The value motion of Bitcoin over the previous week tells an ideal story of its efficiency this 12 months. The premier cryptocurrency skilled incredible levels of volatility all through the week, oscillating between the $90,000 and $86,000 vary over the previous few days.

The most recent market analysis reveals that the way forward for the Bitcoin worth may be wanting bleaker than mere durations of sideways volatility. In line with a distinguished cycle, BTC’s worth cycle has turned and is coming into a bear market.

Bitcoin Cyclical Habits Relies upon On Demand Cycles: CryptoQuant

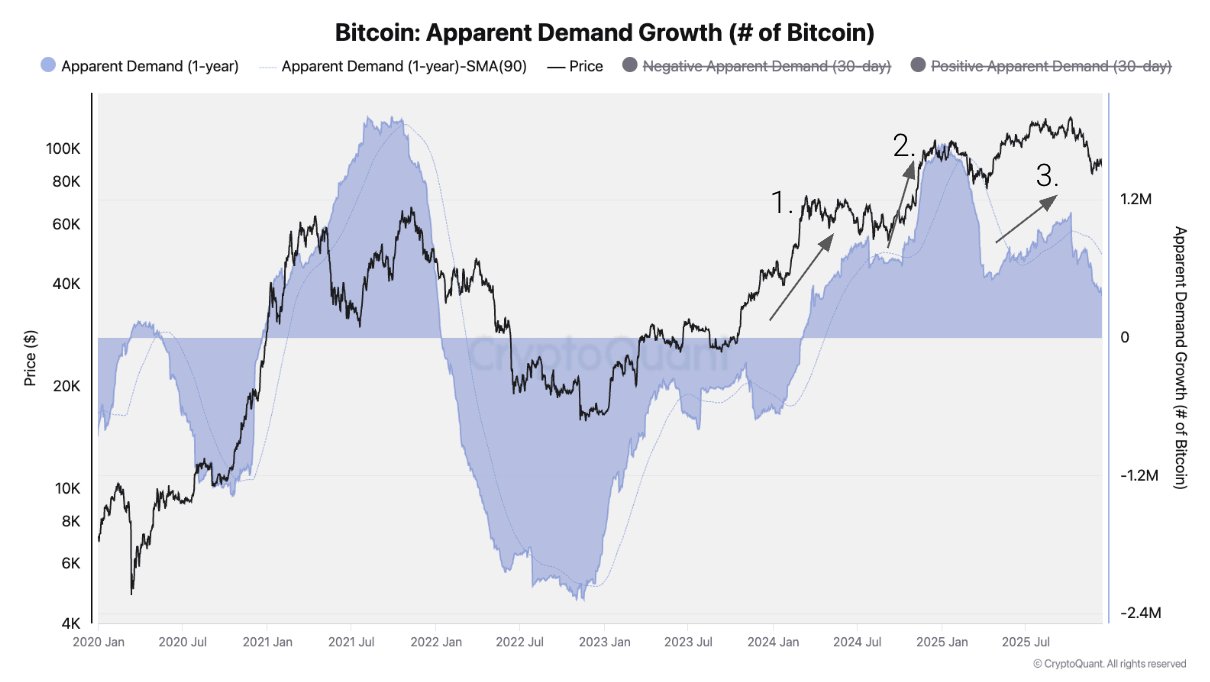

In its newest market report, blockchain analytics agency CryptoQuant has associated the regular decline in Bitcoin worth with the fading demand increase. In line with knowledge on the on-chain platform, the BTC demand development has slowed down in the midst of 2025, signaling the beginning of a bear market.

CryptoQuant highlighted that Bitcoin has witnessed three main spot demand waves—triggered by the US spot ETF launch, the US presidential election final result, and the Bitcoin Treasury Corporations bubble—for the reason that bull cycle began in 2023. Nevertheless, the demand development has slowed down since early October 2025.

Unsurprisingly, this development reversal for the demand development coincides with the October 10 market massacre, one of many largest liquidation occasions in crypto historical past. The Bitcoin worth has since struggled to mount any convincing restoration, falling to as little as $82,000 in late November.

Supply: CryptoQuant

CryptoQuant went on to hypothesize {that a} key pillar of worth help has been eliminated as most of this cycle’s incremental demand has already been realized. As an example, demand from institutional and huge buyers is in a downturn, with US-based Bitcoin exchange-traded funds (ETFs) turning into internet sellers in 2025’s fourth quarter.

In line with CryptoQuant’s knowledge, the US spot ETF holdings have declined by 24,000 BTC in This fall 2025, which is a far cry from the regular accumulation seen in This fall 2024. “Equally, addresses holding 100–1K BTC—representing ETFs and treasury firms—are rising beneath development, echoing the demand deterioration seen on the finish of 2021 forward of the 2022 bear market,” the blockchain agency added.

In addition to the weakening spot demand, the Bitcoin derivatives market has additionally seen lowered exercise and decreased threat urge for food. CryptoQuant revealed that BTC’s funding charges have fallen to their lowest degree since December 2023, an on-chain sign that means the lowered willingness of merchants to maintain long exposure; this development is commonly related to bear markets.

In the end, the blockchain agency concluded that the Bitcoin four-year cycle hinges extra on demand phases—expansions and contractions in demand development— moderately than on the halving occasion. In essence, a bear market tends to come back after the BTC demand development peaks and topples over.

What Subsequent For BTC Worth?

In its report, CryptoQuant revealed that the Bitcoin worth construction has worsened consistent with the demand weak spot. The flagship cryptocurrency is at the moment buying and selling beneath its 365-day transferring common, a key long-term help degree that has traditionally separated bull and bear phases.

In line with CryptoQuant, the downside reference points recommend that the Bitcoin bear market may not be as deep as feared. As in earlier bear seasons, the realized worth—at the moment round $56,000—has been recognized because the potential backside.

This means a doable 55% correction from the most recent all-time excessive, Bitcoin’s smallest drawdown on document (throughout a bear market). In the meantime, the market chief has its intermediate help degree round $70,000.

As of this writing, the value of BTC stands at round $88,170, reflecting a 3% leap prior to now 24 hours.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.