Kevin Warsh will get the nod for Fed Chair… the market’s response… valuable metals lastly right – prepare to purchase… new information about our ever-expanding Okay-shaped financial system

Final Friday, President Trump nominated former Fed Governor Kevin Warsh to guide the Federal Reserve, leaving Wall Avenue asking …

Does this sign a significant shift in financial coverage as soon as Jerome Powell’s time period ends in Could?

Warsh is finest often called a financial hawk who has lengthy criticized the Fed’s aggressive price cuts and quantitative easing over the previous decade.

So why would Trump – who has been vocal about wanting decrease rates of interest – select him?

Credibility.

Not like another rumored candidates, Warsh is extensively considered as a critical, unbiased financial coverage thinker – not somebody who would merely rubber-stamp White Home preferences. Institutional credibility issues for preserving confidence within the Fed and the energy of the greenback.

However Warsh’s status doesn’t imply price cuts are off the desk. The truth is, his current writings recommend he has developed from his earlier hawkish stance.

In a Wall Avenue Journal column final 12 months, Warsh argued that deregulation and spending restraint can be disinflationary, creating room for decrease rates of interest. Plus, he’s been outspoken about what he calls the Fed’s “bloated steadiness sheet.” From a current speech:

That largesse might be redeployed within the type of decrease rates of interest to help households and small and medium-sized companies.

Translation: Warsh believes decrease charges ought to come from productiveness beneficial properties and balance-sheet self-discipline – not from ignoring inflation dangers.

Legendary investor Louis Navellier believes this in the end means price cuts are nonetheless coming; it’s only a query of timing and magnitude.

From his Progress Investor Flash Alert final Friday:

So far as how a lot Warsh will minimize rates of interest, he has to get a consensus on the Fed.

The underside line is he can’t discuss that as a result of he has to stay to the Fed’s mandate, in any other case he gained’t get confirmed.

However this was a decide that calmed Wall Avenue down, for lack of a greater phrase. They don’t need anyone partisan on the Fed, and he’ll faux to not be partisan when he’s confirmed.

The Senate affirmation course of will probably take a number of months.

We’ll maintain monitoring this story because it develops, notably any indicators Warsh offers about his coverage priorities throughout affirmation hearings.

In the meantime, is that this a shopping for alternative in metals?

Friday’s motion wasn’t only a pullback – it was a compelled liquidation.

Right here’s how brutal it was:

- Copper: -4%

- Gold: -10%

- Palladium: -17%

- Platinum: -18%

- Silver: -27%

A part of the rationale for the selloff was a knee-jerk response to Warsh’s nomination. Markets interpreted it as an indication the Fed might stay extra disciplined than some had hoped.

However a broader macro dynamic was at play. The U.S. greenback strengthened on expectations that Warsh will prioritize worth stability and Fed credibility.

This makes dollar-denominated belongings, comparable to gold, much less engaging within the quick time period. When the greenback rallies, gold and silver sometimes pull again because it turns into dearer for worldwide patrons.

Lastly, there was another driver behind the sharp promoting strain: leverage.

The preliminary drop in metals costs triggered margin calls amongst closely leveraged momentum merchants. Compelled promoting pushed costs decrease, triggering extra margin calls – a basic liquidation cascade.

Importantly, this wasn’t a fundamentals-driven breakdown. And Louis sees it as a chance, not a warning signal.

Let’s return to his Progress Investor podcast:

Gold’s a fantastic purchase proper now, any of our gold shares.

So, don’t let that hassle you.

Louis holds three gold miners in his Growth Investor portfolio. I’ll draw your consideration to at least one – Agnico Eagle Mines Ltd. (AEM), which Louis designates as a “High 5” holding.

Although Growth Investor subscribers are up nearly 140% as I write, AEM stays beneath Louis’ “purchase beneath” worth of $206.

Right here’s the funding legend with why he stays as bullish as ever:

AEM is the third-largest gold producer on the earth… Within the third quarter, it produced 866,936 ounces of gold and offered 868,563 ounces of gold.

The analyst group has now revised fourth-quarter earnings estimates 24.8% greater over the previous three months. Fourth-quarter earnings are actually forecast to soar 108% year-over-year to $2.62 per share, in comparison with $1.26 per share in the identical quarter final 12 months.

