As Nvidia (NVDA) prepares to launch earnings, merchants and traders usually are not simply anticipating headline EPS and income beats—these are largely anticipated. The important thing to Nvidia’s post-earnings inventory response will seemingly be underlying enterprise metrics and forward-looking development indicators throughout its AI, gaming, and information middle segments.

Right here’s a fast breakdown of what issues most in tonight’s earnings and what merchants ought to deal with past the floor numbers:

🚀 AI: The Core Progress Engine

- Anticipated: Robust AI chip gross sales, pushed by hyperscalers (Microsoft, Meta, Amazon, Google) and enterprise demand.

- What to Watch:

- Any indicators of AI spending slowing down or, conversely, orders accelerating past expectations.

- Provide constraints—can Nvidia sustain with demand?

- Gross margins—are they sustaining or enhancing regardless of excessive prices?

- H100 and Blackwell GPU adoption—how a lot traction are the next-gen chips getting?

🎮 Gaming: A Regular Money Move Contributor

- Anticipated: Average year-over-year development (~15%), however attainable quarter-over-quarter dip attributable to provide constraints.

- What to Watch:

- If demand for RTX GPUs stays sturdy regardless of worth hikes.

- Indicators of client weak point—is spending softening within the gaming market?

- Any hints at next-gen GPUs (RTX 5000 sequence) that would increase future gross sales.

🏢 Knowledge Facilities: The AI Infrastructure Play

- Anticipated: AI and cloud demand driving huge income development (~112% YoY).

- What to Watch:

- Hyperscaler spending developments—are cloud giants nonetheless ramping GPU orders?

- Competitors from AMD (MI300X) and Google/Amazon customized chips—is Nvidia nonetheless dominating?

- AI inference market development—how is Nvidia increasing past coaching chips?

How Merchants Might React

📈 Bullish Situation: If AI development stays explosive, Nvidia clears provide points, and hyperscalers proceed ramping GPU orders, anticipate upward momentum post-earnings.

📉 Bearish Situation: If there are indicators of AI demand cooling, supply-chain limitations, or weaker information middle orders, Nvidia may face post-earnings profit-taking—particularly after an enormous run-up.

Merchants ought to watch how these segments carry out in relation to expectations, as that can seemingly decide whether or not Nvidia extends its rally or sees a pullback.

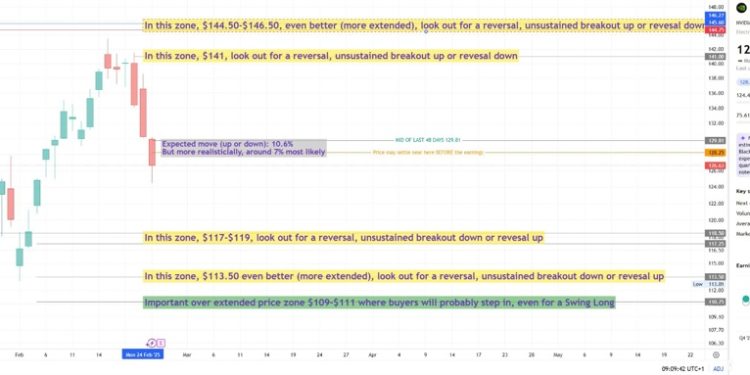

- NVDA is buying and selling close to the midpoint of its 48-day vary forward of earnings.

- Choices market implies a ten.6% transfer, however historical past suggests a extra life like 7% transfer.

- Projected post-earnings vary: $117 – $141, with deeper response zones at $113.50 and $144.50-$146.50.

- Finest buying and selling technique? Fading excessive strikes fairly than chasing breakouts.

Present Market Positioning: The place Is NVDA Now?

NVIDIA closed at $126.63 on February 25, 2025, following a six-day pullback from its $143.44 excessive on February 18th. This decline locations NVDA slightly below the midpoint of its 48-day vary, which spans $113.01 (Feb third low) to $148.97 (Jan twenty fourth excessive).

The market is pricing in uncertainty, however NVDA is neither at an excessive excessive nor an excessive low, reinforcing a impartial positioning that makes chasing breakouts riskier. As an alternative, fading worth extremes at key ranges gives a higher-probability technique.

The Choices Market: Implied Volatility and Anticipated Strikes for NVDA Earnings

- The front-month implied earnings straddle suggests a ±10.6% anticipated transfer.

- Primarily based on historic earnings developments, precise post-earnings strikes are nearer to two-thirds of that, roughly 7%.

Submit-Earnings Value Vary Projections for Nvidia

Assuming NVDA closes at $128.25 pre-earnings, the attainable worth vary is:

- Full 10.6% anticipated transfer:

- Upside: $141.75

- Draw back: $114.50

- Extra life like 7% transfer:

- Upside: $141

- Draw back: $118.50

This implies the most possible vary sits between $118.5 – $141, with stronger response zones past these ranges.

