Quantitative Evaluation of Dynamic Fibo Scalper: Evaluating Returns with Fibonacci Ranges and Monte Carlo Simulations

In our earlier publish, we explored the important thing options, basic settings, and performance of the “Dynamic Fibo Scalper EA,” offering examples of dwell trades on US30 and Nasdaq. Now, we’ll dive into an in-depth quantitative evaluation, sharing the outcomes of 5 years of backtesting . We’ll evaluate two methods primarily based on the identical Fibonacci ranges and decide which method works finest for us…

The primary technique (A) includes:

- Buy_Level4: Shopping for after a breakout above Stage 4 (61.8%).

- Sell_Level2: Promoting after a breakdown under Stage 2 (38.2%).

The second technique (B) is solely the reverse of technique A:

- Buy_Level2: Shopping for after a breakout above Stage 2 (38.2%).

- Sell_Level4: Promoting after a breakdown under Stage 4 (61.8%).

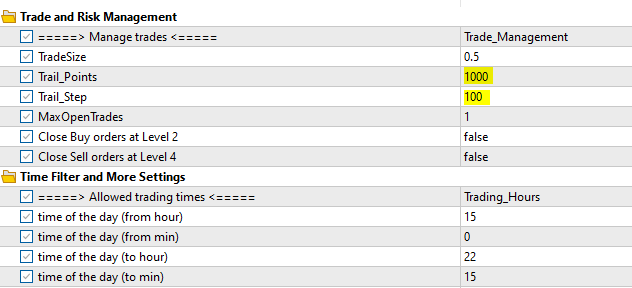

On this publish, we are going to current the backtesting outcomes and evaluation for the Nasdaq (US100) utilizing the M5 time-frame. That is the parameters utilized for the evaluation.

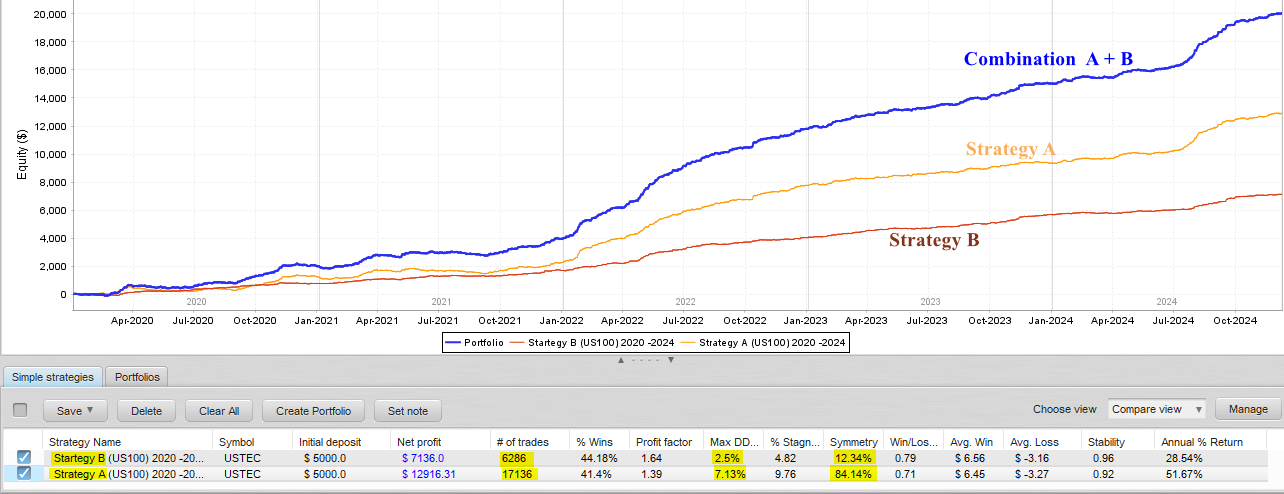

Efficiency Metrics :

- Technique A considerably outperforms Technique B when it comes to internet revenue.

- Technique A executes greater than twice the variety of trades in comparison with Technique B.

- Technique B has a barely greater win charge than Technique A.

- Technique B has a greater revenue issue, indicating that its successful trades are extra worthwhile relative to its dropping trades.

- Technique B has a considerably decrease drawdown, making it much less dangerous in comparison with Technique A.

- Technique A demonstrates a steadiness between lengthy and brief trades, whereas Technique B exhibits a desire for extra lengthy orders than brief ones.

- Technique A delivers a a lot greater annual return in comparison with Technique B

- Technique B is barely extra secure than Technique A, reflecting extra constant efficiency.

Fairness Curve Evaluation :

- Technique A demonstrates a steeper and extra constant progress in fairness over time, reflecting its greater profitability.

- Technique A is extra aggressive, attaining greater income and annual returns however at the price of elevated drawdown and decrease stability.

- Technique B, whereas exhibiting slower progress, maintains a smoother curve with much less fluctuation, aligning with its decrease drawdown and greater stability.

- Technique B is extra conservative, with decrease income and returns however higher danger administration and consistency.

Month-to-month Efficiency :

- Technique A reveals extra damaging month-to-month performances in comparison with Technique B. Nonetheless, each methods exhibit sturdy restoration and spectacular efficiency in later years, significantly in 2022, 2023, and 2024, with constant constructive returns.

