Alternative is brewing beneath the market’s flashiest tickers, and healthcare will be the market’s subsequent breakout sector…

¡Salud! Santé. Na zdrowie. Cheers!

Don’t worry; you’re not stuck on Disneyland’s “It’s a Small World” ride. Although when listing various toasts “to health,” it could feel like it.

Nearly every language has its own version of this sentiment. And these proclamations often accompany raising a drink or clinking glasses. But no matter the country, the wish is globally the same: goodwill.

This year, the healthcare industry could use its own toast “to health.”

In a stock market packed with richly priced companies, the pharmaceutical sector has become a conspicuous outlier. Investors have been rushing to the stage to cheer AI rock stars like Nvidia Corp. (NVDA) and Alphabet Inc. (GOOGL), whereas dismissing most pharma names as has-beens.

Paradoxically, in a market obsessive about AI stocks, few traders appear to care how extensively the biopharmaceutical trade has built-in AI applied sciences.

That oversight is strictly what creates alternative.

Away from the crowds and the blinding lights, drug firms are quietly getting into a interval of renewed energy, very like they did within the early Nineties.

That’s why I’m elevating a glass to an ignored biopharmaceutical firm with the hidden capability to ship outsized positive factors.

Beneath, I’ll share some particulars on this firm… and the place you will discover extra drug shares that possess market-beating potential.

However first, let’s take a better take a look at the well being of the healthcare sector, and why it’s primed for alternative…

A As soon as-in-a-Technology Low cost the Market Is Ignoring

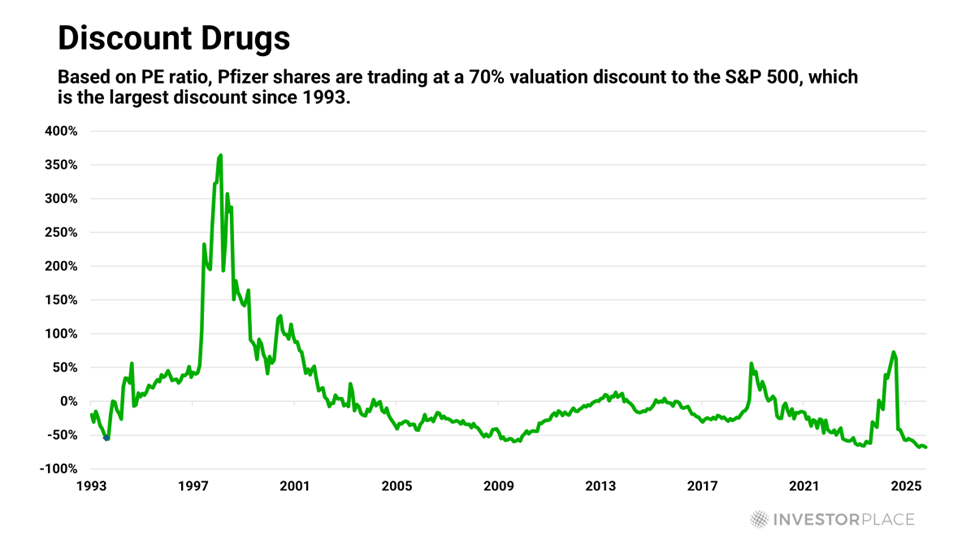

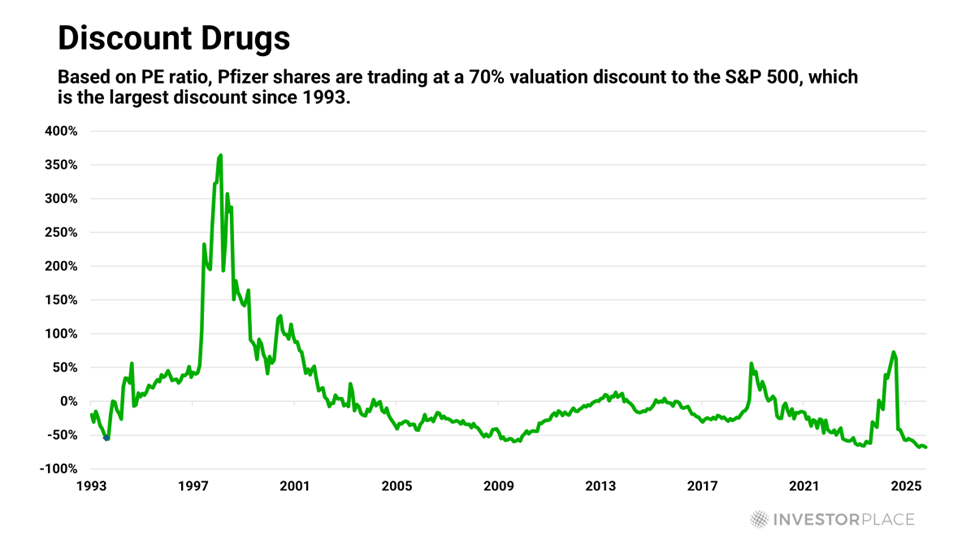

Valuations throughout the healthcare sector have tumbled to report lows relative to the S&P 500. You’d have to return greater than 30 years to search out valuations this depressed.

