Key Notes

- JPMorgan says the US greenback drop is being pushed by short-term flows and sentiment, not a shift in US progress or financial coverage.

- Not like the gold rally, Bitcoin worth has remained range-bound, indicating it’s behaving extra like a liquidity-sensitive danger asset than a retailer of worth.

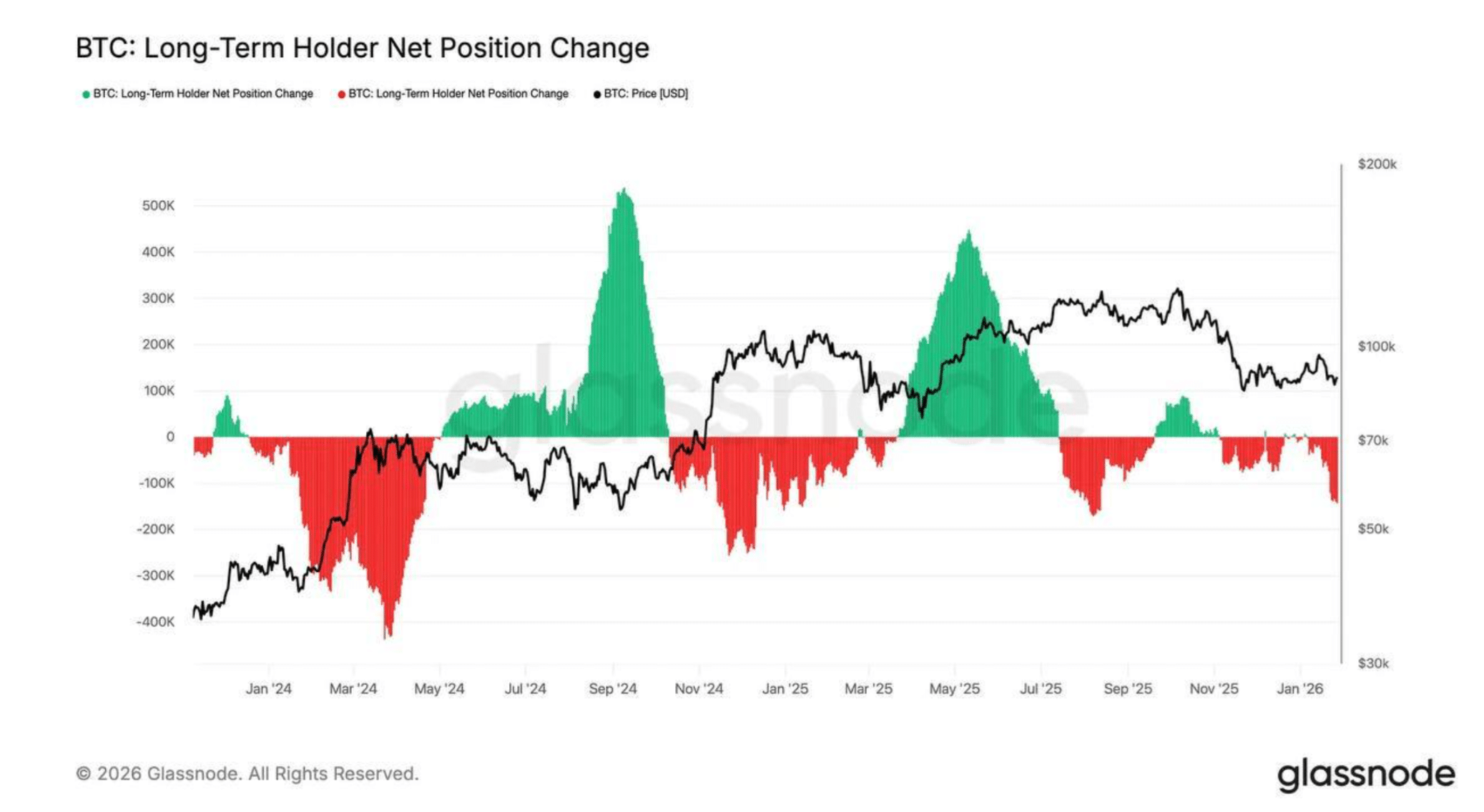

- Glassnode studies muted BTC buying and selling volumes, bearish choices positioning, and ~143,000 BTC offered by long-term holders in 30 days.

