Housing is considered one of life’s elementary wants, proper up there with meals, water, and security. For many years, although, housing affordability has change into more and more out of attain for the common American. With the median U.S. residence worth hovering round $440,000 and the median family revenue roughly $80,000, it’s simple to see why homeownership has change into extra of a dream than a given.

Enter the potential 50-year mortgage, an concept reportedly being explored by the Trump administration. The idea is straightforward: stretch out the compensation time period to make month-to-month funds extra inexpensive, and doubtlessly pair it with a transportable mortgage, which might permit householders to switch their mortgage to a brand new property in the event that they transfer. Collectively, these improvements may unlock housing safety for hundreds of thousands of People.

Critics are fast to say that extending debt over half a century is reckless. However I consider it’s a sensible step ahead – a recognition that our lifespans, careers, and monetary realities have advanced. If applied responsibly, a 50-year mortgage could possibly be one of the transformative housing instruments of our lifetime.

On this submit, I’ll additionally introduce a brand new idea referred to as the Mortgage Utilization Price — a easy framework that helps householders borrow extra responsibly.

Housing Safety And Household Formation

For a lot of People, housing security is the bedrock of household formation. {Couples} understandably need a steady residence earlier than bringing a toddler into the world. The very last thing you need, particularly with a new child, is to be compelled out as a result of your landlord needs to promote or elevate the hire. This occurs way more usually than most individuals notice.

After you have a child, life turns into a blur of feeding each few hours, pediatrician visits, and emotional and bodily restoration. The mom wants months to heal. The mother and father are operating on fumes. Throughout this fragile time, the very last thing you want is uncertainty about your residing scenario.

Whenever you personal your house, that stress largely disappears. You’ll be able to concentrate on elevating your little one moderately than worrying about your subsequent lease renewal. Housing safety permits you to channel your vitality towards what issues most: your loved ones. Don’t underestimate this profit.

The issue is, for a rising share of People, homeownership doesn’t even occur till center age. The Nationwide Affiliation of Realtors experiences that the median age of first-time homebuyers is now 40 years previous, an all-time excessive. That’s not only a statistic; it’s a mirrored image of how a lot more durable it’s change into to afford a house relative to revenue progress.

In the meantime, our life expectancy is round 80 years. We could also be residing longer, however not by as a lot because the rise in age of first-time homebuyers. In consequence, household formation is being pushed later and later, or deserted altogether. From a organic standpoint, this pattern carries monumental penalties.

If you happen to wait till 40 to purchase your first residence and begin a household, the percentages are stacked towards you. A girl’s likelihood of conceiving naturally after age 40 is beneath 1% per thirty days. That’s like entering into the Indian Institute of Expertise in a land of 1.46 billion folks, getting an H-1B visa, touchdown a six-figure job in America, after which rising as much as change into a C-level govt. It occurs, however not usually. The end result? Extra {couples} delaying or forgoing kids altogether.

That’s why the 50-year mortgage and the transportable mortgage could possibly be such game-changers. They don’t simply make properties extra inexpensive, they promote household stability, financial participation, and nationwide renewal. With out sufficient younger households, we face demographic cliffs that threaten long-term financial progress.

The 50-Yr Mortgage Is Nice — If You Don’t Take 50 Years

The loudest criticism of a 50-year mortgage is that it supposedly chains folks to debt eternally. If you happen to take out such a mortgage at 40, you’ll be 90 by the point it’s paid off. Sounds grim, proper? However that argument misses a vital level: virtually no one retains a mortgage for its full time period.

Right now, 90–95% of mortgages in America are 30-year fixed-rate loans. But the median homeownership tenure is barely about 12 years. Earlier than the 2008 monetary disaster, it was even shorter — round seven to eight years.

So why would we assume that debtors would really maintain a 50-year mortgage for 5 many years? They gained’t. Most will promote, refinance, or improve lengthy earlier than then.

Getting a mortgage offers you the choice to purchase, and due to this fact, the choice to promote at a revenue (or a loss). Bear in mind, nothing is everlasting in life. We don’t actually personal something in our quick time on earth. However having choices is extra beneficial than being shut out eternally.

The Mortgage Utilization Price Idea

Give it some thought: in the event you divide the common 12-year homeownership period by 30, that’s a 40% “mortgage utilization fee.” In different phrases, most individuals use lower than half their mortgage’s potential time period.

Apply that very same fee to a 50-year mortgage and the common home-owner would nonetheless find yourself holding it for less than about 20 years — not the total half-century. However realistically, I doubt tenure would soar from 13 years to twenty. Extra possible, it might improve by simply 1–3 years at most as a result of life retains taking place no matter mortgage size.

