- Bitcoin goes via a deleveraging course of, and costs might drop within the short-term.

- Nevertheless, vendor exhaustion might happen the longer BTC consolidates round $100k.

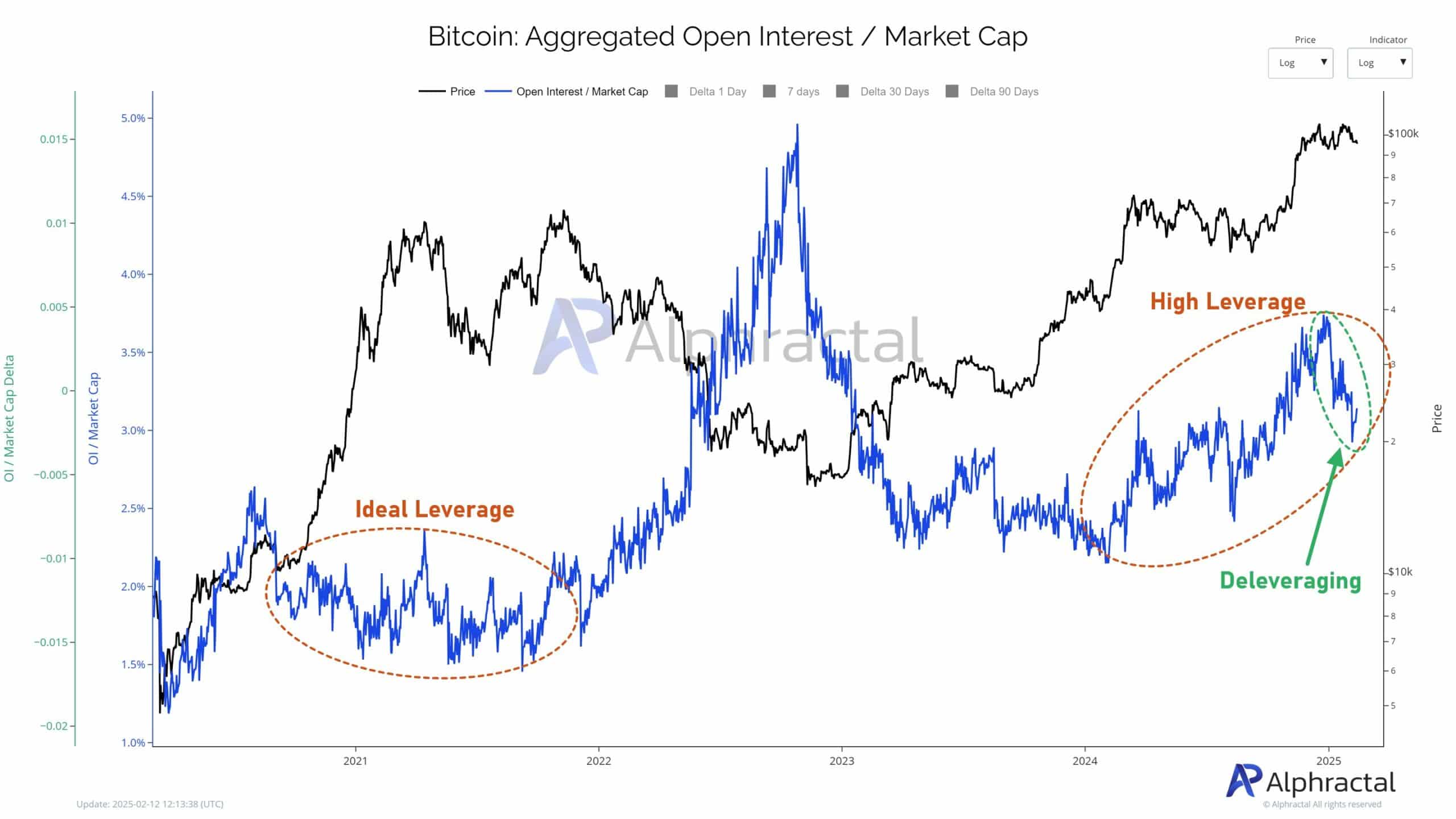

Bitcoin [BTC] is at the moment in a deleveraging course of, as indicated by the 90-day Aggregated Open Curiosity Delta throughout 17 main exchanges.

This pattern is usually adopted by value drops or prolonged sideways motion in response to closing or liquidating positions.

Significantly noteworthy is the Open Curiosity to Market Cap ratio, which has risen markedly since early 2024, suggesting elevated Bitcoin market threat in comparison with the extra balanced situations through the 2021 Bull Run.

Latest actions present vital deleveraging, signaling a BTC wave of liquidations and the closure of institutional positions—akin to a liquidity reset.

This larger ratio might elevate the danger of additional value drops, impacting these in lengthy positions.

