Key Notes

- Bitcoin crashed to $108K as spot ETFs broke their six-day outflow streak.

- Binance funding charges stayed overly optimistic, elevating the danger of an extended squeeze.

- Technicals present key resistance at $117K–$121K and draw back danger towards $100K.

Bitcoin

BTC

$111 389

24h volatility:

1.5%

Market cap:

$2.22 T

Vol. 24h:

$40.27 B

shocked markets with a sudden crash to $108,000, unable to interrupt above $113,000. The decline comes as spot Bitcoin ETFs ended their longest-ever outflow streak, including a stunning twist to BTC value motion.

On August 25, Ethereum spot ETFs recorded $444 million in whole web inflows, marking three consecutive days of inflows. Bitcoin spot ETFs noticed $219 million in whole web inflows, with not one of the twelve ETFs reporting outflows.

https://t.co/Tvs2oCSxTg

— Wu Blockchain (@WuBlockchain) August 26, 2025

ETF Outflows Finish with $219M Inflows

On Monday, market intelligence agency Santiment reported that Bitcoin ETFs had been dealing with their longest outflow streak in months, six consecutive market days, a sample not seen since tariff fears peaked in April.

In accordance to Santiment, this wave of withdrawals could have been retail-driven reasonably than purely institutional, with smaller merchants reacting emotionally to fears of a market prime.

📉 Bitcoin ETF’s are on their longest outflow streak (6 market days) because the tariff fears peaked again in early April. More and more, there are instances to be made that these inflows & outflows are retail-driven, and never simply institutional-driven like they had been early on.

😱 Giant… pic.twitter.com/bM6t19gfgM

— Santiment (@santimentfeed) August 26, 2025

However on Aug. 26, sentiment appeared to shift. SoSoValue data confirmed that Bitcoin ETFs collectively noticed $219 million in inflows, with not one of the twelve funds reporting outflows.

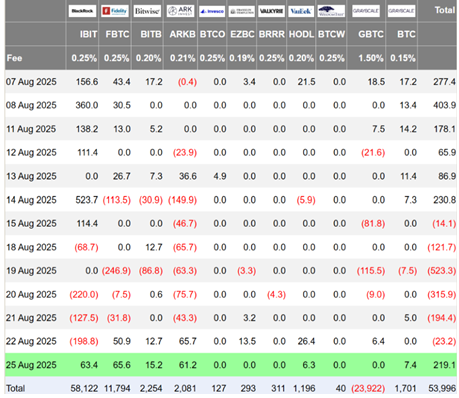

US spot BTC ETFs’ efficiency for August | Supply: Farside

Constancy’s FBTC led with $65 million in inflows, whereas BlackRock’s IBIT attracted $63.38 million. The rebound suggests establishments and retail merchants alike could also be positioning for a restoration amid the BTC crash.