This is the reason I’ve lengthy inspired folks to contemplate adjustable-rate mortgages (ARMs), such because the 7/1 or 10/1 ARM. They higher match real-world conduct. The 50-year mortgage merely extends this flexibility additional. It’s an choice, not a sentence.

A 50-Yr Mortgage Offers Extra Choices, Extra Freedom

The fantastic thing about a 50-year mortgage is that it lowers your month-to-month cost, supplying you with better buying energy and adaptability. For younger households or first-time patrons, this may make all of the distinction. On the finish of the day, life is finite, and we hire every part earlier than we die anyway.

Think about you’re 32, newly married, and need to begin a household earlier than 35. You’ve saved diligently, however with out the Bank of Mom & Dad, you may’t fairly afford the month-to-month cost on a 30-year fastened mortgage. You take into account ready for residence costs to drop 20%.

Eight years later, you get your want — housing costs fall. However now, considered one of you has misplaced a job, and fertility is not in your aspect. IVF remedies price $28,000 per cycle, and also you’re emotionally and financially stretched skinny.

If a 50-year mortgage had existed earlier, you may’ve purchased a house in your early 30s, locked in stability, and centered on beginning your loved ones as an alternative of timing the market. Time waits for nobody, particularly not biology.

The longer amortization interval doesn’t imply you’re trapped. You’ll be able to at all times make additional principal funds or refinance when your revenue rises or charges fall. The bottom line is that you simply get to higher select when to purchase, as an alternative of ready indefinitely for affordability which will by no means return.

A 50-Yr Mortgage Is Music To A Actual Property Investor’s Ears

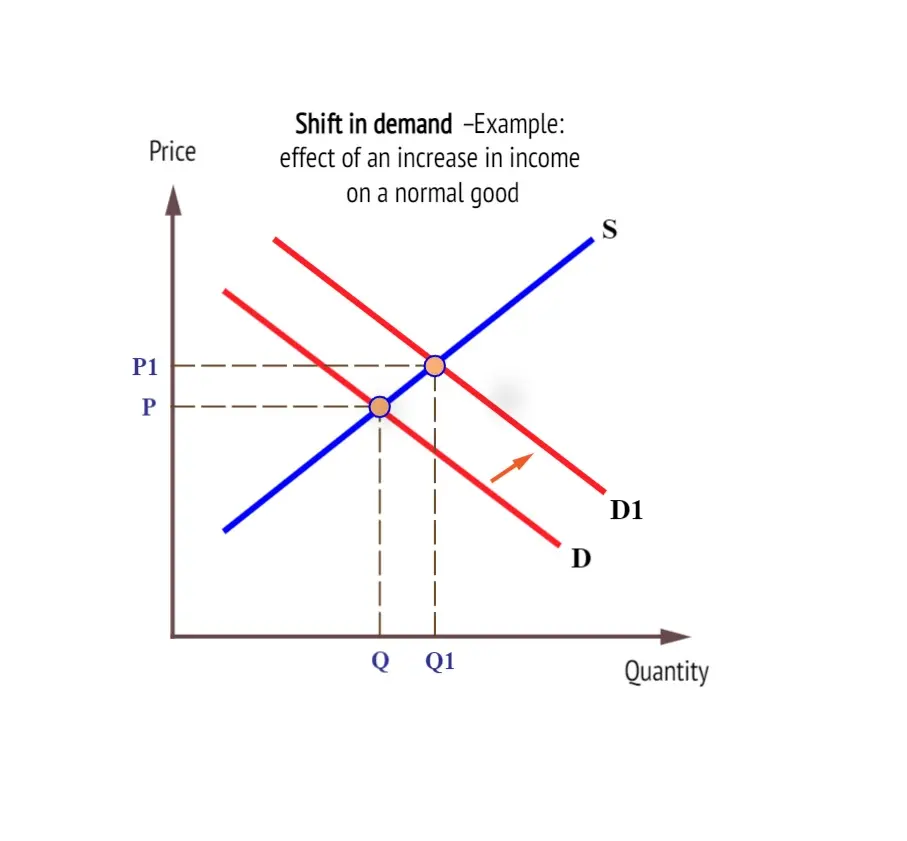

If you happen to’re an actual property investor, you by no means battle the federal government — you journey with it. A 50-year mortgage expands the pool of potential patrons, which naturally helps property costs. In different phrases, it shifts the demand curve to the best, inflicting costs to go from P to P1 within the chart beneath.

Traditionally, housing coverage has at all times leaned towards pro-ownership. The federal government is aware of that about 65% of People personal properties, and people householders kind a robust voting bloc. That’s why federal insurance policies — from mortgage curiosity deductions to capital gains exclusions — are persistently designed to help householders.

Bear in mind the 2008–2009 financial crisis? The federal government bailed out banks and householders alike. That set a precedent: when push involves shove, the federal government will step in to stabilize the housing market.

