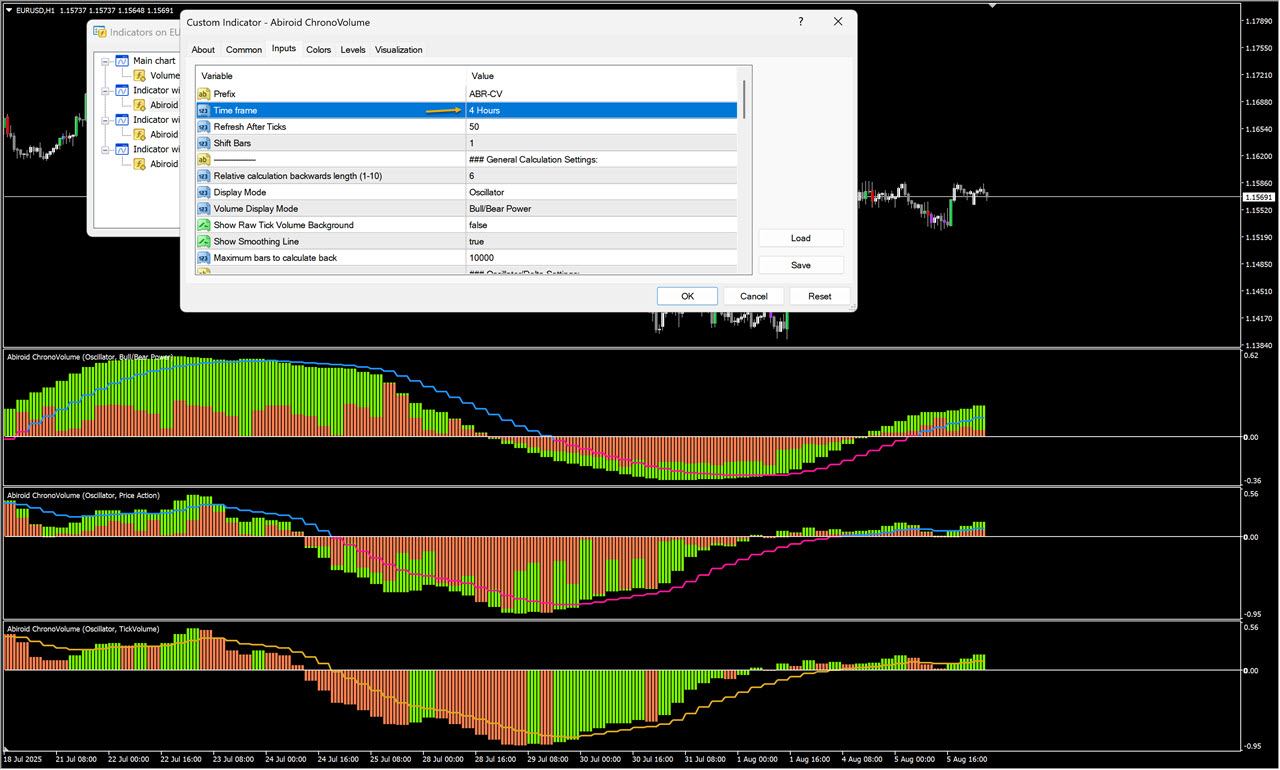

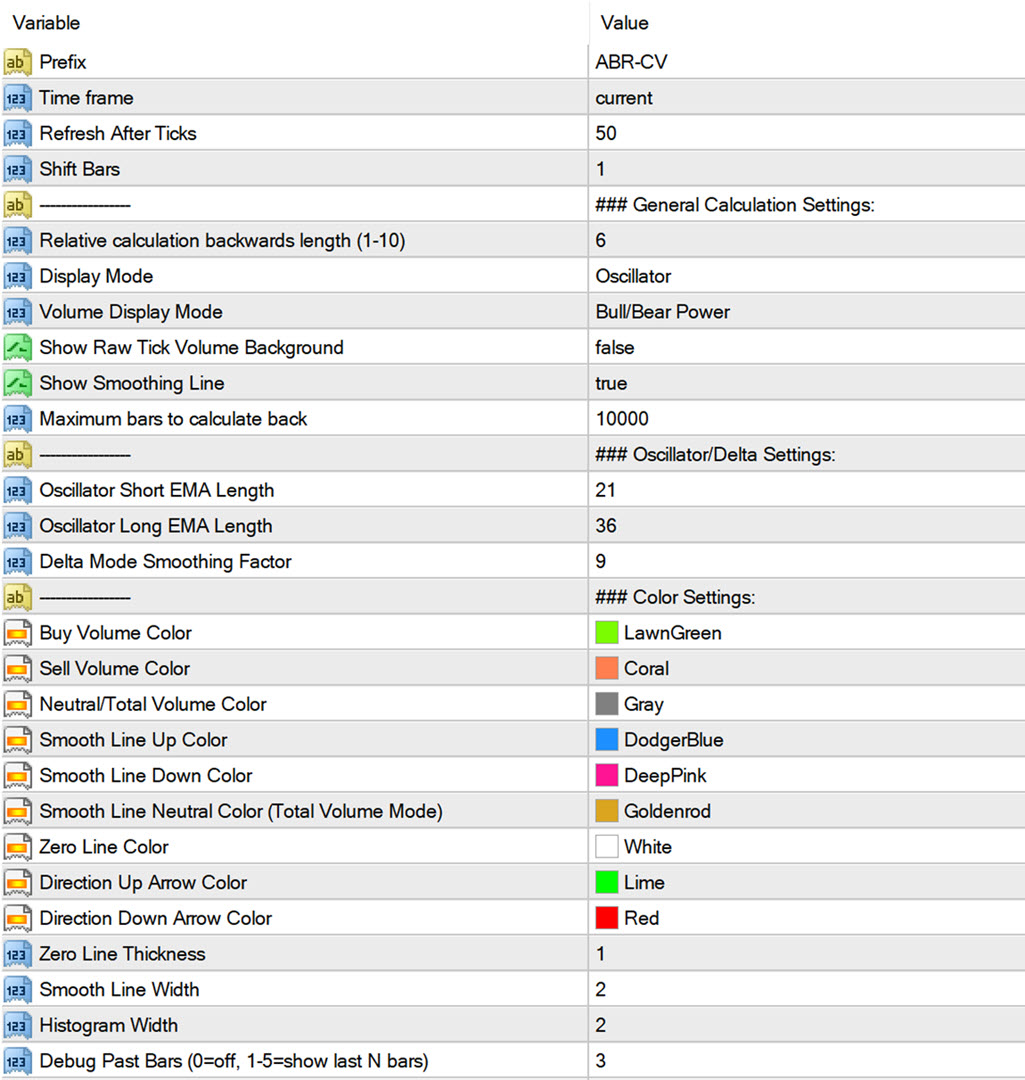

Settings:

Core Settings

- Relative Size (1-10): What number of bars to look again for common quantity calculation. Decrease = extra delicate to current modifications

- Show Mode: Select Basic, Oscillator, or Delta based mostly in your evaluation wants

- Quantity Sort: Choose Worth Motion, Bull/Bear Energy, or Tick Quantity calculation

- Bar Shift: Controls repainting conduct (0 = real-time updates, 1 = confirmed indicators solely)

Visible Choices

- Present Uncooked Tick Quantity: Provides grey background bars displaying precise tick quantity for reference

- Present Smoothing Line: Permits development line with clever colour coding

- Coloration Customization: Alter all colours to match your chart theme

Superior Controls

- Oscillator EMA Lengths: Fantastic-tune the 21 and 36-period averages for momentum calculation

- Delta Smoothing Issue: Alter noise discount in Delta mode (larger = smoother)

- Most Previous Bars: Restrict calculation scope for higher efficiency

Studying the Alerts

Quantity Spikes (All Varieties):

- Giant bars point out uncommon exercise

- Evaluate present bar peak to current common

- Spikes typically precede vital value strikes

Coloration Interpretation:

- Inexperienced/Teal: Shopping for strain or upward momentum

- Crimson: Promoting strain or downward momentum

- Grey: Impartial or uncooked tick quantity

Easy Line Alerts:

- Path modifications: Potential momentum shifts

- Coloration modifications: Development affirmation or reversal warning

- Slope: Energy of present development

Mode-Particular Purposes

Basic Mode Purposes:

- Affirm breakouts with quantity spikes

- Spot divergences (value up, quantity down = weak spot)

- Determine accumulation/distribution phases

- Validate assist/resistance ranges

Oscillator Mode Purposes:

- Commerce zero-line crosses with value affirmation

- Determine momentum divergences

- Spot overbought/oversold extremes

- Affirm development energy

Delta Mode Purposes:

