Pleased New Yr 2026 everybody! With one other yr wrapped up, I believed I’d do a 2025 yr in evaluate so I can at some point look again fondly as an outdated man. General, I give the yr an A for effort, which is all I can actually management. Sadly, the outcome didn’t match the hassle, as I give it a B minus, perhaps even a C plus.

The principle purpose for the B minus is ongoing household points that negatively affected my spirits. I’m naturally a cheerful and joyful individual – a steady-state 8 out of 10. However for a lot of the whole yr, I felt a whole lot of grey clouds and wet days hanging overhead.

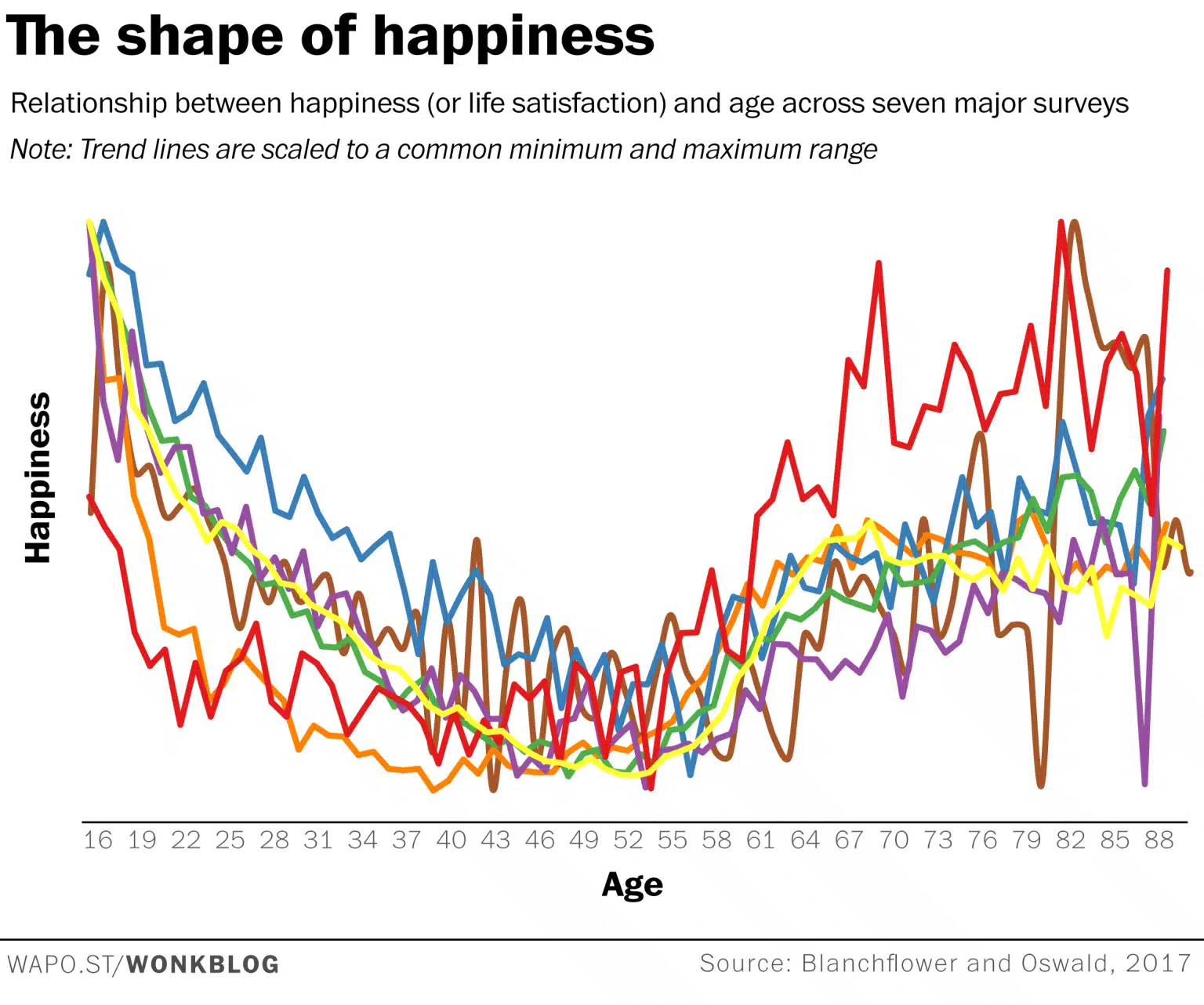

The factor is, even in case you are completely satisfied, when somebody in your loved ones is below duress, your happiness will inevitably decline. From every little thing from ageing to taking good care of youngsters and sick mother and father, the happiness dip for the sandwich technology is actual.