Derivatives Market: Extreme Optimism Raises Liquidation Threat

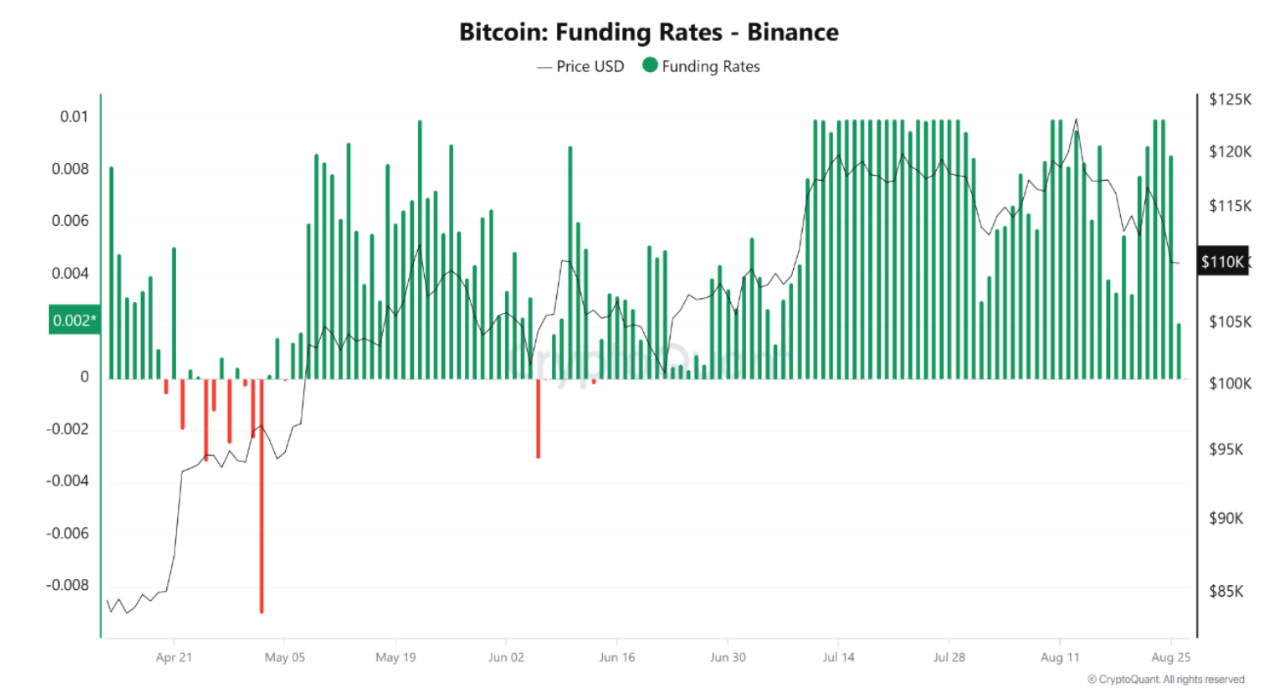

In keeping with CryptoQuant, Binance funding charges in August 2025 highlighted a regarding divergence between derivatives sentiment and precise value motion.

Regardless of Bitcoin’s decline, funding charges stayed constantly optimistic (0.005–0.008), indicating that merchants saved piling into leveraged lengthy positions.

Bitcoin funding charges on Binance | Supply: CryptoQuant

It’s clear that the merchants are betting on a rebound, viewing the drop as non permanent. This retains lengthy positions open regardless of mounting losses.

Nonetheless, if Bitcoin continues to fall, these leveraged longs might set off cascading liquidations, an extended squeeze that accelerates the sell-off.

Bitcoin Value Evaluation: Key Ranges to Watch

The each day chart reveals Bitcoin breaking down from an ascending triangle, confirming bearish strain. Present value motion round $109,800 has dropped under short-term help, elevating dangers of deeper corrections.

The fast help is at $108,000, with $105,000 and $100,000 as key demand zones. Then again, $117,800 (Fib 0.236) and $121,300 (Fib 0.382) must be reclaimed for a bullish reversal.

A profitable breakout might reopen paths to $131,000 and in the end $151,000 (Fib 1.618).

Bitcoin each day chart with Fib ranges and momentum indicators | Supply: TradingView

Momentum indicators help the bears with the RSI (38.2) exhibiting weakening power, whereas Chaikin Cash Stream (-0.02) suggests capital outflows. The Stability of Energy (-0.07) additionally confirms that sellers at present dominate the market.

If Bitcoin fails to carry $108K, the trail towards $100K turns into more and more possible. In the meantime, reclaiming $117K and $121K might stabilize momentum and set the stage for one more push towards new ATHs. Consequently, some merchants view BTC as one of many best crypto to buy.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

A crypto journalist with over 5 years of expertise within the trade, Parth has labored with main media retailers within the crypto and finance world, gathering expertise and experience within the area after surviving bear and bull markets over time. Parth can be an creator of 4 self-published books.