- Monitor institutional shopping for/promoting campaigns

- Determine early reversal indicators

- Affirm development sustainability

- Analyze internet order move imbalances

Finest Practices

Timeframe Choice:

- Decrease timeframes (M1, M5): Extra noise, use for entry timing

- Larger timeframes (H1, H4): Cleaner indicators, higher for development evaluation

- A number of timeframes: Finest total perspective

Combining with Worth Motion:

- Excessive quantity breakouts are extra dependable than low quantity ones

- Quantity ought to verify value course for robust tendencies

- Divergences between value and quantity typically sign reversals

Threat Administration:

- Use quantity affirmation to measurement positions (excessive quantity = larger confidence)

- Be cautious of strikes on declining quantity

- Monitor quantity patterns for early exit indicators

Frequent Patterns

Breakout Affirmation

- Worth breaks resistance + quantity spike = Robust breakout

- Worth breaks resistance + low quantity = Potential false breakout

Development Evaluation

- Uptrend + rising quantity = Wholesome development continuation

- Uptrend + reducing quantity = Potential development weak spot

Reversal Alerts

- Worth makes new excessive + quantity makes decrease excessive = Bearish divergence

- Heavy quantity at assist/resistance = Potential reversal zone

Accumulation/Distribution

- Worth consolidates + quantity will increase = Potential breakout setup

- Worth rises + quantity decreases = Potential distribution section

Suggestions for Totally different Buying and selling Types

Day Buying and selling

- Use Oscillator mode on decrease timeframes

- Concentrate on zero-line crosses and momentum shifts

- Mix with value motion for entry timing

Swing Buying and selling

- Use Basic or Delta mode on larger timeframes

- Search for quantity affirmation on weekly/every day ranges

- Concentrate on multi-day quantity patterns

Scalping

- Use any mode on M1-M5 timeframes

- Concentrate on instant quantity spikes

- Fast in/out based mostly on quantity momentum

Place Buying and selling

- Use Delta mode on every day/weekly charts

- Monitor long-term institutional move

- Concentrate on main quantity development modifications

Why Oscillator Mode Must Recalculate Previous Bars:

The oscillator mode makes use of a sequence of three Exponential Transferring Averages (EMAs) – a 21-period EMA, a 36-period EMA, and a last 9-period EMA of their distinction. Every EMA calculation is dependent upon the earlier bar’s EMA worth.

Smoothing Results: In contrast to easy transferring averages that solely have a look at a set window of knowledge, EMAs give exponentially reducing weight to older values and extra weight to newer values.

Calculation Order Sensitivity: The oscillator’s last worth comes from normalizing the distinction between the brief and lengthy EMAs utilizing a 200-period Easy Transferring Common (SMA) of absolute variations.

This creates a suggestions loop the place:

– New value knowledge impacts the purchase/promote momentum calculation

– This modifications the EMA values for current bars

– The EMA modifications have an effect on the normalization issue (boundSMA)

– The brand new normalization issue recalculates oscillator values for previous bars

Sensible Influence: Whereas this recalculation is mathematically right and supplies smoother, extra responsive indicators, it signifies that oscillator values for the final 50-200 bars might shift barely when new knowledge arrives. For many buying and selling purposes, this smoothing profit outweighs the historic worth changes. As a result of new knowledge is extra important for present trades. If you need completely non-repainting quantity bars, then do not use the oscillator mode.

Keep in mind: Quantity evaluation works greatest when mixed with value motion and different technical evaluation strategies.

Use ChronoVolume to substantiate your buying and selling concepts quite than as a standalone sign generator.