Coming into The Trough Of The Happiness Curve

Simply take a look at this nice chart summarizing seven main surveys of 1.3 million randomly sampled individuals throughout 51 international locations. Between ages 45 and 55 is the place happiness is lowest – and my spouse and I are 45 and 48.

I wrote this submit first earlier than on the lookout for happiness curves to see the place we stand. It’s comforting that we’re not alone.

However gosh, I believed I’d have the ability to keep away from this trough by retiring earlier. The truth is, I wrote a submit stating the best reason to retire early is greater happiness sooner and for longer. That section lasted about 11-12 years, but it surely has now light.

2025 actually made me admire, as soon as once more, how cash can’t purchase happiness after your fundamental wants are met. I used to be pissed off this yr that, regardless of how arduous I attempted, the melancholy nonetheless lingered.

It’s unhappy to comprehend that even if you happen to stay in a pleasant home, have minimal debt, have your well being, don’t really feel caught at work, and have completely satisfied youngsters, you’ll be able to nonetheless really feel down generally. This disconnect additionally feels embarrassing, particularly if you happen to’ve grown up in a growing nation with an incredible quantity of poverty and inequality.

Everyone knows the options: observe gratitude each day, take steps to eliminate regrets, stroll and train each day, cut back need, and decrease expectations Nonetheless, in addition to always displaying up, there’s generally nothing you are able to do when uncontrollable circumstances happen.

Now on to my 2025 evaluate, categorized by Investments, Household, and Artistic Endeavors.

Public Investments – Grade A

General, 2025 was a stable yr financially thanks to a different bull market. My mixed public fairness portfolio rose by about 23%. The explanation for its 6% outperformance in comparison with the S&P 500 was as a result of my obese positioning in Google, Tesla, and Nvidia. On the draw back, my shares in Apple, Amazon, and Nike underperformed the S&P 500.

That is now three years in a row of 20%+ returns, which seems like a lottery win after a tough 2022 (-24% for my tech-heavy equities). The after-tax positive aspects alone are capable of pay for about 4 years of regular dwelling bills for a household of 4 right here in San Francisco.

The issue with a 23% return is that it took a whole lot of effort to get there as an active investor. And albeit, I believed I had returned much more earlier than I crunched the numbers.

If I had simply invested all my cash in an S&P 500 index and finished nothing, I’d have made about 16.5%. I’m undecided if the hassle to make an additional 6% is value it, particularly since I might have simply underperformed. However I keep energetic as a result of some huge cash is at stake as DUPs with no regular energetic revenue.

Going by means of the whipsaw of the April tariff tantrums, adopted by making an attempt to always determine whether or not the economic system would actually be OK amid stagflation fears, took a toll on my psychological power. However I would like to acknowledge {that a} ~6% outperformance has purchased us just a little over one yr of dwelling bills. I simply should be cautious not dropping an excessive amount of this yr.

Personal Investments – Grade A Minus

As for my personal investments in enterprise debt and enterprise capital, it’s more durable to gauge returns since a lot is illiquid. I do know one 2018 classic enterprise fund holds Rippling, which is doing nice. However the remainder of the closed-end funds stay unclear as many investments are nonetheless within the early stage.

Fundrise Venture was a standout performer. It rose over 45%, making it my top-performing fund funding of the yr. I had about $140,000 invested at the beginning of 2025, and invested $100,000 on June 20.

In July/August, I additionally determined to reinvest $200,000 value of expiring Treasury payments and open a brand new private account earmarked for my youngsters’s future. I figured, if I am keen to take a position over $200,000 in a 529 plan, then I would as properly put money into the very know-how which may make their school educations out of date.