Take into account Pfizer Inc. (PFE) for example, which is buying and selling at a record-low 70% low cost. Put in a different way, traders at the moment are paying about 70% much less for a greenback of Pfizer earnings than for a greenback of earnings from the S&P 500 as a complete.

That is the most important low cost since 1993 – proper earlier than the beginning of a robust bull marketplace for healthcare stocks. Over the following six years, PFE soared greater than 1,000% over the S&P 500 index.

In hindsight, that chance ought to have been apparent. The corporate was getting into a brand new development section, producing revenue margins twice as excessive as these of the S&P 500.

At present, the basics look even stronger than they did in that 1994 trough. Pharma’s money flows are on the rise, gross margins are nonetheless roughly double the S&P’s, and the sector is integrating AI in methods that can probably make drug growth quicker, cheaper, and extra exact.

As an added plus, the sector affords a wholesome 3% dividend yield – greater than double the S&P 500’s.

For affected person traders, the setup is attractive: a sector priced for disappointment, regardless of fundamentals that time in the wrong way.

One firm is a transparent instance of this disconnect. Its valuation suggests stagnation, but its operations inform a special story: accelerating development in newer therapies, a deepening pipeline throughout main illness areas, and a strategic embrace of AI that ought to make future innovation quicker and extra predictable.

Listed here are the small print…

Gaining Momentum at a Discounted Value

The corporate I’m referring to is Bristol-Myers Squibb Co. (BMY).

It is among the largest pharmaceutical firms on the planet, with a lot of medicine that deal with ailments in immunology, cardiovascular, and oncology.

Plus, I imagine this firm possesses monumental potential to generate sturdy revenue development from its AI initiatives.

That signifies that Bristol-Myers is not only a drugmaker. It’s changing into a digital-first biomedical firm.

CEO Chris Boerner put it plainly within the firm’s newest earnings name: “We’re integrating digital know-how and AI throughout the corporate to drive effectivity and velocity in how we uncover and develop medicines.”

The affect is already seen. Trials begin sooner. Sufferers are matched extra effectively. Information high quality improves.

In drug growth, velocity lowers price and higher-quality information will increase the chances of success. Bristol-Myers is making use of AI to enhance each.

Boerner additionally remarked, “Q3 was one other sturdy quarter, reflecting centered execution throughout the enterprise as we proceed to make progress on our plan to place Bristol-Myers Squibb for long-term sustainable development.”

The outcomes backed him up.

The corporate’s “Development Portfolio” – the group of newer medicine that should exchange its getting old blockbusters – grew 17% 12 months over 12 months. Opdivo and Qvantig, key most cancers immunotherapies, continued their regular advance.

Given these positives, the corporate raised its midpoint income steering for the 12 months from $46 billion to $47.75 billion and bumped its earnings-per-share steering to $6.50. Free money circulate is rising sharply, and web debt continues to say no.

Bristol-Myers trades for about seven instances ahead earnings – one-third of the S&P’s a number of – and yields greater than 5%, backed by sturdy free money circulate and an A-rated stability sheet.

These numbers recommend a drained, no-growth firm, but its enterprise is clearly regaining momentum. Bristol-Myers isn’t attempting to reinvent itself; it’s merely executing, steadily and visibly, in ways in which the market has but to understand.

However I imagine the inventory nonetheless affords vital upside.

And it’s not the one healthcare play that gives vital, market-beating potential…

Two Healthcare Winners Already Proving the Bears Incorrect

I presently advocate two drug shares to my paid members at Fry’s Investment Report. Each have superior practically 50% year-to-date, in comparison with the S&P’s 13% achieve.

I contemplate these firms to be new-and-improved “Buys” proper now. That’s the reason I spotlighted them within the November month-to-month subject of Fry’s Investment Report that I launched simply yesterday.

You can learn how to access the names of these healthcare recommendations here.

As I discussed, Wall Avenue has its consideration squarely on dazzling AI darlings like Nvidia, which releases its newest quarterly earnings report later right now. (I’ll share extra on that tomorrow.)

That signifies that the healthcare sector’s present discounted valuation, together with its appreciable long-term development potential, affords compelling alternatives in right now’s richly priced market.

And to that I say: Cheers!

Regards,

Eric Fry