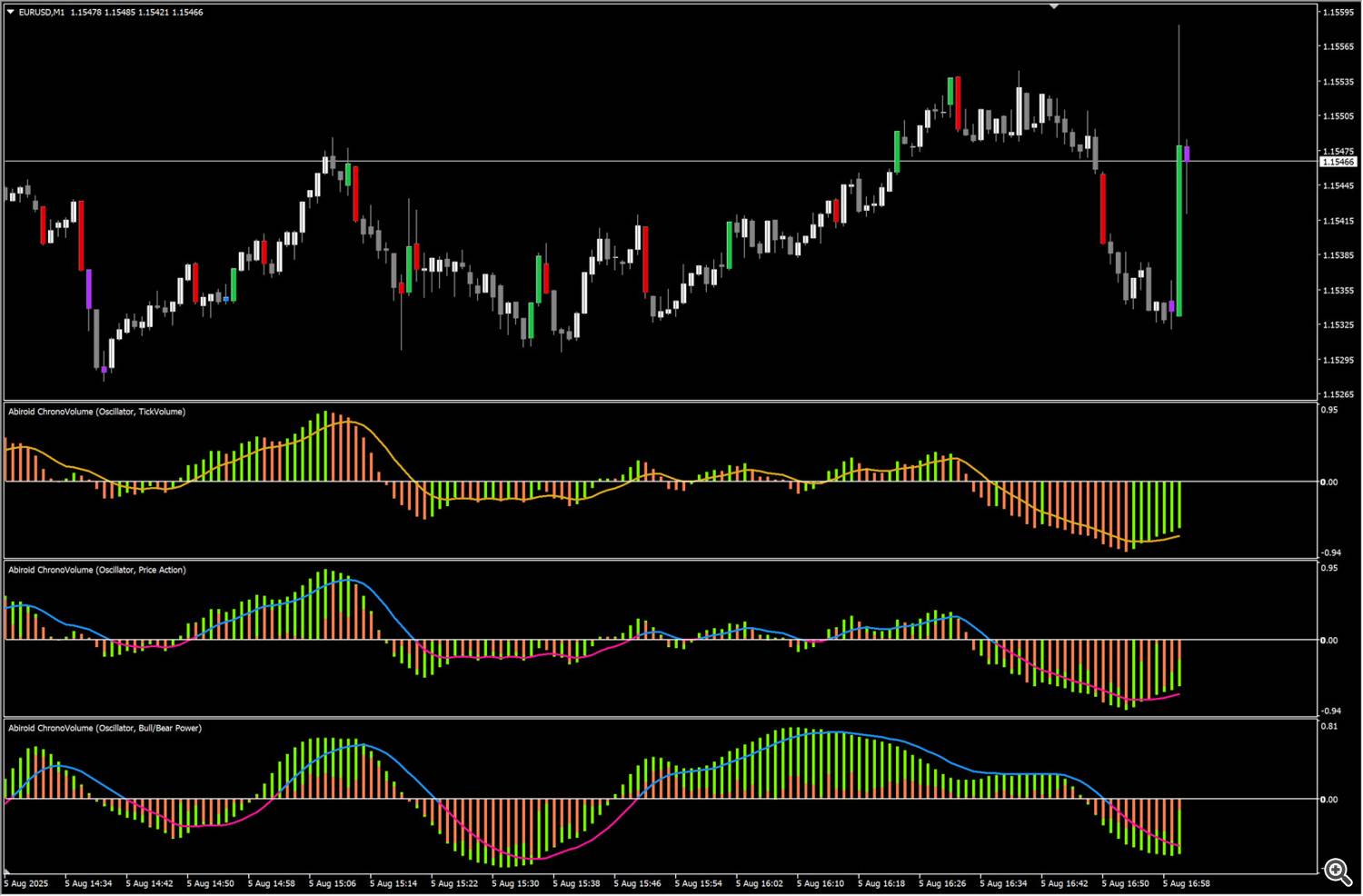

How Oscillators are Truly Helpful:

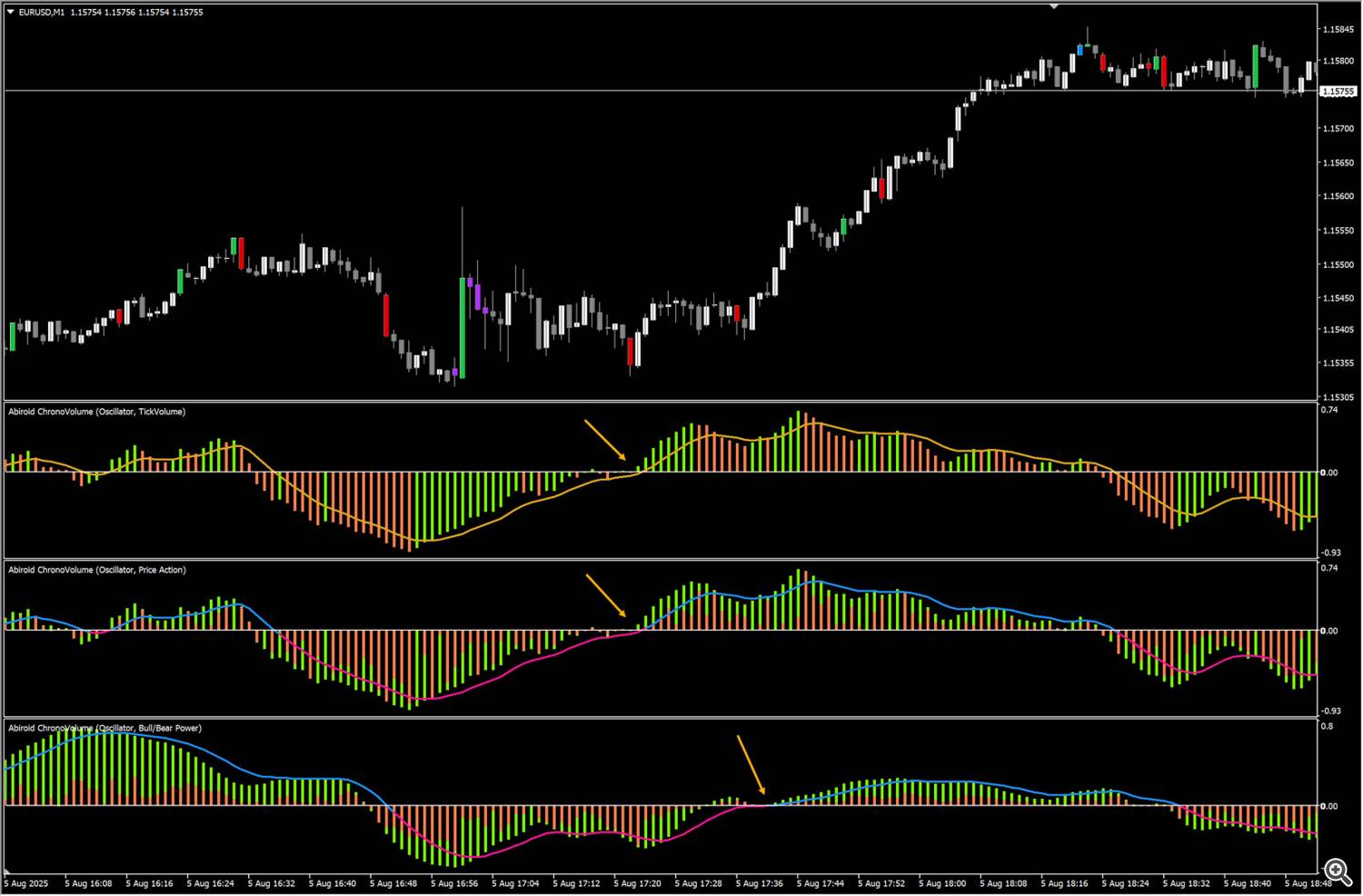

They’re nice for vaildating trades. Instance, right here value appears prefer it’s breaking out of a good vary, and would possibly enter a bullish transfer.

However oscillators are nonetheless under 0, and present bearish traces. So not the most effective time to commerce simply but:

And certainly sufficient, after just a few bars, value nonetheless stays in a spread:

Lastly when oscillators do transfer above 0, value goes Bullish:

Bull/Bear energy oscillator takes it is time to go above 0, however after that the development actually picks up.

However, one factor to watch out about Bull/Bear Energy, is that it research the Bull vs Bear energy push and pull.

And so the histogram bars would possibly generally look too lengthy, even when value is in a gradual market transfer.

So it is nice for capturing development shifts, however watch out throughout gradual markets. Different quantity varieties mirror gradual markets quite a bit higher:

Smartest thing to do is to check all modes and quantity varieties side-by-side and see which one fits your buying and selling greatest.