My important remorse is just not investing extra at the start of the yr once I had a windfall from promoting a property. However out of self-discipline, I preserve personal funding allocation to at most 20% of my investable capital.

The explanation I don’t give my personal investments an A is that one enterprise debt fund (out of three) closed out at a 12% IRR, underperforming the S&P 500. In the meantime, my private commercial real estate investments noticed one other flat yr, though there are optimistic indicators of life.

Bodily Actual Property – Approach Too A lot Effort

2025 was the most tough yr I’ve ever had as an actual property investor.

The principle purpose is that I had three tenant turnovers out of 4 properties, which required my spouse and me to organize every property both on the market or for hire. Then I did one other transforming job. The time, coordination, and emotional power concerned had been vital.

Property #1: Most Latest Main Residence Turned Rental

The primary property required about two months of preparation and in the end offered by way of a preemptive offer. I hit my sensible goal gross sales value and felt terribly relieved that we offered it, particularly after the devastating January fires in Southern California. It was an excellent property with ocean views, however the rental yield was low because of the excessive value level and the necessity to handle 4 tenants annually was annoying.

After this sale, which solely had a 13-day shut, I believed the remainder of the yr can be straightforward avenue with regard to property administration. Oh, how improper I used to be!

Property #2: Summer season Transform Job

Given we determined to go to Hawaii for 5 weeks for summer season college and see my mother and father, I figured it was time to remodel the neglected two-bedroom in-law unit linked to my mother and father’ home. It was my aunt’s outdated dwelling area, and it hadn’t been inhabited for over 13 years. The place was piled with stuff, crawling with bugs, and had damaged taps and defective wiring all over the place.

I believed the rework would take two or three weeks and price perhaps $25,000. Nevertheless it ended up taking 4 weeks whereas I used to be there and one other week after I returned to make the place totally livable, with furnishings, a fridge, and home equipment.

After gut-remodeling a property from 2019–2022, I swore I’d by no means rework one other property once more. It’s a horrible course of, and I’d fortunately pay a premium for a fully remodeled home. Nonetheless, I felt my summer season in Hawaii was a now-or-never second to get to work as a result of no person else would after my aunt handed a number of years in the past.

The silver lining is that I obtained the place finished and totally furnished, offering my spouse and kids with a extra comfy dwelling association throughout our 10-day winter vacation journey. That stated, I did nearly burn down my parents’ house twice in a single week as a result of defective wiring for the dryer. Ah, extra stress.

Property #3: Partial Rental Turned Full Rental

After coming back from Hawaii in July, I wanted to relaxation as a result of the journey was additionally arduous on my spouse. I additionally felt unsettled for the reason that eating room furnishings, fridge, and washer and dryer weren’t going to reach till early September, after which had been pushed again till the tip of November.

Sadly, throughout our time away, our long-time tenants since 2019 at one other property discovered one other place to stay. They had been stable renters who occupied the upstairs portion of a home with two bedrooms and one rest room. They wished a whole single-family house as a result of having a child.

To accommodate, earlier than we went to Hawaii, I supplied to hire them the downstairs portion as properly, giving them three bedrooms, two loos, and an workplace. Maintain df, Even after providing a reduction to comparable market rents, they determined to hire a smaller home farther south for much less. No downside, however not excellent for me.

The method took about 5 weeks to search out new tenants. As soon as once more, we needed to clear, paint, backyard, and repair some random issues in preparation for brand spanking new tenants. I additionally hosted a number of personal showings for events. Thankfully, we discovered an excellent household who’s respectful and had beforehand owned property within the space. They relocated again to San Francisco as a result of larger enterprise demand after shifting away throughout COVID.

The optimistic of our tenants shifting out was our semi-passive income elevated by $3,500 a month. This was because of charging market hire after a number of years of undercharging by ~$1,000/month and renting the whole home as a substitute of simply the upstairs for an additional ~$2,500 / month.