In his Flash Alert, Louis additionally defined why gold has been on such a robust run – and why it’s prone to proceed after this correction:

The explanation gold’s gone up a lot is the central banks are shopping for it as a result of they’ve a scarcity of credibility.

The Financial institution of Japan, the Financial institution of England and even the European Central Financial institution should not going to have the ability to repay their debt finally.

They’ve received quite a lot of issues.

Louis’ level in regards to the central banks is essential for traders questioning how one can interpret the promoting strain

The basic case for gold hasn’t modified.

Central banks proceed to build up gold at a document tempo – to not speculate, however to hedge in opposition to unsustainable debt and long-term forex danger. For instance, Japan’s debt-to-GDP ratio exceeds 260%. Different international locations are in comparable circumstances.

- Italy sits at 137%

- Greece at 161%

- The U.Okay. is nearing 100%

That demand doesn’t disappear due to one Fed nomination. The macro forces supporting gold – together with huge sovereign debt, central financial institution debasement, and geopolitical uncertainty – stay firmly in place.

So, for traders (not leveraged merchants), sharp pullbacks are sometimes entry factors, not exits.

To study extra about becoming a member of Louis in Progress Investor and accessing all his gold suggestions and evaluation, click here.

For those who’re nonetheless not satisfied about metals…

I’ll remind readers what veteran dealer Jonathan Rose of Masters in Trading Live instructed me about copper final week:

Jeff: So, what’s your timing recommendation for stepping into a brand new copper commerce from right here?

Jonathan: Copper will pull again, and we’re patrons on any pullback.

It is a structural copper thesis, not a short-term commerce.

Demand is being pushed by AI infrastructure, grid upgrades, electrification, and reshoring, whereas provide stays constrained as a result of years of underinvestment, lengthy mine lead occasions, and geopolitical focus in Latin America.

Use volatility and pullbacks to construct publicity, measurement appropriately, and specific the view by both inventory or choices relying on danger tolerance and time horizon.

For extra from Jonathan on copper and which shares he’s buying and selling, you’ll be able to revisit our 1/28 Digest here.

Backside line: For those who’ve been on the sidelines watching metals roar greater, the shopping for window has simply opened up.

New information confirms what we’ve been warning about

Common Digest readers are accustomed to our ongoing protection of America’s Okay-shaped financial system.

Individuals with belongings are thriving as we speak as their internet worths climb. Nonetheless, Individuals with out belongings are feeling rising monetary strain as entrenched excessive costs weigh on month-to-month budgets.

Friday introduced recent information that confirms this divide isn’t simply persisting – it’s accelerating.