The indicator is a single histogram solely. However you possibly can place a number of on the chart:

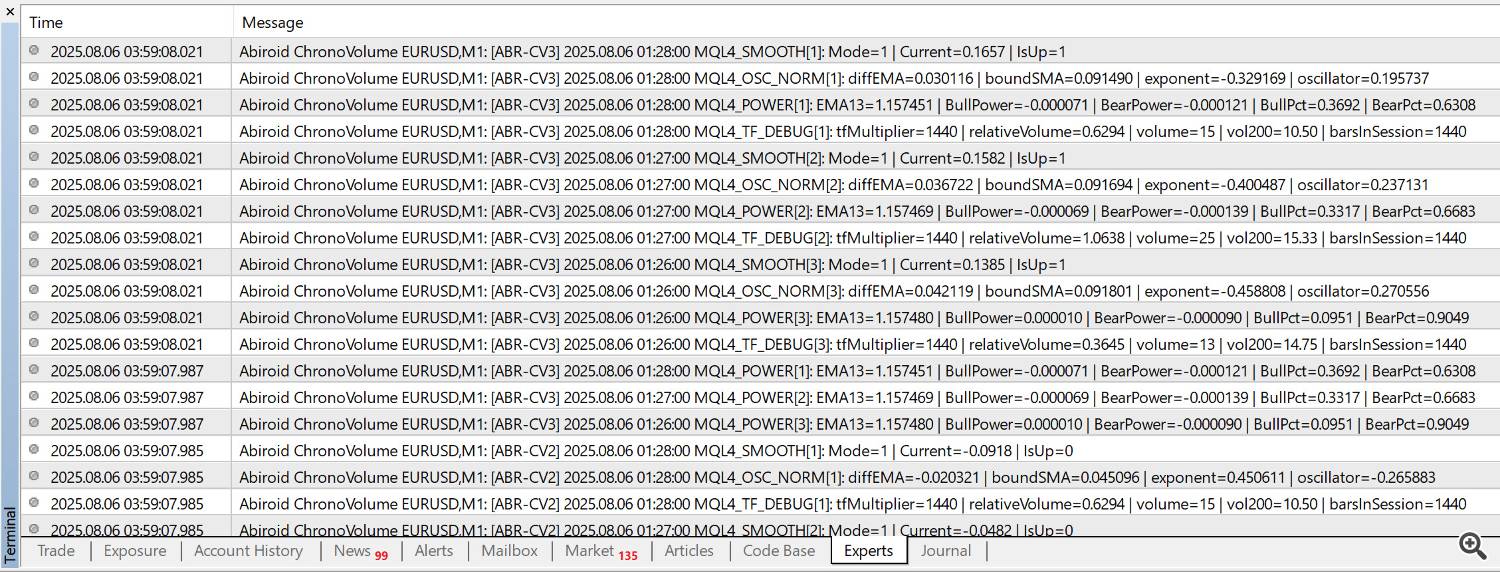

Debugging:

Maintain DebugPastBars to any worth greater than 0, and it’ll present you detailed debug logs in your Consultants tab.

It is very helpful when evaluating values. By default it’s off (set to 0):

