Gold (XA/USD) surges in the course of the North American session on Friday, up 0.30% regardless of rising US Treasury bond yields and of the US Greenback, which is poised to complete the week with modest positive factors of 0.25%. On the time of writing, XAU/USD trades at $4,344 after bouncing off every day lows of $4,309.

Bullion advances late Friday regardless of rising US yields, steadier US Greenback

On Friday, the US financial docket is scarce, because the final ‘formal’ buying and selling week of the yr involves an finish, as most buying and selling desks get off for the Christmas holidays. The Client Sentiment Index by the College of Michigan for December missed the mark, as folks surveyed see an increase within the unemployment fee, and as shopping for for sturdy items tumbled for the fifth straight month.

Earlier, New York Federal Reserve (Fed) President John Williams stated that he doesn’t have a “sense of urgency on altering financial coverage.” Williams’ posture shifted from dovish to neutral-hawkish because the Buck recovered some floor, whereas Gold costs retreated to $4,320, earlier than hitting a every day excessive.

Within the week, Gold costs hit a weekly excessive of $4,374 on Thursday, however consumers remained reluctant to check the year-to-date (YTD) excessive of $4,381, as international bond yields rose. US Treasury yields rose because the Financial institution of Japan elevated charges from 0.50% to 0.75% on Friday.

Subsequent week, the US financial docket will probably be busy on December 23, as a consequence of a shortened week by the Christmas holidays. Merchants will digest the ADP Employment Change 4-week common, development figures for Q3 on its preliminary launch, October’s Sturdy Items Orders and Industrial Manufacturing prints for October and November.

Every day digest market movers: Gold worth jumps as Client Sentiment dips

- Gold worth rallies regardless of each US yields and the US Greenback are posting strong positive factors. The US 10-year Treasury be aware yield is up two and a half foundation factors to 4.147%. US actual yields, which correlate inversely with Gold costs, surge almost three foundation factors to 1.907%.

- The US Greenback Index (DXY), which tracks the buck’s worth towards a basket of six currencies, rises 0.22% to 98.63.

- US Client Sentiment was revised down in December from 53.3 to 52.9, felling wanting expectations of a print of 53.5. The College of Michigan survey additionally up to date that inflation expectations for one yr climbed to 4.2%, whereas five-year expectations held at 3.2%, indicating that longer-term inflation views stay elevated however steady.

- New York Fed President John Williams stated that latest knowledge level to additional disinflation, whereas noting that the uptick within the unemployment fee could mirror momentary distortions, probably by round one-tenth of a proportion level, and subsequently was not a shocking improvement. He added that he doesn’t sense any urgency to regulate financial coverage at this stage.

- On Thursday, the US Client Value Index (CPI) for November rose by 2.7%, under the earlier print of three%. Regardless of this, economists warned that knowledge needs to be taken with a pinch of salt, because of the 43-day shutdown of the US authorities, which may distort some knowledge.