I nonetheless keep in mind when Financial institution of America voluntarily lowered my fixed-rate mortgage from 5.75% to 4.25% on a trip property — unprompted. It boosted my money circulation by $500 a month in a single day. That’s the facility of coverage alignment between lenders and the federal government.

And now, with the SALT cap raised from $10,000 to $40,000 beneath the One Big Beautiful Bill Act and discuss of a transportable mortgage system that permits you to take your fee with you while you transfer, the momentum is clearly pro-housing.

When the federal government alerts that it needs extra People to personal properties, you don’t resist — you make investments.

Moveable Mortgages: Unlocking Extra Freedom To Transfer

Whereas the 50-year mortgage is getting many of the consideration, the transportable mortgage may very well be the extra revolutionary idea. Roughly 70% of house owners have a mortgage fee beneath 5%, and residential gross sales is at a 3 12 months low, which implies individuals are placing their lives on maintain.

Below a transportable system, householders may switch their current mortgage (and rate of interest) to a brand new property. They’d nonetheless must qualify and provide you with any money distinction given monetary conditions have a tendency to vary time beyond regulation.

Nevertheless, Think about locking in a 3.5% fee and carrying it with you while you transfer. This innovation would clear up the “golden handcuff” downside that’s frozen the housing market since 2022.

Proper now, hundreds of thousands of People are reluctant to maneuver as a result of they don’t need to lose their low fixed-rate mortgages. A conveyable mortgage would release stock, increase mobility, and make housing markets extra environment friendly — all with out driving up default threat.

Mixed with the 50-year choice, the housing system turns into way more adaptable to real-world circumstances. Younger households should purchase earlier. Retirees can downsize with out penalty. Staff can transfer for jobs with out monetary pressure.

Make investments In The Development, Don’t Combat It

As an investor, the important thing to long-term success is aligning your self with policy and demographic trends, not combating them.

If the federal government needs to make housing extra inexpensive via longer mortgage phrases and portability, then housing demand will improve. And when demand will increase, costs observe.

For homebuyers, the 50-year mortgage is usually a bridge to stability when used responsibly. For buyers, even when these new mortgage merchandise by no means materialize, their mere dialogue alerts enduring help for the actual property market.

Having optionality is an excellent factor. A 50-year mortgage isn’t for everybody, and that’s tremendous. However for many who use it strategically, it will possibly imply many years of housing safety and better flexibility to speculate elsewhere.

Think about in the event you may safe your loved ones’s housing for half a century whereas nonetheless having the liquidity to construct wealth in shares, companies, or training. That’s not a burden. That’s empowerment.

When you have any options to growing housing affordability in America, I might love to listen to them!

Make investments In American Actual Property Passively

Proudly owning actual property straight isn’t for everybody. Between rising insurance coverage premiums, clogged bathrooms, and random HOA assessments, being a landlord can put on you down quick. However in the event you nonetheless consider — as I do — that actual property is among the most dependable methods to construct long-term wealth, there’s a better, extra passive strategy to play the pattern: Fundrise.

Fundrise allows you to put money into diversified portfolios of residential and business actual property tasks nationwide — with no need an enormous down cost or taking over a lifetime of mortgage debt. You get publicity to actual belongings, managed by professionals, whilst you sit again and accumulate potential dividends and appreciation.

You don’t should be a millionaire or accredited investor. You can begin with simply $10 and personal a slice of America’s housing market. The platform handles the acquisitions, renovations, and tenant complications for you.

If 50-year and transportable mortgages change into actuality, the housing market may expertise a robust second wave of demand. Extra patrons means extra liquidity — and doubtlessly increased property values. Fundrise buyers can profit from that very same macro tailwind with out ever signing a 600-month mortgage.

You’ll be able to both be the one paying off a mortgage for 50 years or the one accumulating hire and appreciation throughout these 50 years. Take a look at Fundrise right here and begin investing passively in America’s housing future.

Concerning the Writer

Sam Dogen based Monetary Samurai and kickstarted the modern-day FIRE motion in 2009. Each article relies on firsthand expertise and deep monetary evaluation.

Sam has been a house owner since 2003 and manages a diversified rental property portfolio that generates roughly $150,000 a 12 months in semi-passive revenue. By Monetary Samurai, he shares sensible insights on constructing wealth, reaching monetary independence, and residing life in your phrases.

Choose up a replica of his USA TODAY nationwide bestseller, Millionaire Milestones: Simple Steps to Seven Figures. He is distilled over 30 years of economic expertise that can assist you construct extra wealth than 94% of the inhabitants—and break away sooner.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Financial Samurai newsletter. It’s also possible to get his posts in your e-mail inbox as quickly as they arrive out by signing up here.