- Bitcoin bear market might begin if BTC breaks beneath key help ranges.

- With BTC bouncing from $94K to $96,200, volatility is excessive.

With Bitcoin [BTC] briefly dipping below $94K earlier than rebounding to $97,200, volatility stays excessive.

On this local weather, a possible Bitcoin bear market danger lingers if key investor teams, at the moment sitting on unrealized earnings, begin promoting.

Key ranges to observe

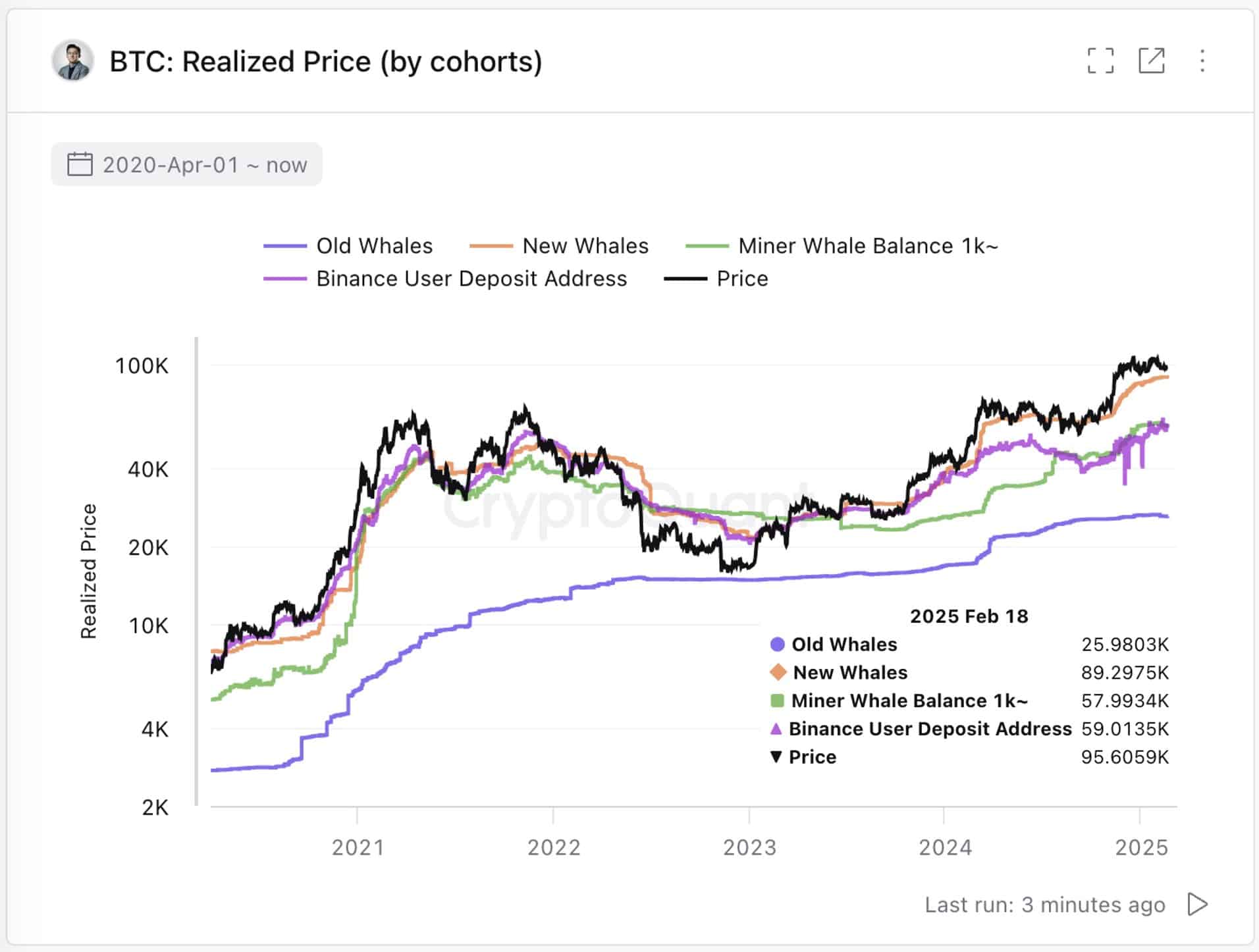

If BTC loses momentum, a drop beneath $89,300 might set off profit-taking amongst short-term holders (1,000+ BTC, held <155 days) whales, rising promote stress.

