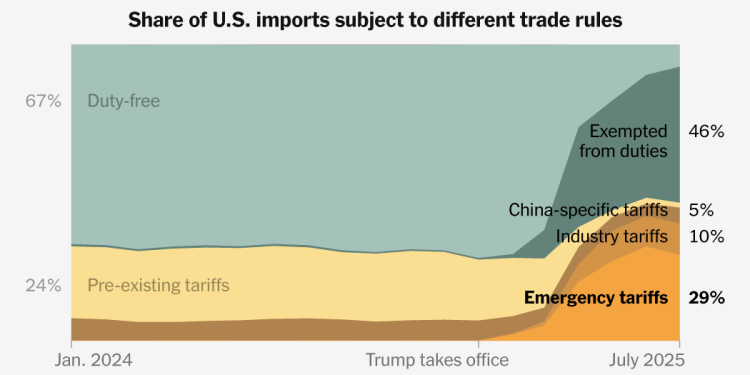

Share of U.S. imports subject to different trade rules

Just under half of all goods that enter the United States are now subject to tariffs, a New York Times analysis of Census Bureau trade data shows, a stark sign of how President Trump has reshaped American trade since returning to office in January.

Throughout the year, Mr. Trump has issued wave after wave of new duties, targeting almost every country in the world at levels not seen in roughly a century. The legality of the bulk of the new tariffs is now in jeopardy, as the Supreme Court on Wednesday begins hearing a case that challenges Mr. Trump’s use of an emergency powers law to impose the levies.

If the court rules against the president, it will nullify a major tool in Mr. Trump’s trade agenda. He has used the law under question, the International Emergency Economic Powers Act, or IEEPA, to impose tariffs on an estimated 29 percent of all U.S. imports, the Times analysis found. So far this year, these emergency tariffs have hit more than $300 billion in imported goods.

This illustrates both how much the president has transformed longstanding U.S. trade policy in favor of protectionist tariffs and how much is at stake for him in the unfolding legal battle.

The Times analysis, based on years of product-level import data, provides one of the fullest glimpses yet of the White House’s attempt to rewire the global trade order.

Before Mr. Trump’s second term, almost all imports entered under long-established trade rules that were agreed upon within the World Trade Organization, the analysis shows. By July of this year, when many of Mr. Trump’s tariffs began taking effect, that trend had been inverted.

Now, more than 90 percent of imports are subject to some aspect of Mr. Trump’s trade policy — a tariff he announced this year or during his first term, or a sweeping exemption granted to some products, at least temporarily.

Mr. Trump has used a broad range of presidential authorities to issue tariffs this year. He has imposed industry-specific duties on steel, automobiles, lumber and other products, using a national security provision known as Section 232. Those tariffs — as well as levies issued under separate legal authorities, some of which stem from his first term — are not being challenged at the Supreme Court.

That means that regardless of what the justices decide, nearly 16 percent of American imports will remain heavily tariffed.

Diverging Consequences

Every nation is affected by a different mix of these new trade rules, meaning that a court ruling overturning the emergency powers act could be far more consequential for some countries than for others.

Take China and countries in the European Union.

China was already subject to protectionist tariffs that were imposed during Mr. Trump’s first term, then expanded under the Biden administration. These tariffs, which affect more than half the country’s exports to the United States, would also remain in effect regardless of the Supreme Court’s decision.

The emergency power tariffs imposed a higher rate on all Chinese imports, and in many cases, they are added on to existing duties. That means that China’s trade-weighted average rate — more than 40 percent — is one of the highest in the world.

Goods from the European Union, on the other hand, largely entered the country duty-free before Mr. Trump’s second term. Only about a quarter of E.U. exports to the United States faced a tariff; now, roughly 60 percent face a tariff. Much of those are subject to the tariffs under review by the Supreme Court.

Sweeping Exceptions

For some countries, emergency power tariffs have been largely toothless.

Mr. Trump used the emergency power law to issue tariffs on imports from Canada and Mexico in the first months of his term, saying the countries had not done enough to stop the flow of fentanyl and migrants into the United States — what he deemed national emergencies. The fentanyl tariffs were then revised to cover only goods not entering under the U.S.-Mexico-Canada Agreement, a free trade deal that Mr. Trump signed during his first term.

Most imports from the United States’ two closest trading partners, however, qualify for the U.S.M.C.A. trade deal. Their goods now enter duty-free, side stepping the harsh new provisions Mr. Trump has enacted.

In fact, the share of goods entering the United States from Canada duty-free has increased since Mr. Trump took office, despite an intense trade clash between the countries. That’s mainly because U.S. imports from Canada have dropped and what is entering is much more likely to be covered by U.S.M.C.A. tariff exemptions.

Some imports from Canada and Mexico are subject to Mr. Trump’s tariffs on industries like automobiles, lumber and steel, and those would remain in place even if the court overturned Mr. Trump’s emergency tariffs.

Strategic Allowances

The administration has also issued broad exemptions to its tariffs, often to ensure that critical products from certain nations remain available to consumers. Ireland is a major exporter of name-brand drugs to the United States, and many pharmaceuticals from Ireland have been given exemptions. A trade deal between the United States and European Union also caps the tariff rates on pharmaceuticals at 15 percent, sparing them from rates that could be as high as 100 percent.

Many Taiwanese imports are similarly spared by an exemption on smartphones, computers and other electronics that was set up in April, shortly after many of Mr. Trump’s emergency tariffs went into effect. The administration has said those electronics will be subject to new tariffs in the future, although it’s unknown how high they could be.

Targeting Vital Industries

Some countries are already heavily affected by industry-specific tariffs, perhaps most notably economies that export automobiles to the United States.

Nearly a third of Japan’s exports to the United States are subject to auto tariffs, which were set at 25 percent before a trade deal lowering them to 15 percent was reached. South Korea is also heavily exposed to the auto tariffs and appears to be close to reaching a similar deal.

If the president’s power to wield tariffs is limited by the Supreme Court, the White House could wield these kinds of industry duties much more widely in the months to come.

Methodology

To estimate the share of U.S. imports covered under different tariff regimes, The New York Times analyzed years of international trade data from the U.S. Census Bureau. The data covers imports through July 2025, the latest available month because of the government shutdown.

The classification of imported goods is determined by the Harmonized Tariff Schedule of the United States code. For each trading partner, data was analyzed at the 10-digit H.T.S.U.S. level — the most detailed level available — and further broken out by the rate provision code under which the goods entered. Using the rate provision codes, we classified the share of imports by value entering under various broad categories.

“Duty-free” includes anything entering under Provision Codes 00, 10, 11, 13, 14, 16, 17 and 18. “Regular tariffs” includes anything entering under Provision Codes 61, 62, 64 and 70. “Exempted” consists of Provision Code 19.

The Times further classified the share of trade entering under Provision Codes 69 and 79, which contain imports tariffed under special rules, by cross-referencing those goods against the list of goods subject to Section 232 and Section 301 legal authorities for imposing tariffs. Goods that entered under Provision Codes 69 and 79, which are tariffed under special rules and are not in a Section 232 or Section 301 list and are considered to be subject to IEEPA “reciprocal” and “fentanyl” tariffs. In the case of China, imports covered under just Section 301, or both Section 301 and Section 232, are considered China-specific tariffs. Imports from Hong Kong are not subject to Section 301 tariffs, according to U.S. Customs and Border Protection.