Assessing liquidity zones and Dealer Sentiment Hole

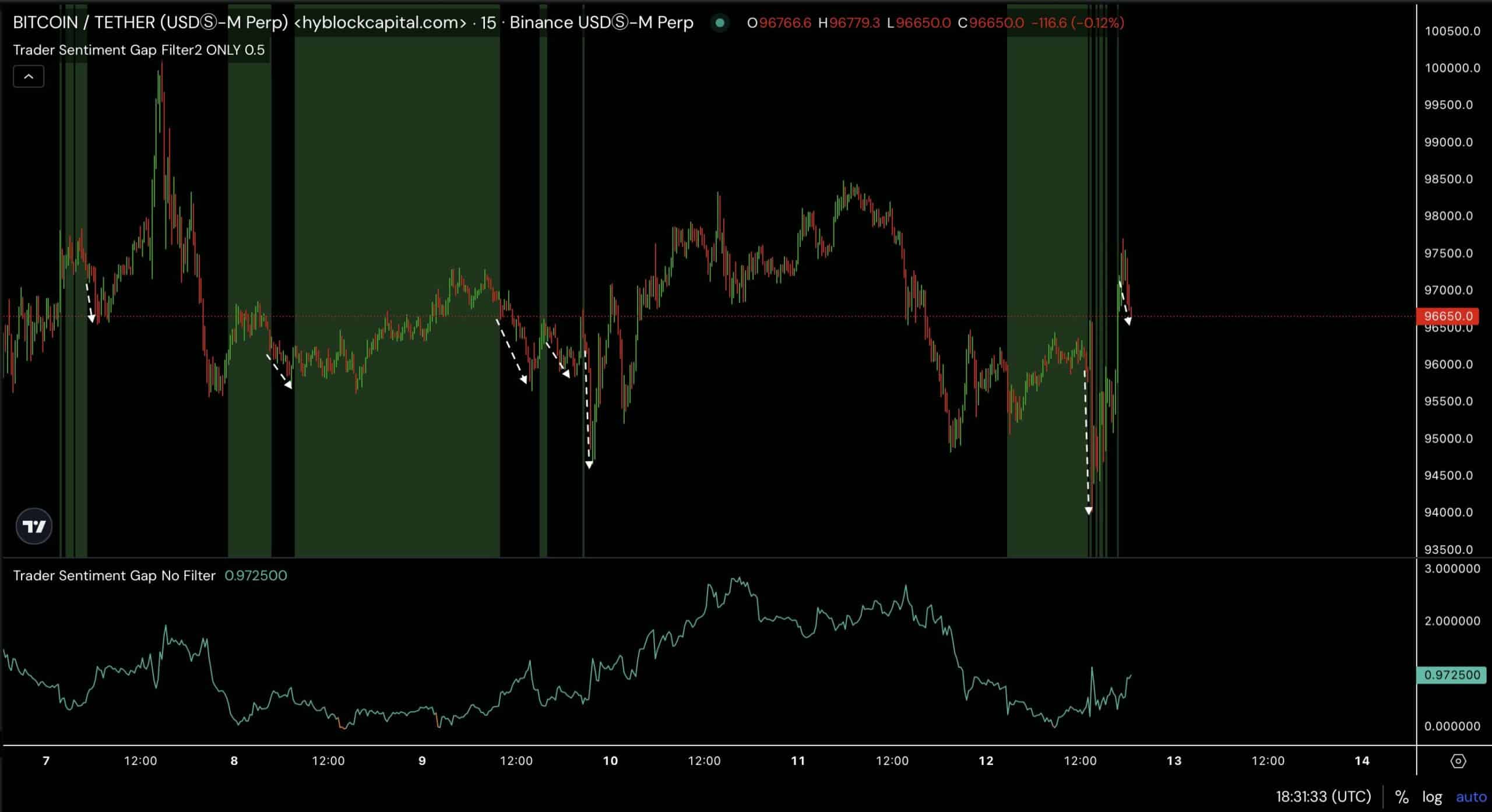

Extra evaluation famous vital liquidity was pooled at $93,700 and $98,800. After yesterday’s information, there was a short-term restoration for BTC adopted by a decline.

This preliminary drop might purpose for the $93,700 stage to soak up this “liquid liquidity,” the place purchase orders are ready.

If BTC doesn’t drop to $93.7K, it would sign robust underlying assist or bullish sentiment, the place patrons step in at larger ranges, stopping a deeper fall. This situation might result in a faster restoration or perhaps a value surge.

Additionally, the Dealer Sentiment Hole on the BTC confirmed a notable shrinkage to a decrease stage, significantly when filtered at 0.5, indicative of a minimal sentiment hole between prime merchants and retail merchants.

Traditionally, such a contraction typically precedes a major value motion. On February 12, following a niche discount, Bitcoin’s value sharply dropped from $96,650 to a low of $94,000 earlier than rebounding.

This sample advised {that a} slender sentiment hole might result in preliminary value declines, adopted by a restoration, reflecting shifts in dealer conduct and market dynamics.

This additional helps the anticipated drop as per the deleveraging sign.

Given the present low sentiment hole, BTC would possibly see an identical short-term volatility with potential draw back adopted by an upward correction.

Why accumulation round $100K is essential for BTC

Nevertheless, a major pattern the place Quick-Time period Holders (STHs) now possess 4 million Bitcoin has emerged. This represents 46% of the 2017 peak and 86% of the 2021 peak, having gathered 1.6 million BTC since September.

The growing variety of Quick-Time period Holders (STHs) contrasts with the declining distribution from Lengthy-Time period Holders (LTHs) as seen of their lowering share of the full BTC provide.

This exhibits BTC continues to build up across the $90K — $100K value vary.

This consolidation might suggests vendor exhaustion, offering a steady base for a possible continuation of the rally.

As BTC stabilizes, the market might achieve confidence, decreasing the chance of sudden sell-offs. This is able to set the stage for a sustained uptrend after the deleveraging is over.