Unlock the Editor’s Digest without cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

Gilts posted their finest week since July and the FTSE 100 hit a report excessive on Friday after a string of weak information weighed on sterling and prompted bets that the Financial institution of England will reduce rates of interest extra aggressively to kick-start progress.

The rally in UK authorities bonds continued on Friday after official figures confirmed retail gross sales unexpectedly dropped in December, elevating the danger the economic system contracted on the finish of final yr.

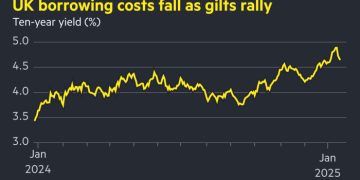

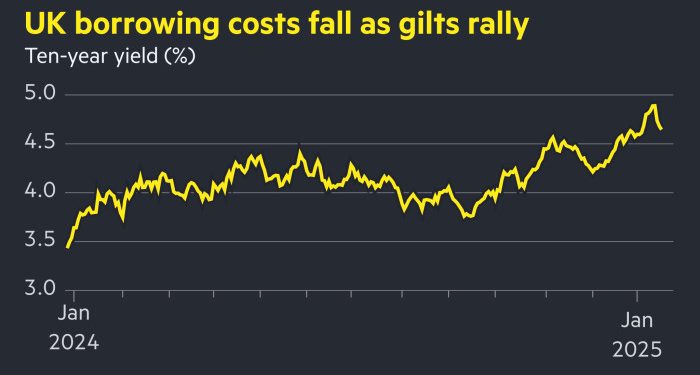

The ten-year gilt yield fell one other 0.02 proportion factors to 4.66 per cent, taking its drop to 0.18 proportion factors this week. Yields transfer inversely to costs.

The indicators of weak point on the excessive avenue observe disappointing GDP figures for November and a lower-than-forecast inflation studying in December. The IMF on Friday afternoon predicted a pick-up in UK progress this yr, however the growth continues to be set to be slower than within the US and Canada.

The FTSE 100 rose 1.4 per cent, taking it previous its earlier report excessive hit in Might, helped by the weaker pound. Most of the corporations within the blue-chip index are greenback earners, that means they profit from a stronger US foreign money.

“The higher information on inflation let gilts be the protected haven asset the market now more and more feels it wants within the UK,” mentioned Gordon Shannon, a portfolio supervisor at TwentyFour Asset Administration.

Rising expectations of fee cuts to assist a stagnating economic system had made it “simpler for international patrons to step again in [and buy gilts]”, added Shannon.

The 2-year yield fell 0.02 proportion factors to 4.37 per cent on Friday, taking its drop this week to 0.17 proportion factors. Sterling fell 0.6 per cent towards the greenback to $1.217.

“It’s greater than pound weak point,” mentioned Luca Paolini, chief strategist at Pictet Asset Administration, of the FTSE excessive. “I discover the UK enticing as a market,” he added, saying it was “low cost” on valuation grounds and “effectively diversified”.

Merchants now anticipate at the very least two quarter-point fee reductions this yr from the present stage of 4.75 per cent, and a roughly two-thirds probability of a 3rd reduce, in keeping with ranges implied in swaps markets.

Regardless of the rally within the gilt market, 10-year yields remained considerably above the three.75 per cent stage they have been in mid-September, earlier than a sell-off pushed by each Treasuries and fears the UK is contending with stagflation — the place persistent value rises make it troublesome for the Financial institution of England to chop charges.

That took the UK’s borrowing prices to a 16-year excessive final week, the upper yields attracting a wave of retail investors but additionally forcing chancellor Rachel Reeves to defend her financial plans earlier than MPs.

The rise in borrowing prices has severely curbed the headroom that the chancellor has towards her self-imposed fiscal guidelines. Large gilt investors have warned that the federal government could be pressured to lift taxes, or reduce spending, to keep up credibility with the market.

In an replace to its World Financial Outlook, the IMF mentioned on Friday the UK economic system would develop 1.6 per cent in 2025 — a 0.1 proportion level improve on the earlier forecast and up from 0.9 per cent final yr. UK progress would proceed at an analogous tempo of 1.5 per cent in 2026, it mentioned.

The outlook was welcomed by Reeves, who mentioned the IMF forecast instructed the UK could be the fastest-growing “main European economic system” over the following two years. “I’ll go additional and sooner in my mission for progress via clever funding and relentless reform, and ship on our promise to enhance residing requirements in each a part of the UK,” she mentioned.

However merchants betting on fee cuts have been inspired by a speech earlier this week by one of many central financial institution’s rate-setters that it’d want to chop charges 5 – 6 occasions over the approaching yr to assist the economic system.

Alan Taylor, a member of the Financial Coverage Committee, warned that current UK information pointed to “an more and more gloomy outlook for 2025”, as he argued the central financial institution wanted to take pre-emptive motion to assist the economic system with decrease borrowing prices.

Whereas expectations of decrease charges will present some reduction to the chancellor in relation to UK authorities borrowing prices, the poorer progress prospects that accompany them might have a detrimental bearing on fiscal forecasts if the weak point is judged to be persistent.

The federal government’s Workplace for Funds Duty is because of current its new financial and financial outlook on March 26, with the chancellor set to reply with an announcement to parliament.

UK gilts have been helped by a trailing wind from US Treasuries, which have additionally rallied as information confirmed weaker underlying inflation pressures within the US economic system. That has taken the 10-year Treasury yield down 0.16 proportion factors this week to 4.61 per cent.