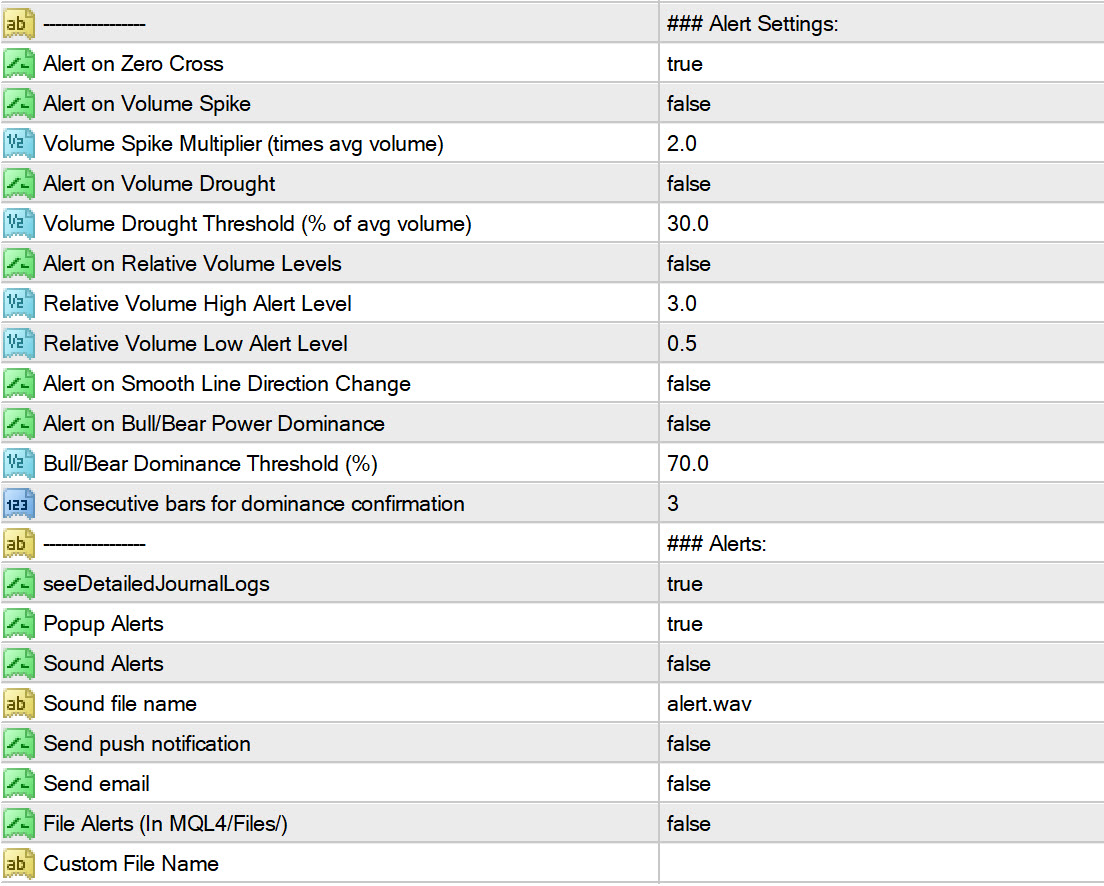

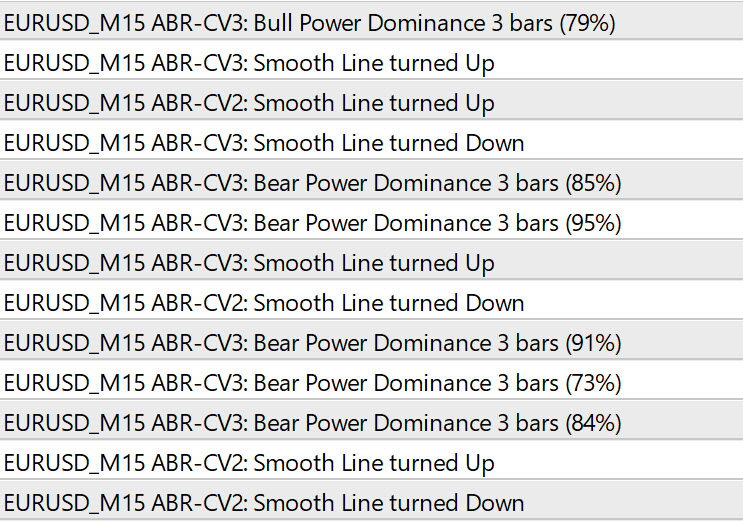

Enhanced Alert System

Alerts are designed to inform merchants of serious quantity and development occasions throughout all show modes.

The alert system contains six distinct alert varieties that may be turned on/off:

Core Quantity Alerts:

- Quantity Spike Detection: Triggers when present quantity exceeds a configurable a number of (default 2x) of the 200-period common, serving to establish sudden will increase in market exercise

- Quantity Drought Alerts: Notifies when quantity drops under a specified share (default 30%) of the typical, indicating intervals of low market participation

- Relative Quantity Thresholds: Offers alerts when relative quantity crosses above excessive ranges (default 3.0) or under low ranges (default 0.5), providing early warning of bizarre quantity situations

Technical Evaluation Alerts:

- Zero Cross Alerts: Out there in Oscillator and Delta modes, these alerts set off when the indicator crosses above or under the zero line, signaling potential development modifications

- Easy Line Path Modifications: Detects when the graceful line transitions between bullish and bearish states, offering development reversal indicators based mostly on the chosen quantity mode

- Bull/Bear Energy Dominance: Unique to Energy mode, this alert screens consecutive bars the place bull or bear energy exceeds a threshold share (default 70% for 3+ consecutive bars), indicating sustained directional strain

Maintain shiftBars 1, to make sure that alerts are based mostly on confirmed bar knowledge quite than fluctuating real-time values for ongoing bar 0.

When you have a number of indicators on identical chart, use Prefix to separate the alerts:

Easy Line Alerts do not work for Basic Mode, as that solely has a single coloured line. And does not observe the up/down development actions.

Larger Timeframes:

You may as well choose a better timeframe from drop-down.

This is EURUSD H1 chart utilizing a better H4 timeframe: