The federal government shutdown is simply noise… a replay of yesterday’s T-Line occasion with Keith Kaplan… seasonal hiring is down large… be in tech shares, or else… one approach to make investments now

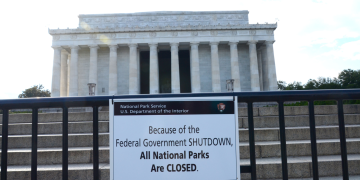

The federal authorities is formally shut down after lawmakers failed to achieve a finances deal yesterday.

Over the following few days, anticipate the information cycle to be dominated by political brinkmanship. However for Wall Road, these shutdowns are often simply noise.

Right here’s our hypergrowth skilled Luke Lango with the info:

The U.S. authorities shutdown that everybody is speaking about nowadays is much-ado-about-nothing for Wall Road.

We’ve had over a dozen shutdowns since 1980 – about one each 3 years. None of them imply squat. They usually final a couple of week, and shares barely transfer throughout that week.

Nothing to see right here.

If this develops into a much bigger story that would materially influence your portfolio, we’ll report again. For now, it’s a fleeting sideshow.

Transferring on…

Unbelievable suggestions from yesterday’s “T-Line” Occasion with TradeSmith CEO Keith Kaplan…

Yesterday afternoon, Keith went reside to stroll attendees by means of a strong new software that helps merchants determine when choices contracts are mispriced.

This mispricing creates alternatives to step in and gather money premiums due to mathematical odds which might be stacked in your favor.

The “T-Line” is known as after Ed Thorp – the quant genius who invented card counting and later turned probably the most profitable hedge fund managers in historical past. Thorp’s pioneering analysis into chance and mispricing in choices markets laid the groundwork for the T-Line, which Keith and his staff have now dropped at life.

Throughout yesterday’s occasion, Keith showed the tool in action. He demonstrated how one can spot mispriced trades, and the way the T-Line helps sharpen your entry/exit timing whereas controlling danger.

It builds on TradeSmith’s earlier innovation, the Likelihood of Revenue (PoP) indicator, which has already helped ship a 98.8% win price throughout greater than 900 earnings trades of their mannequin portfolio.

Collectively, these instruments assist merchants lower by means of the noise and make extra constant income-generating trades.

Right here’s Keith:

Within the free replay, you’ll see how the T-Line works and how you can use it to generate your own extra income streams by combining it with the PoP. I additionally confirmed some real-world trades you can make straight away.

The PoP and T-Line instruments might change the best way you commerce—simply as they did for me and 1000’s of different buyers

Backside line: When you’re trying to pull additional cash out of the market, I encourage you to check out the free replay of yesterday’s demonstration.

Extra purple flags from shopper confidence and the labor market

Yesterday, the Convention Board September survey confirmed that buyers are the least optimistic since April.

From Stephanie Guichard, the group’s senior economist for world indicators:

Customers’ evaluation of enterprise circumstances was a lot much less constructive than in latest months, whereas their appraisal of present job availability fell for the ninth straight month to achieve a brand new multiyear low.

This morning, ADP confirmed the roles weak spot with its newest personal payrolls report.

Dow Jones economists had been anticipating a rise of 45,000 jobs. As an alternative, the financial system shed 32,000 jobs – the worst efficiency since March of 2023.

Including insult to damage, ADP’s August payrolls report, which had are available at 54,000, was revised right down to a lack of 3,000 jobs.

This Friday brings the large jobs report that everybody will likely be watching intently – the Non-Farm Payrolls report from the Bureau of Labor Statistics (assuming there isn’t a wrinkle as a result of authorities shutdown).

August introduced simply 22,000 new jobs – dramatically beneath the forecast. The expectation for Friday is a higher-but-still-anemic 43,000 jobs with an unemployment price that is still at 4.3%.

In the meantime, seasonal hiring is coming within the weakest in years

If the most recent Challenger, Grey & Christmas report is any indication, Friday’s numbers will likely be disappointing.

Challenger, Grey & Christmas is a number one govt outplacement agency that publishes quite a lot of jobs market experiences. It’s turn into a go-to useful resource for getting a bead on labor market circumstances.

From its newest report final Thursday, specializing in retail seasonal hiring bulletins:

Following a summer season of subdued hiring, Challenger, Grey & Christmas expects seasonal Retail hiring in 2025 to fall to its lowest level because the recession-hit season of 2009…

Challenger tasks Retailers could add below 500,000 positions within the final three months of 2025, marking the smallest seasonal achieve in 16 years.

Right here’s Senior Vice President Andy Challenger:

Seasonal employers are going through a confluence of things this 12 months: tariffs loom, inflationary pressures linger, and plenty of corporations proceed to depend on automation and everlasting employees as a substitute of huge waves of seasonal hires?

Automation?

Put a pin in that – we’ll circle again.

A story of two shoppers

Within the background of this subdued hiring, since mid-August, we’ve had a string of both “all-time” or “52-week” highs within the funding markets:

- S&P 500 – all-time excessive

- Nasdaq – all-time excessive

- Dow Jones – all-time excessive

- Bitcoin – all-time excessive

- Gold – all-time excessive

- Silver – 14-year excessive

- Uranium (by way of the ETF URA) – 52-week excessive

- Copper (by way of the ETF COPX) – 52-week excessive

- Chinese language shares (by way of the ETF MCHI) – 52-week excessive

- 1-3 12 months Treasury bonds (by way of the ETF SHY) – 52-week excessive

Individuals with property are using excessive, whereas Individuals with out property are going through growing monetary challenges.

This break up is more durable to see immediately as a result of well-off Individuals are spending up a storm, skewing the common spending information and camouflaging what’s occurring with lower-income Individuals.

Right here’s Fortune with the truth:

In keeping with Financial institution of America Institute’s newest report, Shopper Checkpoint: Features and Gaps, higher-income households are having fun with accelerating wage progress and elevated spending, whereas lower-income households face slowing pay beneficial properties and flat expenditure—marking the widest such divide in additional than 4 years…

The result’s a warning signal for the financial system regardless of a robust total spending image.

Fortune highlights Financial institution of America Institute senior economist David Tinsley, saying “Decrease-income households aren’t actually spending.” The well-to-do households are those driving the financial system.

That’s not anecdotal – within the second quarter of 2025, shoppers within the high 10% of the earnings distribution accounted for 49.2% of all U.S. spending. That’s the very best degree since 1989.

However this story of “haves” versus “have-nots” isn’t restricted to the U.S. shopper…

There’s an identical break up within the financial system and inventory market

Let’s return to Luke.

From Monday’s Each day Notes in Innovation Investor:

We’ve advised you earlier than that the U.S. financial system is bifurcating between a booming AI Economic system and a struggling The whole lot Else Economic system. We noticed information [Monday] which confirmed this thesis.

Funding in info processing gear and software program rose ~30% within the first half of 2025. Excluding info processing gear and software program funding, actual GDP within the U.S. grew simply 0.1% within the first half of 2025.

So, primarily, the AI Economic system grew by 30% within the first half of the 12 months, whereas the The whole lot Else Economic system didn’t develop in any respect.

This received’t change anytime quickly.

There’s an identical bifurcation within the inventory market with AI stocks crushing nearly every little thing else.

For instance, let’s return to Andy Challenger’s reference to “automation” changing seasonal job work. Let’s increase that to cowl robotics and humanoids.

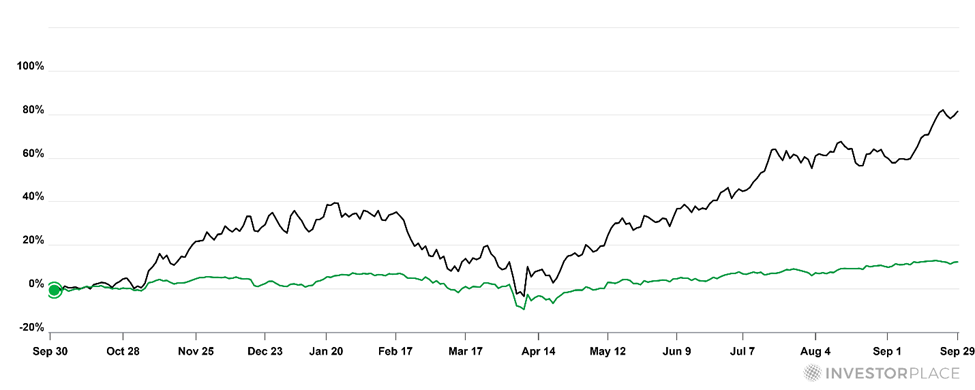

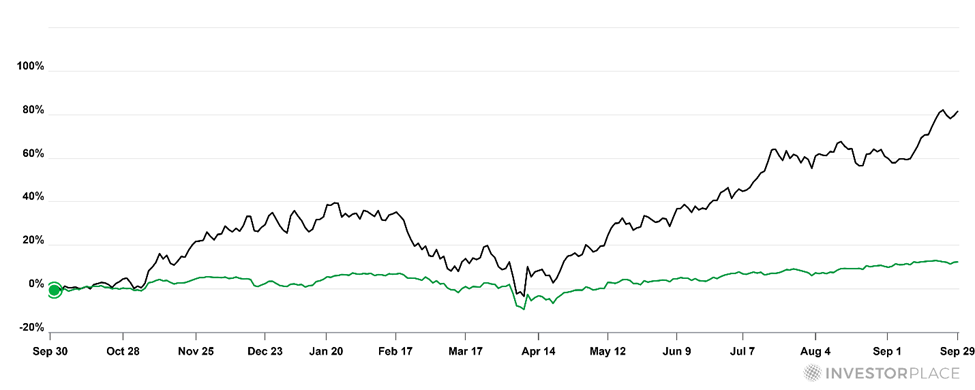

Beneath, we examine two ETFS:

- The ProShares S&P 500 Ex-Know-how ETF (SPXT), which provides us the efficiency of all “non-tech” shares within the S&P

- The ARK Autonomous Know-how & Robotics ETF (ARKQ), which focuses on tech leaders on the forefront of AI with a tilt towards Bodily AI (robotics and humanoids)

As you possibly can see beneath, during the last 52 weeks, our “AI/robotics” proxy (in black) has soared 86%, 7Xing our “non-tech” proxy (in inexperienced) which climbed simply 12%.

AI is driving today’s market boom, period.

This is, in part, why Luke has been urging investors to get exposure to automation, robotics, and humanoids.

Clearly, ARKQ is an option. It holds some great stocks, but it also has 37 different holdings. So, some of the performance of ARKQ’s high-fliers – like Tesla, its biggest holding – could be weighed down by underperformers. That’s just a reality of ETF investing.

For a more targeted approach, Luke recently released a free research report that breaks down Tesla’s Optimus humanoid challenge, flagging a backdoor way to invest in robotics/humanoids without buying Tesla itself.

Backside line: Right this moment’s bifurcated financial system and inventory market will solely develop extra divergent from right here. Our greatest shot at not simply surviving this break up, however thriving from it, will come from aligning ourselves with AI tech leaders at the forefront of momentum.

Coming full circle

Job progress is falling… asset costs are hovering… and the hole between the “haves” and “have-nots” is widening – whether or not these “haves” are high-income shoppers or main AI shares.

This places much more deal with Friday’s jobs report…

Will the Major Road/AI hole widen?

We’ll report again.

Have a great night,

Jeff Remsburg