UPCOMING

EVENTS:

- Monday: NYFed Inflation Expectations.

- Tuesday: US NFIB Small Enterprise Optimism Index, Fed Chair

Powell Testimony. - Wednesday: US CPI, Fed Chair Powell Testimony, BoC Assembly

Minutes. - Thursday: Japan PPI, UK GDP, Switzerland CPI, US PPI, US

Jobless Claims, New Zealand Manufacturing PMI. - Friday: US Retail Gross sales, US Industrial Manufacturing and

Capability Utilization.

Wednesday

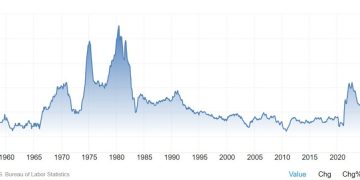

The US CPI Y/Y is

anticipated at 2.9% vs. 2.9% prior, whereas the M/M determine is seen at 0.3% vs. 0.4%

prior. The Core CPI Y/Y is anticipated at 3.1% vs. 3.2% prior, whereas the M/M

studying is seen at 0.3% vs. 0.2% prior. The Fed is targeted primarily on

inflation progress in the mean time and these readings wouldn’t be dangerous, though

decrease than anticipated figures might be way more welcomed.

Nonetheless, the

projection for 2 fee cuts by the top of the yr nonetheless holds despite the fact that the

market leant on a extra hawkish aspect on Friday following the NFP report and particularly the inflation expectations knowledge within the

University of Michigan consumer sentiment survey.

The NFP report was

good and the enhance in common hourly earnings isn’t worrying but given

the drop in weekly hours labored. The soar in inflation expectations, on the

different hand, has been totally because of the tariffs information, so that ought to

ease going ahead because the fears round commerce wars fade (barring in fact

precise commerce wars).

US Core CPI YoY

Thursday

The Switzerland

CPI Y/Y is anticipated at 0.4% vs. 0.6% prior, whereas the M/M determine is seen at

-0.1% vs. -0.1% prior. The market is at present pricing a 92% chance of

a 25 bps lower in March and a complete of 40 bps by yr finish which is mainly

two fee cuts that will take the coverage fee again to 0%.

Inflation in

Switzerland has been falling markedly for years as a consequence of a robust Swiss Franc

which noticed the central financial institution threatening interventions and damaging charges at

totally different instances. SNB’s Chairman Schlegel repeated lately that regardless of

being reluctant to reintroduce damaging charges, they may do this if the

situations name for it.

Swiss Core CPI YoY

The US PPI Y/Y is

anticipated at 3.2% vs. 3.3% prior, whereas the M/M determine is seen at 0.3% vs. 0.2%

prior. The Core PPI Y/Y is anticipated at 3.3% vs. 3.5% prior, whereas the M/M

studying is seen at 0.3% vs. 0.0% prior. So long as we don’t get large deviations

right here, the development will doubtless be set by the US CPI the day earlier than.

US Core PPI YoY

The US Jobless

Claims proceed to be one of the vital releases to comply with each week

because it’s a timelier indicator on the state of the labour market.

Preliminary

Claims stay contained in the 200K-260K vary created since 2022, whereas Persevering with Claims proceed to hover round

cycle highs though we’ve seen some easing lately.

This week Preliminary

Claims are anticipated at 216K vs. 219K prior, whereas there’s no consensus for

Persevering with Claims on the time of writing though the prior launch confirmed a rise

to 1886K vs. 1850K prior.

US Jobless Claims

Friday

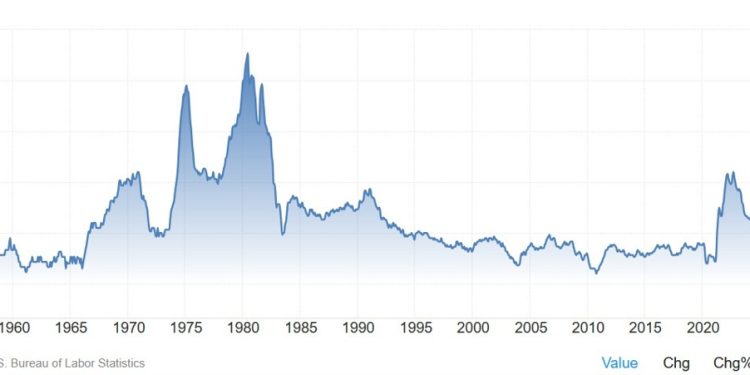

The US Retail

Gross sales M/M is anticipated at -0.1% vs. 0.4% prior, whereas the ex-Autos determine is

seen at 0.3% vs. 0.4% prior. The main target might be on the Management Group determine

which is anticipated at 0.3% vs. 0.7% prior.

Shopper

spending has been steady

which is one thing you’ll anticipate given the optimistic actual wage progress and

resilient labour market. Extra lately, we’ve been seeing some easing in

client sentiment although which may additionally result in some softening in

client spending.

If the information certainly

softens, it shouldn’t be worrying simply but however may assist alleviate some

extra inflation worries and hold the market pricing round two fee cuts in

2025.

US Retail Gross sales YoY