Regardless of the US Greenback Index falling greater than 10% over the previous yr, Bitcoin

BTC

$81 274

24h volatility:

8.2%

Market cap:

$1.63 T

Vol. 24h:

$80.39 B

worth has failed to point out power, leaving traders confused. Alternatively, a weakening greenback is pushing valuable metals like gold and silver to recent highs. JPMorgan strategists clarify the explanation why BTC is failing to catch up regardless of the USD weak point.

Why Bitcoin Value Underperformed Regardless of US Greenback Index Drop

Traditionally, BTC worth often strikes in the wrong way to the USD.

Explaining the linearity between USD and BTC over the previous yr, JPMorgan strategists famous that the weak point in USD is being pushed largely by short-term flows and market sentiment, relatively than a basic shift in US progress or financial coverage expectations.

They famous that US price differentials proceed to favor the greenback, suggesting the transfer will not be structural.

Moreover, the financial institution famous that the US greenback weak point might be momentary, and any restoration within the US financial system might result in a surge within the greenback index. That is the explanation why BTC hasn’t acted as a standard hedge to the US greenback. Yuxuan Tang, JPMorgan Non-public Financial institution’s head of macro technique in Asia, defined:

“It’s essential to notice that the current greenback slide isn’t about shifts in progress or financial coverage expectations. If something, rate of interest differentials have truly moved within the USD’s favor because the begin of the yr. What we’re seeing now, very like final April, is a USD selloff pushed primarily by flows and sentiment.”

Gold Dominating BTC as Retailer of Worth

With the gold price hitting $5,500 historic excessive amid the USD weak point, Bitcoin worth has remained rangebound. This exhibits that BTC is buying and selling extra like a liquidity-sensitive danger asset as a substitute of being a retailer of worth.

Till forex markets are pushed by progress and price dynamics relatively than by flows and sentiment, JPMorgan believes Bitcoin might proceed to lag conventional macro hedges. The $1.8 billion outflows from US Bitcoin ETFs over the previous week additionally present waning institutional confidence in BTC.

💸 Bitcoin ETF’s have seen vital cash shifting out main as much as in the present day’s FOMC resolution. Since January fifteenth, the final 7 full buying and selling days have had a complete of -$1.86B in internet outflows.

🔗 Bitcoin, Ethereum, and Solana cash flows and buying and selling quantity. https://t.co/QJvmafU9xX pic.twitter.com/Eed0rLmTRb

— Santiment (@santimentfeed) January 28, 2026

Bitcoin critic Peter Schiff mentioned that digital gold Bitcoin is dropping its shine over the yellow metallic.

Bitcoin is melting down by way of actual cash. Priced in gold, Bitcoin is down 56% from its November 2021 peak. This gradual soften is about to show into a quick burn. Earlier than the hearth ignites, commerce your Bitcoin in for gold proper now. Schiff Gold makes it straightforward. https://t.co/GGNU9tT9EQ

— Peter Schiff (@PeterSchiff) January 29, 2026

The newest Glassnode report mentioned Bitcoin is consolidating amid subdued buying and selling volumes. It added that the spot demand is displaying little indicators of restoration, whereas choices are positioned on the bearish aspect.

Bitcoin long-term holder internet place | Supply: Glassnode

The on-chain analytics agency added that long-term holders have offered roughly 143,000 BTC over the previous 30 days. This marks the quickest distribution since August 2025.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Bhushan is a FinTech fanatic and holds a very good aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in direction of the brand new rising Blockchain Know-how and Cryptocurrency markets. He’s constantly in a studying course of and retains himself motivated by sharing his acquired information. In free time he reads thriller fictions novels and generally discover his culinary expertise.