Quantity Profile and Order Move Issues for NVDA Inventory Upon Earnings

NVDA earnings buying and selling map; Searching for a contrarian and ready.

Key ranges from quantity profile evaluation spotlight potential short-covering zones and profit-taking areas:

- $117 – $119: Probably space for short-covering or an unsustained breakout down earlier than a reversal up.

- $113.50: A deeper liquidity zone the place a stronger response is predicted.

- $144.50 – $146.50: An prolonged stage the place lengthy merchants might take earnings, rising the likelihood of a reversal decrease.

- $109 – $111: If NVDA extends past anticipated volatility to the draw back, this stage is the place consumers will seemingly step in, even for a swing-long commerce.

Three key views emerge:

- Value is close to the center of the anticipated vary.

- The choices market supplies a way of the place volatility is probably going contained.

- Quantity profile information fine-tunes exact areas the place liquidity-based reversals are possible.

NVDA Earnings Buying and selling Method: Fading, Not Chasing

-

Contrarian pondering at prolonged ranges: When NVDA reaches excessive worth zones, the herd mentality typically results in emotional choices, creating high-probability contrarian alternatives.

-

Shopping for close to $110 when panic promoting happens:

- If NVDA drops to $110 or decrease, most merchants could also be frantically promoting, fearing additional draw back.

- Quantity profile evaluation suggests this can be a key liquidity zone the place institutional consumers might step in.

- As an alternative of promoting, a contrarian strategy could be to search for indicators of stabilization and a reversal to go lengthy.

-

Promoting close to $146 if euphoria takes over:

- If NVDA surges to $146+ after a powerful earnings report, retail merchants might chase the transfer, anticipating new all-time highs.

- Nevertheless, quantity profile suggests this zone is the place massive gamers might take earnings, resulting in a possible pullback or reversal.

- A contrarian strategy could be to monitor for indicators of an unsustained breakout up and search for quick alternatives.

-

Anticipate affirmation, not blind entries:

- Don’t fade strikes instantly—look forward to clear indicators of a failed breakout or a sustained reversal.

- Use your personal technique and danger administration to make sure a well-timed commerce execution.

The ideally suited technique is to fade excessive strikes fairly than chase them. Right here’s why:

-

Earnings strikes are sometimes overestimated pre-event.

- Merchants overpay for choices, resulting in exaggerated implied strikes.

- Possibility sellers (market makers) capitalize on this sentiment.

-

NVDA is close to its midpoint, not at an excessive.

- Breakouts are likely to fail extra typically than they succeed when a inventory is not close to a key excessive or low.

- Algos usually tend to fade extremes (shorting prolonged rallies, shopping for sharp dips).

-

Key Resistance and Help Ranges for Fading Strikes:

- Upside Resistance for Fades:

- $141: A key stage the place unsustained upside strikes might reverse decrease.

- $144.50 – $146.50: A increased likelihood promote zone, the place longs take earnings.

- Draw back Help for Fades:

- $117 – $119: First space for potential short-covering and a bounce.

- $113.50: A higher risk-reward zone for consumers.

- $109 – $111: Deeply prolonged purchase zone for a long-term swing place.

- Upside Resistance for Fades:

Execution Ways for Fading Strikes at NVDA

A Structured Playbook for NVDA Earnings, However This Is Solely An Opinion

- Use this as an opinion about the right way to play NVDA earnings tonight, or at the least take some data-backed worth ranges talked about into consideration

- The choices market suggests a big transfer, however historical past helps a extra tradable 7% vary.

- NVDA is close to the midpoint of its multi-week vary, making breakout chasing unreliable.

- Finest commerce? Anticipate extremes (both $113.50 – $119 or $141 – $146.50) and fade the transfer again towards equilibrium.

- Keep away from going lengthy close to $145+ or quick close to $117—as a substitute, let worth attain key response zones earlier than getting into trades.

This will not be monetary recommendation, however fairly a structured strategy to earnings buying and selling primarily based on options-derived anticipated strikes, quantity profile ranges, and historic worth habits.

Visible Information: NVDA’s Anticipated Earnings Vary and Key Buying and selling Zones

The next chart highlights the key ranges to observe post-earnings, reinforcing the fade-the-move technique.

By following this strategy, merchants will be ready, not reactive, and function with a logical buying and selling map fairly than emotional bias. Whereas something can occur—NVDA may break down 17% or rally to new highs—the focus right here is on a structured, high-probability technique fairly than speculative bets.

Go to ForexLive.com for extra views and vital updates.