- Lengthy-term holders could start accumulating BTC as short-term holders step by step distributed their holdings.

- Miners have seen elevated profitability regardless of the rising problem of mining one BTC.

Bitcoin [BTC] has established a brand new worth stage above $100,000 for the second time this 12 months, hitting an all-time excessive of over $109,000.

This milestone steered that $100,000 may probably function a brand new psychological help stage, with bullish market sentiment offering additional momentum for worth will increase.

AMBCrypto evaluation confirmed that the continued change of BTC between short-term and long-term holders was additional contributing to the optimistic outlook for the cryptocurrency.

Will historical past repeat as BTC adjustments hand?

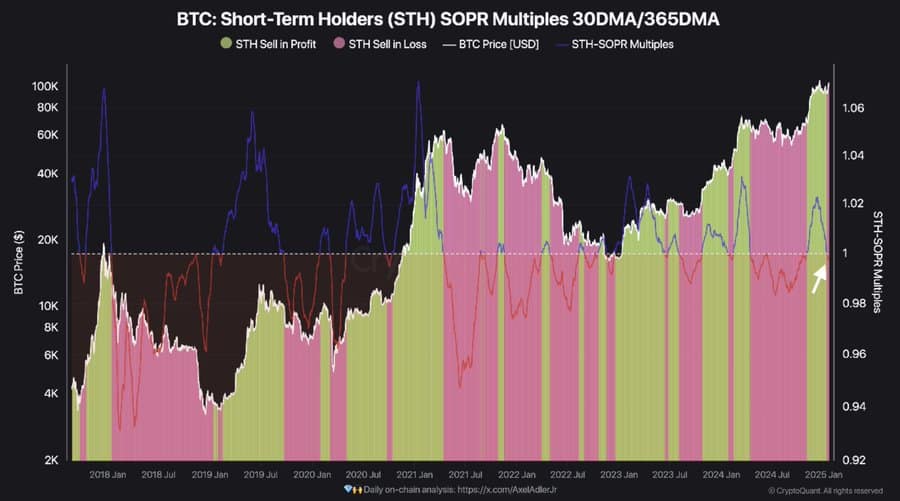

In line with insights from CryptoQuant, short-term Bitcoin holders have began promoting at a loss, as indicated by the Brief-Time period Holder (STH) SOPR a number of.

This metric compares the Brief-Time period Holder Spent Output Revenue Ratio (SOPR) over 30-day and 365-day intervals.

Usually, a worth above 1 signifies STHs are in revenue, whereas a worth beneath 1 alerts losses. Present information exhibits that STHs are promoting at a loss.

Traditionally, when the STH SOPR turns detrimental, it usually attracts long-term holders (LTHs) to build up extra BTC.

LTHs are thought of a extremely bullish cohort available in the market, as they maintain BTC for at the very least 155 days.

This habits reduces circulating provide, which means accumulation at this stage may positively influence BTC’s worth and drive it increased.

Can miner profitability spark worth pump?

Whereas long-term and short-term BTC holders are actively exchanging positions, miner profitability has reached new highs regardless of rising mining problem.

Mining problem is a mechanism designed to take care of the Bitcoin community’s safety by guaranteeing constant block manufacturing over time.

As problem will increase, it turns into tougher for miners to course of transactions and earn rewards.

In line with Glassnode’s Problem Regression Mannequin, miners are experiencing roughly 3x profitability. The present value to mine 1 BTC is $33,900, whereas BTC’s worth at press time stood at $104,900.

This vital revenue margin may incentivize miners to carry onto their BTC reserves because the asset’s worth traits increased.

This habits, coupled with accumulation by long-term holders (LTHs), reduces BTC’s circulating provide and will pave the way in which for a possible worth surge.

May BTC be on observe for a 500% surge?

BTC’s present worth efficiency seems to align with historic traits, significantly the bull market rally noticed between 2015 and 2018, in response to Glassnode information analyzing BTC’s worth actions for the reason that cycle low.

Based mostly on this metric, BTC has the potential to rally by roughly 562%, or 5.62 instances its present worth of $104,850.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

If this projection holds, BTC may surpass $589,000 by the tip of the present cycle, setting a brand new all-time excessive for the cryptocurrency.

Thus far, market sentiment stays bullish, reinforcing the potential of BTC persevering with its upward trajectory.