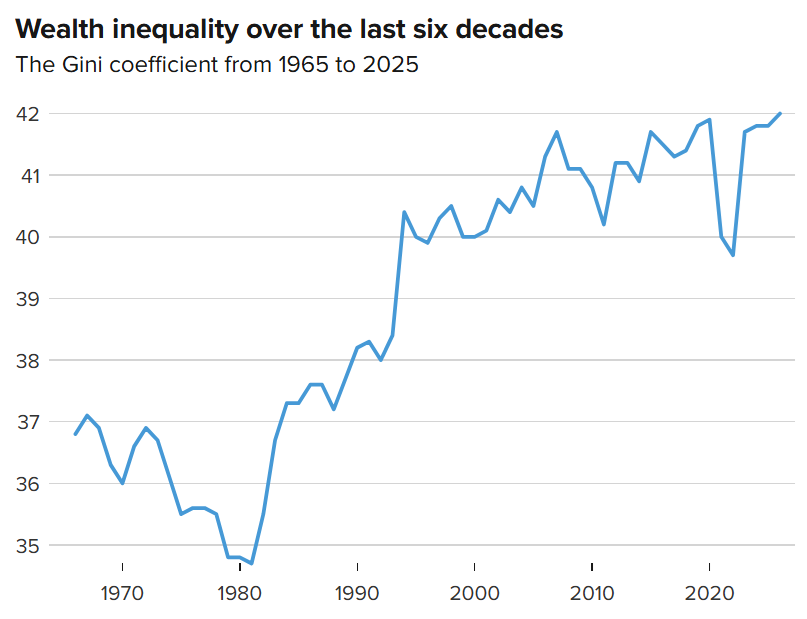

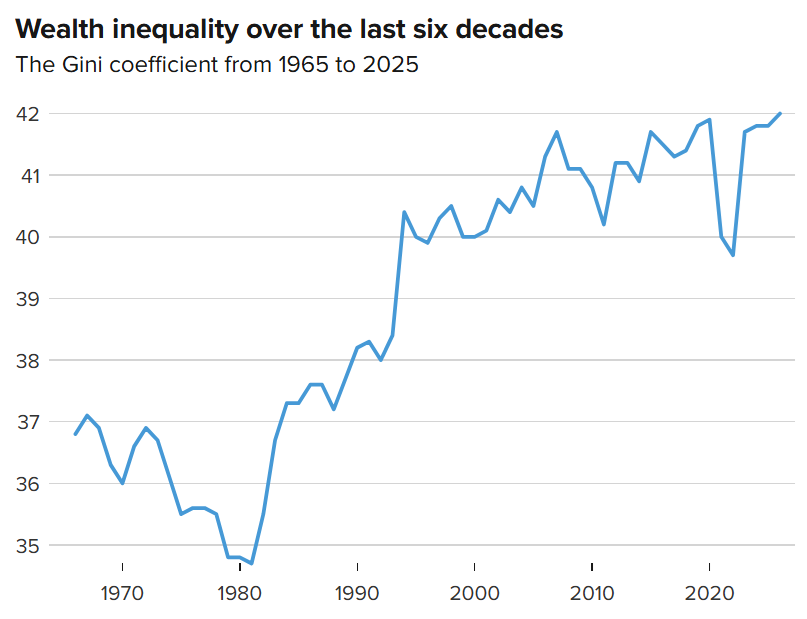

A brand new U.S. Financial institution report exhibits the Gini coefficient – a key measure of wealth focus – has hit 60-year highs.

To ensure we’re all on the identical web page, the Gini coefficient quantifies revenue or wealth inequality throughout a inhabitants. The dimensions runs from 0 to 1, the place 0 represents excellent equality (everybody has the identical wealth) and 1 represents most inequality (one particular person has all the pieces).

The upper the quantity, the extra concentrated wealth is on the prime. And proper now, we’re on the highest studying in six many years…

Supply: CNBC

Whereas there was a short lived easing in the course of the pandemic when stimulus checks narrowed the wealth hole, it was short-lived. As you’ll be able to see above, as the last decade has continued – with its huge inflation – wealth focus resumed its climb after which accelerated.

The numbers paint a stark image of simply how concentrated wealth has change into

The web price of America’s prime 1% hit a document 32% share of complete wealth within the third quarter of 2025, in keeping with Federal Reserve information. In the meantime, the underside 50% collectively maintain simply 2.5% of total internet wealth.

Take into consideration that – half of all Individuals mixed personal simply 2.5% of the nation’s wealth. Given inflation and AI, that is unlikely to reverse anytime quickly.

Right here’s Mark Zandi, chief economist at Moody’s Analytics:

This isn’t a cyclical or non permanent phenomenon.

It is a structural, basic concern.

However right here’s a hanging statistic I haven’t coated but within the Digest…

In line with Bureau of Labor Statistics information, the portion of U.S. GDP going to employees within the type of compensation simply hit its lowest degree in over 75 years.

Translation: Even because the financial system has boomed over the previous 15 years, the typical employee is seeing a smaller slice of the pie than at any level because the late Forties.

And as we’ve coated many occasions within the Digest, AI goes to make this downside worse.

As we’ve been warning within the Digest for months, this type of persistent financial divide doesn’t keep contained

It produces coverage responses – notably on the state and native degree.

We’re already seeing it play out with the next proposals:

- California’s proposed billionaire wealth tax,

- The potential for Washington State’s first-ever revenue tax,

- Michigan’s potential 5% surcharge on revenue over $500,000, and

- Colorado’s graduated revenue tax poll measure.

Initially of this 12 months, I predicted that 2026 would deliver a wave of controversial tax proposals geared toward funding wealth. Nicely, with this newest Gini information exhibiting wealth focus at 60-year highs, I really feel assured about my name.

We’ll proceed monitoring all these tales right here within the Digest.

Have an excellent night,

Jeff Remsburg