Financial institution of Canada (BoC) Governor Tiff Macklem addressed reporters’ questions, providing insights into the central financial institution’s financial coverage outlook. His remarks got here after the BoC lowered its rate of interest by 25 foundation factors to 2.50%, a transfer that markets had broadly anticipated.

BoC press convention key highlights

Wage progress continued to ease.

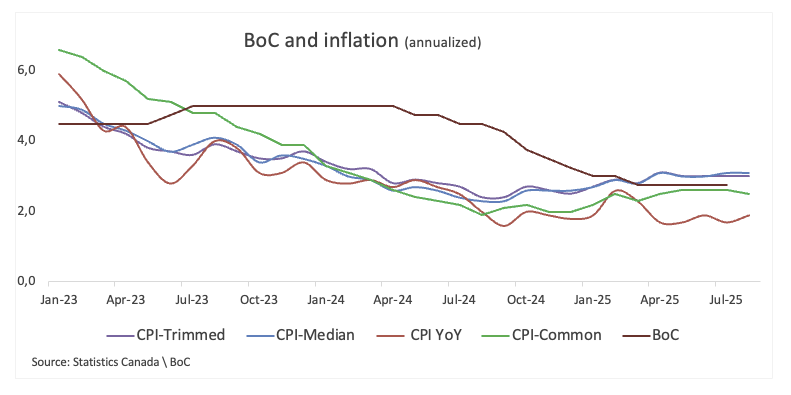

The popular core inflation measures have been round 3.0%.

Underlying inflation is operating round 2.5%.

Consensus to chop charges was clear.

Consideration now shifts to how exports carry out.

There are nonetheless some blended alerts on inflation.

The Inflation image hasn’t modified a lot since January.

We’re not being as forward-looking as regular.

The Financial institution of Canada thought-about holding the in a single day price regular.

I’ve extra consolation trying on the upward stress on CPI.

We will probably be assessing the affect of presidency bulletins on focused assist and assist for large initiatives.

Inflationary pressures look considerably extra contained.

If dangers tilt additional we’re ready to take extra motion.

Will take it one assembly at a time.

This part beneath was printed at 13:45 GMT to cowl the Financial institution of Canada’s coverage bulletins and the preliminary market response.

In step with market analysts’ expectations, the Financial institution of Canada (BoC) trimmed its coverage price by 25 foundation factors, taking it to 2.50% on Wednesday. Buyers’ consideration will now shift to the same old press convention by Governor Tiff Macklem at 14:30 GMT.

BoC coverage assertion key highlights

Price lower was acceptable given the weaker financial system and fewer upside threat to inflation.

On a month-to-month foundation, upward momentum in core inflation seen earlier this 12 months has dissipated.

Disruption linked to commerce shifts will proceed so as to add prices at the same time as they weigh on financial uncertainties.

BoC says it’ll proceed to assist financial progress whereas making certain inflation stays properly managed.

Ottawa’s resolution to scrap tariffs on US imported items will imply much less upward stress on costs of these items.

Broader vary of indicators continues to recommend underlying inflation is operating round 2.5%.

Within the months forward, sluggish inhabitants progress and labour market weak point will probably weigh on family spending.

Market response

The Canadian Greenback (CAD) stays on the defensive on Wednesday within the context of renewed USD shopping for, with USD/CAD navigating the 1.3760 zone and reversing two consecutive every day pullbacks.

Canadian Greenback Value At present

The desk beneath exhibits the share change of Canadian Greenback (CAD) in opposition to listed main currencies right now. Canadian Greenback was the strongest in opposition to the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.17% | -0.08% | -0.12% | 0.16% | -0.01% | -0.01% | 0.16% | |

| EUR | -0.17% | -0.25% | -0.29% | 0.02% | -0.04% | -0.05% | -0.00% | |

| GBP | 0.08% | 0.25% | -0.02% | 0.27% | 0.06% | 0.07% | 0.17% | |

| JPY | 0.12% | 0.29% | 0.02% | 0.27% | 0.21% | 0.11% | 0.14% | |

| CAD | -0.16% | -0.02% | -0.27% | -0.27% | -0.09% | -0.12% | -0.03% | |

| AUD | 0.00% | 0.04% | -0.06% | -0.21% | 0.09% | 0.01% | 0.04% | |

| NZD | 0.01% | 0.05% | -0.07% | -0.11% | 0.12% | -0.01% | 0.07% | |

| CHF | -0.16% | 0.00% | -0.17% | -0.14% | 0.03% | -0.04% | -0.07% |

The warmth map exhibits share adjustments of main currencies in opposition to one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, in case you choose the Canadian Greenback from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will characterize CAD (base)/USD (quote).

