The US greenback is constant its run to the draw back. Th slide in yields proceed to help the greenback promoting. The ten yr yield is now down -5.1 foundation factors at 4.474%.

The USD is the weakest vs the NZD with the buck falling -0.86%. The greenback is shifting down -0.74% vs the AUD as nicely.

A snapshot of the declines capability main currencies is at the moment displaying:

- EUR -0.40%

- GBP -0.44%

- JPY -0.34%

- CHF -0.53%

- CAD -0.23%

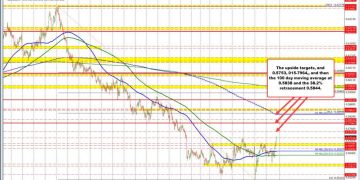

The NZDUSD is gaining momentum, breaking above the January excessive of 0.57226 and reaching its highest stage since December 18. Whereas this transfer indicators short-term bullish power, the pair continues to be buying and selling close to its lowest ranges in over two years, with the broader pattern remaining bearish since September 2022.

The break above the 2025 excessive opens the door for additional upside, even when this rally is only a correction inside a longer-term downtrend. If shopping for stress continues, the subsequent key resistance comes on the 38.2% retracement of the September decline at 0.5844, which intently aligns with the 100-day shifting common.

Nearer targets are available in at 0.57535, and 0.57964 forward of the 100-day and 38.2% retracement targets.

A push towards this stage is feasible if momentum holds, making it a key technical zone to look at.

Wanting on the weekly chart beneath, the NZDUSD bottomed in 2025 simply shy of the 2022 low at 0.55109. The double backside give merchants the springboard for a corrective transfer increased. There’s a swing space goal at 0.5739 – 0.5772. Above that and the 38.2% comes extra into focus.

NOTE. The NZDUSD excessive reached at 0.74625 in 2021, bottomed in 2022 and bounced to 0.6563 in 2023. There may be room to roam to the upside if the bias can stay bullish within the quick time period (watch 0.5683 to 0.5694 as help).

NZDUSD technical on weekly chart

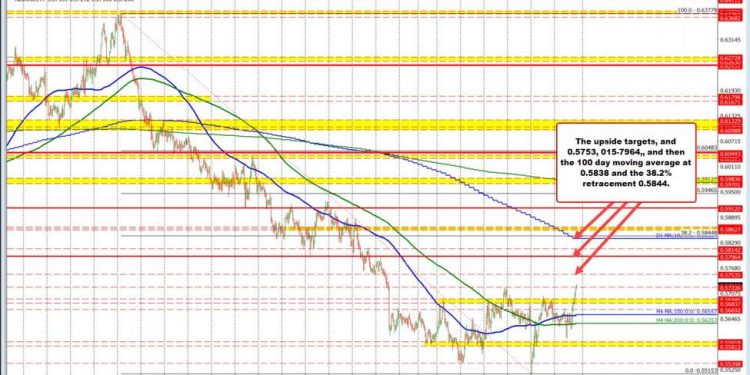

The AUDUSD is gaining power, reaching its highest ranges since mid-December. The following upside goal is 0.63986, adopted by the 38.2% retracement of the September decline at 0.64139. Past that, the 100-day shifting common at 0.64473 serves as one other key resistance stage. If bullish momentum continues, these ranges stay in focus as potential upside targets, signaling additional restoration inside the broader pattern.

AUDUSD technicals