Property #4: The Largest Rental That Was Hardest To Hire Out

Lastly, I believed I used to be finished after three property turnovers! However no, the actual property gods had extra work for me to do. Solely a month after discovering new tenants, I acquired one other e-mail from one other set of tenants giving their 45-day discover. Apparently, that they had already relocated to Colorado and had been solely returning often. This was a shock, particularly since their youngsters attended a college simply blocks away and so they had moved in solely 15 months earlier.

As soon as once more, I spent about six weeks coordinating cleansing, repairs, and the tenant search. This time it was more durable. The hire was a 35% greater value level than my different rental, which diminished the rental pool. Additional, I used to be looking in the course of the off-peak months of October and November, a part of the worst time of the year to find renters.

Thankfully, 5 weeks after I printed my first advert on Craigslist, a lady reached out saying she and her husband had been relocating to San Francisco for work. One labored at a Collection C personal tech startup, and the opposite at one of the crucial well-liked AI LLM corporations immediately, which I’m a shareholder in by means of the Fundrise.

To my shock, the couple was keen to pay $10,000 a month for a five-bedroom, four-bathroom house. Given their salaries and fairness compensation, the hire was truly fairly inexpensive. They wished two house workplaces and area for a house health club.

As a result of these new tenants, hire for this reworked house went from $9,000 a month for 12 months in 2024-2025, to $9,200 a month for 3 months in 2025, and now $10,000 a month from November 2025 onwards.

Stable Whole Rental Earnings Development

General, I boosted my semi-passive revenue by about $4,300 a month, supplied there are not any unexpected bills. I offered a property bought in 2020 for roughly a 20% web revenue after taxes and costs and reinvested many of the proceeds into private and non-private fairness. Then I made made a two-bedroom in-law unit very nice for all relations to remain.

Because of this, I give the actual property returns an A, however the effort required an F. I really feel like I did 4 years value of standard actual property administration in a single yr.

Because of this, I’m decided to promote one other property after 2027 once I can reap the benefits of the tax-free exclusion rule. Within the meantime, I hope my tenants benefit from the properties and stay self-sufficient. Actual property was my biggest supply of monetary stress in 2025.

The industrial actual property market additionally appears to be waking up from its lengthy slumber. It’s been a troublesome slog since inflation surged and the Fed started climbing rates of interest aggressively in 2022. However valuations are actually extraordinarily compelling in comparison with the inventory market, and I’m beginning to invest more in private real estate again.

Household Dynamics – Grade B Minus

As a result of some advanced points affecting one beloved member of the family particularly arduous, a grey cloud hung over my spouse and me all year long. I attempted to be a rock by preserving our funds stable, working Daddy Day Camp each weekend, dropping off and selecting up the children 95% of the time, and at all times being round within the evenings.

My days would usually run from about 5:15 a.m. till 11:30 p.m. as a result of I wished to write down earlier than the household wakened and after the household had gone to mattress. Sadly, my effort to be a full-time dad didn’t appear to be sufficient. My spouse has rather a lot on her plate, is doing the perfect she will, and is genuinely adored by our youngsters. I’m additionally studying the best way to be extra empathetic to issues and organic adjustments exterior our management.

The excellent news is that we have now the monetary sources to supply the perfect remedy and care potential. One other shiny spot is that our youngsters proceed to develop and thrive. They love their college, have pals, and obtain an infinite quantity of high quality time from each mother and father.

In significantly, I spent a whole lot of time instructing each youngsters tennis and swimming. They now have decent-looking forehands and backhands, together with improved freestyle strokes. In complete, I gave every youngster at the very least 35 one-on-one classes, every lasting one to one-and-a-half hours.

Educating your individual youngsters requires endurance, inside prayers for endurance, and sheer dedication. However seeing seen progress has been extremely rewarding.

It’s deeply satisfying to have the ability to assist my household and allow my spouse to be 10 years free from full-time work after helping her negotiate a severance package again in 2015. Nonetheless, the burden is getting heavier because of persistent elevated inflation, pointless wishes, and hedonic adaptation. I have to make changes with a view to final.

Artistic Endeavors – Grade A Plus

As soon as you allow your day job, you’ll almost definitely want to search out one thing artistic or purposeful to do. I extremely doubt you’d be completely satisfied solely watching eight hours of TV a day and enjoying pickleball. Personally, I’ve a have to really feel helpful. It additionally feels nice to assist individuals really feel higher and acquire confidence of their funds.