Nevertheless, the important thing degree to observe stays $58,000 – the realized worth of miner whales (wallets of mining firms that maintain over 1,000 BTC).

Traditionally, breaking beneath this mark has confirmed Bitcoin bear market cycles, making it a essential long-term help.

Whereas BTC holds a protected margin for now, sustained volatility might check these ranges. Holding above them is essential to sustaining bullish market construction.

Will bulls forestall a Bitcoin bear market?

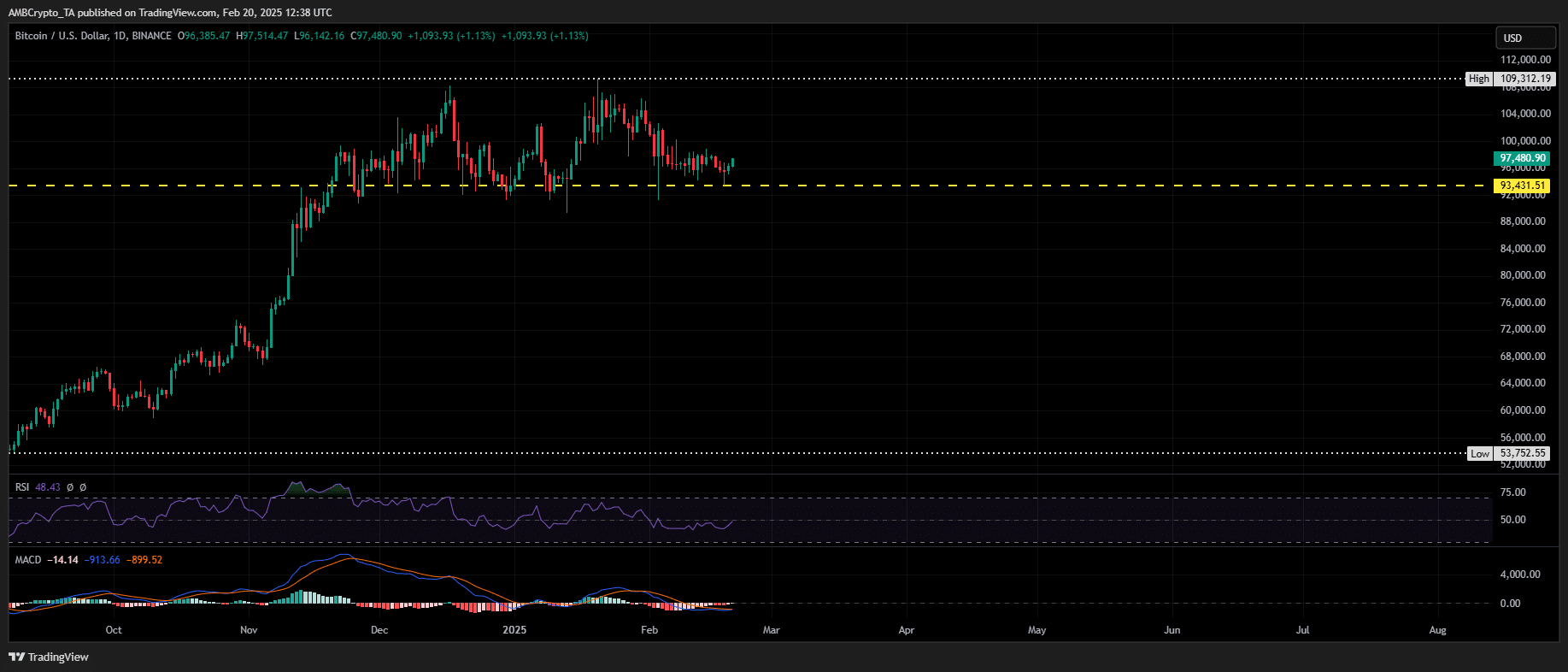

Regardless of a hawkish macro backdrop within the U.S., bulls have averted a Bitcoin bear market by defending the $90K degree for over a month, signaling sturdy demand.

Nevertheless, extended consolidation close to resistance suggests a possible liquidity entice.

If BTC breaches $99K without strong spot demand, leveraged lengthy positions might shut down, triggering liquidation cascades.

A drop again to $90K would then be a key check. Shedding this degree might push BTC towards $89,300, the place STH whales might start offloading, rising draw back stress.

Whereas a Bitcoin bear market isn’t confirmed, weak ETF inflows, fading FOMO, and declining network activity might set off a pointy reversal, wiping out billions in leverage.