This part beneath was printed as a preview of the Financial institution of Canada’s (BoC) financial coverage bulletins at 09:00 GMT.

- The Financial institution of Canada is anticipated to cut back its key rate of interest to 2.50%.

- The Canadian Greenback maintains a constructive tone vs. the US Greenback this month.

- The BoC saved a gradual hand within the final three financial coverage conferences.

- The affect of US tariffs on the financial system ought to stay centre stage.

The Financial institution of Canada (BoC) is extensively anticipated to cut back its benchmark rate of interest by 1 / 4 share level on Wednesday, taking it to 2.50% after three consecutive ‘on maintain’ selections.

The possibilities of the BoC resuming its easing cycle have elevated as a consequence of weak progress, a mushy labour market, and comparatively managed inflation.

Canada’s financial system contracted by 1.6% within the second quarter, a sharper decline than anticipated, whereas employment fell by greater than 100K in July and August, lifting the jobless price to 7.1%. Dovish forecasts had been bolstered by August inflation figures launched on Tuesday, which got here in higher than anticipated. The Shopper Value Index (CPI) rose by 1.9% YoY, beneath the two% forecast, whereas the core CPI remained regular at 2.6%.

“Inflation remained largely unthreatening in August, making the anticipated Financial institution of Canada rate of interest lower tomorrow a comparatively straightforward resolution,” stated Andrew Grantham, senior economist at CIBC Capital Markets, per Reuters.

The central financial institution left rates of interest unchanged at its gathering on July 30, a transfer that got here as little shock to markets. Nonetheless, the choice has raised a extra vital query: Has the cycle of price cuts already reached its peak?

Governor Tiff Macklem defined that the pause was pushed by inflation that simply received’t totally budge. The financial institution’s most well-liked measures, the trim imply and trim median, are nonetheless hovering round 3%, and a broader vary of indicators have additionally ticked greater. Macklem acknowledged that this persistence has drawn the eye of policymakers, who will intently monitor it within the coming months.

Nonetheless, he shortly clarified that not the entire present value pressures are everlasting. A stronger Canadian Greenback (CAD), softer wage progress, and an financial system operating beneath capability ought to all work to carry inflation decrease over time.

Previewing the BoC’s rate of interest resolution, analyst Taylor Schleich on the Nationwide Financial institution of Canada (NBC) famous, “After holding regular for the final three conferences, the Financial institution of Canada’s Governing Council (GC) is about to decrease the in a single day goal by 25 bps to 2.5%. OIS markets choose a lower to be probably with ~90% implied easing odds. An inflation report simply over 24 hours earlier than the choice is a supply of uncertainty, however we don’t anticipate it to derail a lower.”

When will the BoC launch its financial coverage resolution, and the way may it have an effect on USD/CAD?

The Financial institution of Canada will publish its coverage resolution on Wednesday at 13:45 GMT. After that, Governor Tiff Macklem will attend a press convention at 14:30 GMT.

Market individuals have largely anticipated a price lower on Wednesday, whereas implied charges recommend practically 45 foundation factors of easing by year-end.

In response to FXStreet’s Senior Analyst, Pablo Piovano, the Canadian Greenback (CAD) has been appreciating at a agency tempo in opposition to the US Greenback (USD) in the previous few days, with USD/CAD easing towards the 1.3750 area.

He notes that renewed promoting may see the pair drift again towards the August ground within the 1.3730-1.3720 band. Additional assist sits on the weekly base at 1.3575 (July 23) and the June valley at 1.3556 (July 3), earlier than reaching the 12 months’s backside at 1.3538 (June 16).

On the topside, resistance is pegged on the August high at 1.3924 (August 22), adopted by the 1.4000 spherical degree, with the Might ceiling at 1.4015 (Might 13) being strengthened by the proximity of the numerous 200-day Easy Shifting Common (SMA).

From a broader perspective, Piovano argues that the bearish bias stays intact so long as spot trades beneath its 200-day SMA.

That stated, momentum alerts stay blended: the Relative Energy Index (RSI) has damaged beneath the 43 degree, hinting at strengthening draw back momentum, whereas the Common Directional Index (ADX) close to 16 means that the broader pattern nonetheless lacks juice.