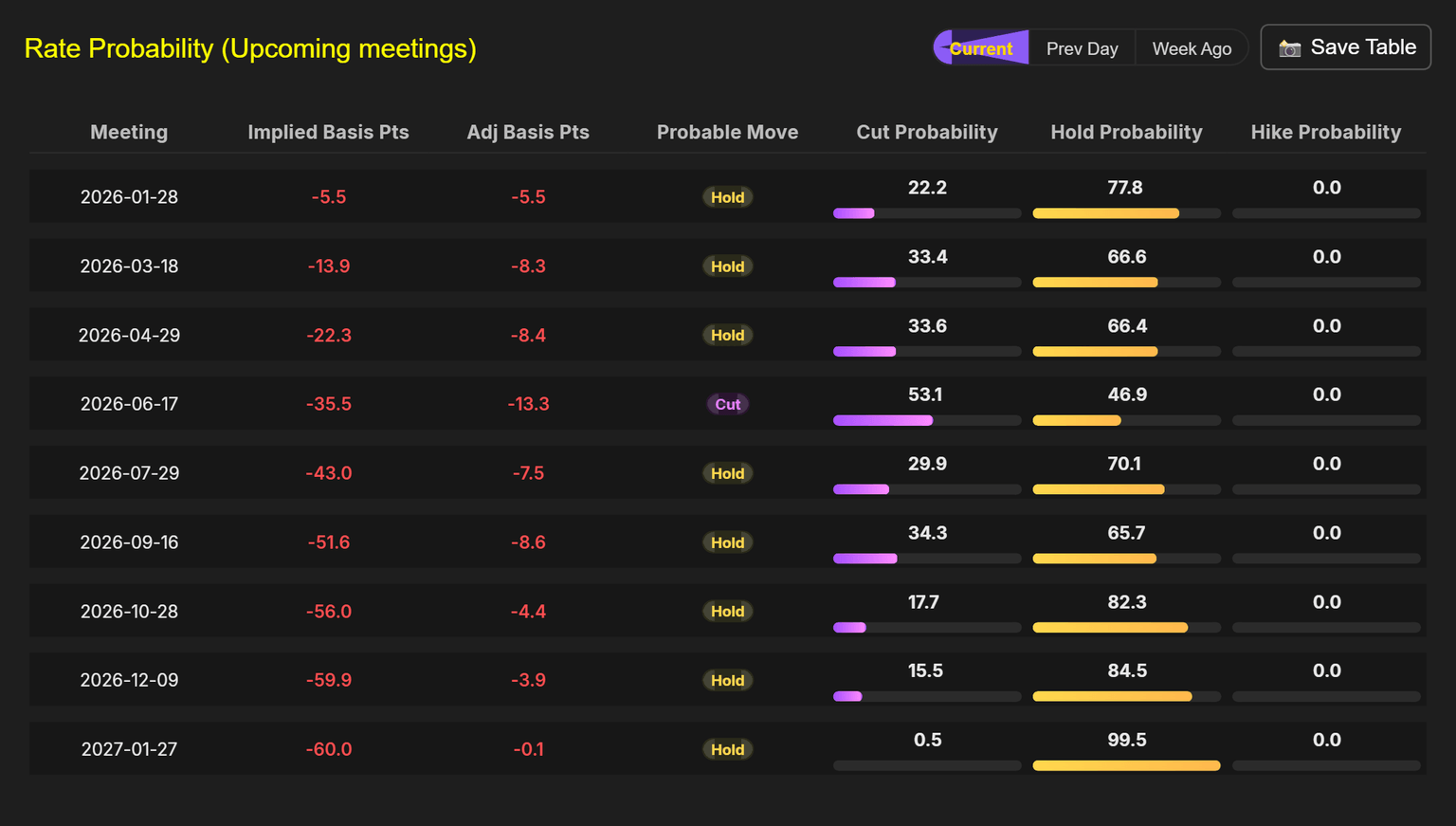

- Expectations that the Fed will reduce charges on the subsequent assembly on January 28 stay unchanged at 22%, in accordance with Capital Edge Price likelihood knowledge. Nonetheless, for the total yr forward, traders had priced 60 foundation factors of easing, with the primary reduce anticipated in June.

Technical evaluation: Gold loses steam because it falls to punch by means of $4,381 peak

Gold’s uptrend stalled because the yellow steel consolidates forward of the yr’s finish. Nonetheless, Bullion is poised to finish with an appreciation of greater than 60%, set to check $4,500 and $5,000 within the subsequent yr.

For a bullish continuation, XAU/USD must surpass the report excessive of $4,381 forward of $4,400. A breach of the latter exposes $4,450 and $4,500. Alternatively, if Gold slides under $4,300, merchants may problem the December 11 excessive at $4,285, adopted by $4,250, and the $4,200 psychological mark.

Gold FAQs

Gold has performed a key position in human’s historical past because it has been extensively used as a retailer of worth and medium of change. At the moment, other than its shine and utilization for jewellery, the dear steel is extensively seen as a safe-haven asset, that means that it’s thought-about a great funding throughout turbulent instances. Gold can also be extensively seen as a hedge towards inflation and towards depreciating currencies because it doesn’t depend on any particular issuer or authorities.

Central banks are the most important Gold holders. Of their goal to assist their currencies in turbulent instances, central banks are likely to diversify their reserves and purchase Gold to enhance the perceived energy of the economic system and the forex. Excessive Gold reserves is usually a supply of belief for a rustic’s solvency. Central banks added 1,136 tonnes of Gold value round $70 billion to their reserves in 2022, in accordance with knowledge from the World Gold Council. That is the very best yearly buy since data started. Central banks from rising economies corresponding to China, India and Turkey are rapidly rising their Gold reserves.

Gold has an inverse correlation with the US Greenback and US Treasuries, that are each main reserve and safe-haven property. When the Greenback depreciates, Gold tends to rise, enabling traders and central banks to diversify their property in turbulent instances. Gold can also be inversely correlated with danger property. A rally within the inventory market tends to weaken Gold worth, whereas sell-offs in riskier markets are likely to favor the dear steel.

The worth can transfer as a consequence of a variety of things. Geopolitical instability or fears of a deep recession can rapidly make Gold worth escalate as a consequence of its safe-haven standing. As a yield-less asset, Gold tends to rise with decrease rates of interest, whereas larger value of cash often weighs down on the yellow steel. Nonetheless, most strikes depend upon how the US Greenback (USD) behaves because the asset is priced in {dollars} (XAU/USD). A powerful Greenback tends to maintain the value of Gold managed, whereas a weaker Greenback is more likely to push Gold costs up.