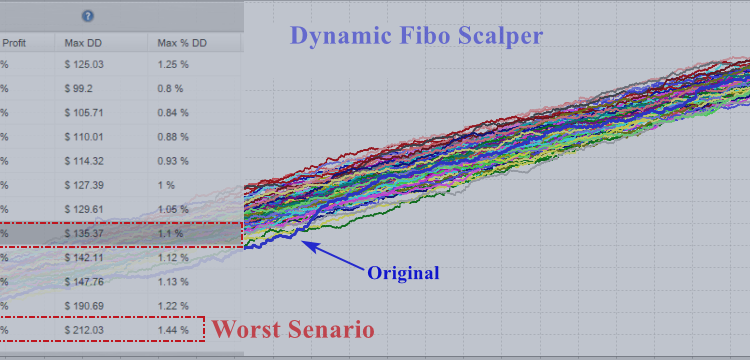

Monte Carlo Simulations : Finest and Worst Situations

Monte Carlo evaluation is a robust approach used to estimate the danger and profitability of buying and selling methods with higher realism. By working a number of simulations with small random variations, it helps consider the robustness of a technique, predict anticipated revenue and drawdown, and decide whether or not the technique is appropriate for dwell buying and selling. This methodology offers helpful insights into the finest and worst-case eventualities, enabling merchants to higher put together for market uncertainties and make knowledgeable choices about technique efficiency and danger administration.

In our case, we are going to evaluate the unique outcomes of each methods A and B with their potential worst-case eventualities…

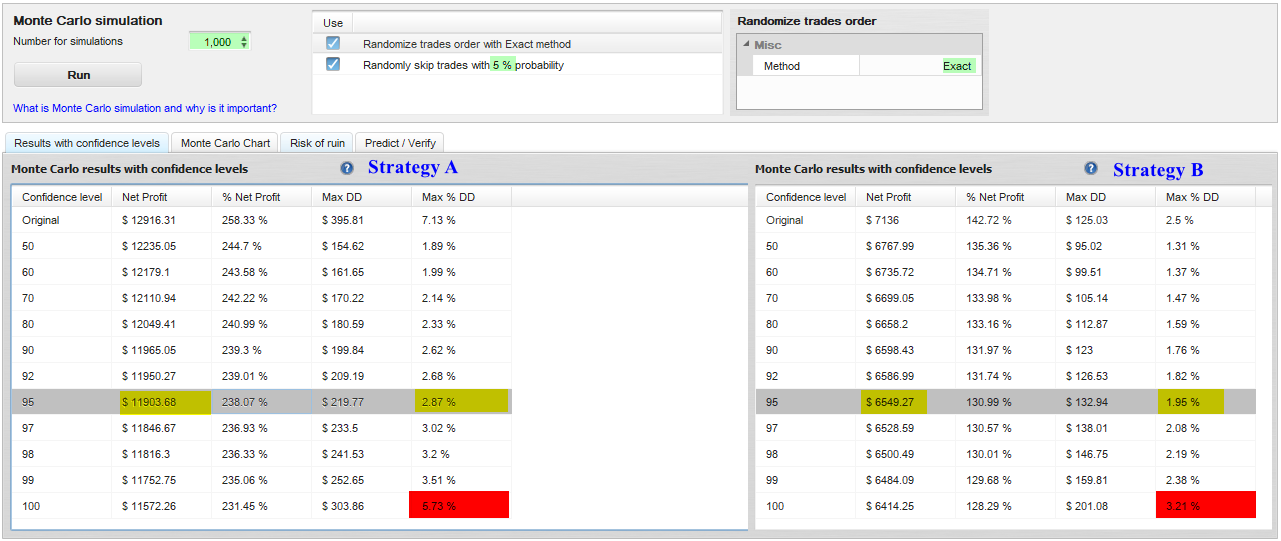

We’ll run a 1000 simulations utilizing Precise randomization and 5% trades missed to find out extra life like drawdown and revenue expectations.

The 95% confidence stage means there may be solely a 5% probability that outcomes shall be worse than these simulated (96 to 100%). We’ll now evaluate the unique outcomes with these introduced at this confidence stage.

Technique A

- Drawdown : The Max DD at our 95% confidence stage is 2.48 occasions decrease than the unique, indicating that the technique is predicted to carry out nicely in most eventualities.

- Internet Revenue : Attaining a 238.07% revenue over 5 years by buying and selling a single market remains to be a robust efficiency. The $1,000 distinction in comparison with the unique stage is comparatively minor and doesn’t considerably diminish the general success of the technique.

Technique B

- Drawdown : The Max DD at our 95% confidence stage is 1.28 occasions decrease than the unique, indicating that the technique is predicted to carry out nicely in most eventualities. This technique is extra conservative ( The worst-case state of affairs, which has a 5% likelihood of occurring, is experiencing a most drawdown of three.21% ).

- Internet Revenue : Attaining a 129.68% revenue over 5 years by buying and selling a single market remains to be a great efficiency for a 5K cap.

Conclusion

The selection between Technique A and Technique B finally will depend on the dealer’s particular person danger tolerance and funding aims. Technique A is right for these prioritizing greater income and are prepared to just accept higher danger and variability. However, Technique B affords a extra conservative method, specializing in diminished danger and constant stability.

In our subsequent publish, we are going to dive deeper into the evaluation, discover further insights, and talk about potential enhancements to reinforce the efficiency of those methods. Keep tuned!