In 2025, I printed one other 156 articles, 52 newsletters, and roughly 30 podcast episodes. Right here’s a recap of the best articles on Financial Samurai for 2025. What made this significantly gratifying had been two issues.

First was the success of my second nationwide bestseller, Millionaire Milestones: Simple Steps to Seven Figures. It took two years to write down and numerous hours to market. One of many highlights was narrating the audiobook myself. It was one of the crucial difficult skilled experiences I’ve had.

The problem of the method made me notice how a disability or health issue could take away your ability to earn, so please take nothing with no consideration. If you’re wholesome, reap the benefits of your capability to provide earlier than it is gone.

Second was sustaining my publishing streak regardless of Google and AI negatively impacting website site visitors. As natural site visitors declined, so did income. However as a result of I genuinely love writing, I stored going anyway. I’ve been anticipating at the present time for 5 years, and now the existential crisis from AI is right here. I do not suppose I am going to ever totally give up.

Shock Video Interview

Lastly, Enterprise Insider released a fun video interview that includes my household and two others discussing cash classes for elevating youngsters. The inquiry got here out of the blue and felt like an ideal method to shut out the yr.

As an alternative of paying to take photos and ship out vacation playing cards, I had an Emmy-winning producer attain out and produce a video for us as a substitute.It was an effective way to complete the yr and commemorate my mother and father and grandparents.

Cash Is Good, A Pleased Household Is Far Higher

2025 strengthened a fact I’ve identified for many years: the window to live your best life doesn’t keep open ceaselessly. That is the principle purpose I give up the desire to make maximum money at age 34 and left my finance job behind. As soon as your fundamental wants are met, cash now not brings incremental happiness.

Household and pals matter way more. They’re additionally the individuals who can damage us or assist us probably the most. To at the present time, I’m nonetheless making an attempt to raised perceive my mother and father’ personalities. Particularly, I’m making an attempt to distinguish how a lot of the best way they’re is because of their personalities versus their ages. They function so otherwise than I do this I discover myself trying to find clues once I’m with them.

I’m additionally dwelling life for the primary time and am fascinated to see how our views change over time. You’d suppose we’d at all times have the ability to steadily enhance our pleasure the extra we obtain, however I’m not seeing this correlation after age 45. As an alternative, the extra we have now, the heavier we are likely to really feel and the extra we undergo. Having ever-higher expectations is a recipe for unhappiness.

Genetically, we’re all constructed otherwise. Based mostly on twin research, roughly half of our happiness is influenced by genetics, setting a “set level,” whereas the opposite half comes from our intentional actions and life circumstances. So I would like to stay aware that we’re all distinctive in our personal methods.

Glad 2025 Is Over, However Additionally Miss The Time We No Longer Have

I’m pleased with my effort and my perspective this yr. I referred to as my mother and father often and made time to see them greater than I’ve since I used to be 19. The spotlight was stunning my dad for his eightieth birthday on November 17 by merely showing within the kitchen one afternoon as he got here downstairs.

Well being-wise, I continued to play tennis and pickleball 3 times per week and even began going to Sunday night time basketball at my youngsters’s college. I simply should be cautious to not overdo it to keep away from accidents.

Ultimately, I grew our family funds, spent great high quality time with our youngsters, helped many individuals with their funds, and survived a yr of persistent grey clouds. On the flip aspect, the time spent actively managing our funds throughout a unstable inventory market, discovering new tenants and consumers, and dealing with significant car problems on the finish of the yr actually beat me up.

A B minus grade feels about proper. However I hope the rays of sunshine will burn off the clouds extra often once more. Subsequent up are my New Yr’s resolutions for 2026.

How was your 2025? What had been a few of your hits and misses?

Subscribe To Monetary Samurai

Pay attention and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview specialists of their respective fields and talk about a few of the most attention-grabbing matters on this website. Your shares, scores, and opinions are appreciated.

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Financial Samurai newsletter. You can even get my posts in your e-mail inbox as quickly as they arrive out by signing up here. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. The whole lot is written primarily based on firsthand expertise and experience.