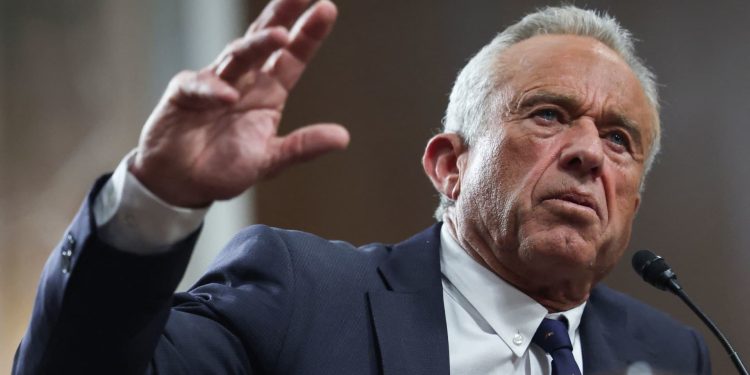

Robert F. Kennedy Jr., U.S. President Trump’s nominee to be secretary of Well being and Human Providers, testifies earlier than a Senate Finance Committee affirmation listening to on Capitol Hill in Washington, U.S., Jan. 29, 2025.

Evelyn Hockstein | Reuters

Individuals’ bank card balances soared to a record $1.17 trillion in 2024 — and even the wealthy usually are not immune from carrying these balances.

One instance is Robert F. Kennedy Jr., who not too long ago revealed in financial disclosures that he was carrying as much as $1.2 million in bank card debt. Kennedy is President Donald Trump’s nominee for Well being and Human Providers secretary.

Kennedy’s bank card balances vary between $610,000 and $1.2 million in accounts that carry rates of interest of 23.24% to 23.49%, the submitting reveals.

Extra from Private Finance:

What to know about student loans as Trump seeks to close Education Department

How the U.S. has used tariffs throughout history — and why Trump is different

‘Where’s my refund?’ How to check the status of your federal tax refund

Monetary consultants interviewed by CNBC mentioned balances that prime are uncommon.

“That is a very large quantity of bank card debt,” mentioned Ted Rossman, senior business analyst at Bankrate.

“He has plenty of revenue, so I do not even know why you’d have all that debt when you have that a lot revenue,” mentioned Carolyn McClanahan, an authorized monetary planner and founding father of Life Planning Companions, who reviewed Kennedy’s submitting.

Kennedy was not instantly accessible for remark.

For all shoppers — from the ultra-wealthy like Kennedy with an estimated $30 million web price, to decrease incomes households — consultants say it is best to avoid ongoing bank card debt.

Bank cards have grow to be a ‘de facto emergency fund’

But lately, as costs have climbed, carrying bank card debt has been tough for some debtors to keep away from.

“With inflation being so highly effective and so cussed, it is simply shrunk lots of people’s monetary wiggle room right down to zero,” mentioned Matt Schulz, chief credit score analyst at LendingTree. “Individuals have a look at bank cards as form of a de facto emergency fund.”

These balances could be pricey.

As a result of the disclosures are basically snapshots, it isn’t clear if he pays off his balances in full every month, consultants say.

If Kennedy pays $50,000 monthly towards the decrease estimated $610,000 bank card steadiness, it is going to take him an estimated 15 months to repay the money owed. Notably, that can value him roughly $93,000 in curiosity, in line with a Federal Reserve Bank of Dallas calculator.

If he pays $50,000 monthly on a $1.2 million steadiness, it is going to take 33 months to repay and value roughly $434,000 in curiosity.

To cut back these prices, consultants say, it might be smart for Kennedy to speed up the paydown of these balances.

That very same recommendation might apply to the typical family, for whom bank card debt can be pricey.

The common debt per bank card borrower was $6,380 as of the third quarter of 2024, in line with TransUnion. At the moment, the typical bank card rate of interest is 20.13%, in line with Bankrate.

These debtors can also be paying for different money owed. Common unsecured debt — excluding balances tied to actual property equivalent to automobiles or properties — climbed 8% to $29,364 in 2024, in line with Cash Administration Worldwide.

Paying off money owed gives ‘assured risk-free’ return

With rates of interest that prime, it often makes essentially the most sense to prioritize debt paydown over different priorities equivalent to investing or saving, in line with consultants.

“When you’re paying down bank card debt at 20%, that is a assured risk-free, tax-free return,” Rossman mentioned. “You are unlikely to get that a lot out of your investments.”

Bankrate’s analysis has discovered higher-income people usually tend to carry long-term bank card debt, with 59% of debtors who earn $100,000 or extra having been in debt for not less than a yr. That features 24% who’ve been in bank card debt for not less than 5 years, Rossman mentioned.

“Larger-income individuals usually get increased credit score limits, and typically that will get individuals into bother,” Rossman mentioned.

Whereas rich debtors might face substantial curiosity expenses, they might be tempted to make use of bank cards for sure perks. For instance, the American Categorical Centurion Card, also referred to as the Black Card, comes with a $10,000 one-time price, in addition to an annual $5,000 price. In return, debtors get entry to airport lounges, elite standing at motels and assist discovering tables at eating places, amongst different rewards.

Nonetheless, bank cards often usually are not the best approach for the rich to borrow cash, in line with Charlie Douglas, an authorized monetary planner who works with ultra-high-net-worth households.

For rich buyers to keep away from having to promote investments and incur capital beneficial properties taxes after they need to make an enormous buy equivalent to actual property, it is smart to have a line of credit score already established, Douglas mentioned. Importantly, that comes with no prices on an ongoing foundation.

It might additionally make sense to have as much as one years’ price of bills in money as a buffer, he mentioned.