- Fed liquidity has surged by $395 billion because the begin of the yr, marking the biggest ten-day hike in two years

- May this spark curiosity in riskier property once more?

Two market-wide crashes in lower than a month reveal a placing shift – The rising ‘inverse’ correlation between macro developments and riskier property. If the U.S. financial system continues to point out power – just like the 256K jobs added in December – the crypto market might take an surprising flip.

With that in thoughts, holding a pointy eye on the U.S. economic calendar is extra essential than ever.

Sudden alternatives forward?

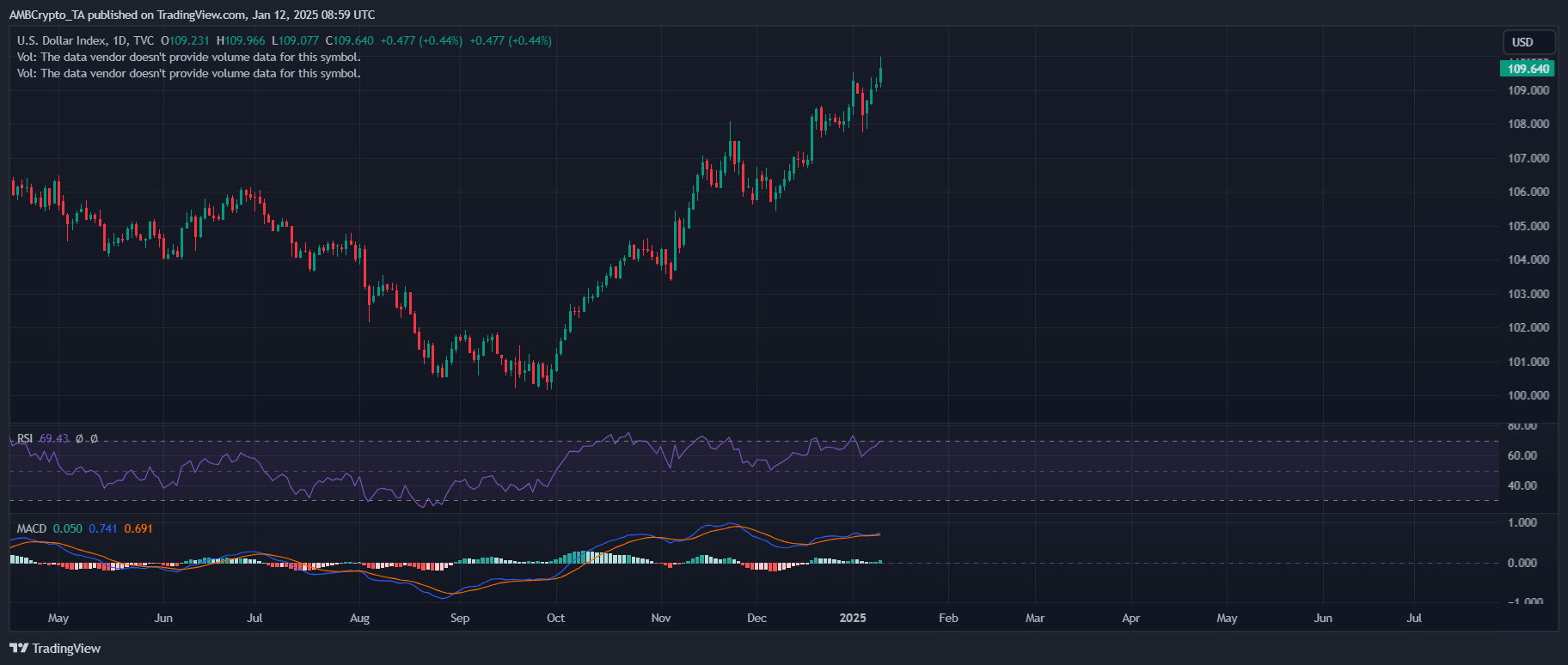

With the Greenback Index (DXY) staying firmly above 109 and the 10-year Treasury yield hovering to 4.79% – its highest degree in 14 months – it’s straightforward to imagine {that a} shift in the direction of riskier property like crypto or shares continues to be off the desk.

The S&P 500 just lately misplaced $800 billion in market cap and fell by 4.5% from its December excessive. On the identical time, the crypto market has dropped 8% in only a week, falling from $3.60 trillion. Given these developments, the case for avoiding riskier property appears sturdy.

However right here’s the twist – Net Federal Reserve liquidity has hiked by about $395 billion because the begin of the yr. Excessive liquidity might sign a possible devaluation of the U.S. greenback, which means the worth of every greenback might shrink.

Curiously, the Greenback Index has hit greater highs for 4 straight days, pushing its RSI into overbought territory. A correction might be close to, and if the greenback weakens, Treasuries could turn into much less engaging – A development value watching carefully within the days forward.

Including one other layer, hypothesis is rising about liquidity injections from the Treasury General Account (TGA). Because the U.S. approaches its debt ceiling, the Treasury could launch important liquidity into the market. Consequently, this might additional shake issues up within the weeks forward.

Market nonetheless stays cautious

The surge in liquidity from each the Fed and U.S. authorities is actually a bullish signal, injecting recent capital into the market. With the anticipated “Trump pump” including to the optimism, issues are trying up – Not less than for now. Nevertheless, there’s a catch.

With the debt ceiling quick approaching, traders could flip in the direction of safer, extra steady property moderately than diving into the unstable crypto market.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

Why? Treasury yields are set to rise, particularly with the Fed signaling fewer charge cuts and the federal government relying on them to boost capital.

Whereas there’s hope, all eyes are actually on the brand new administration. Will they push by way of tax cuts to unlock much more liquidity? In the event that they do, it might devalue the greenback and make Treasuries much less interesting.

The stress’s on. Trump must show he’s severe about delivering on these guarantees. If not, 2025 might be a wild trip for riskier markets.