- XAG/USD slips to $31.13, with draw back dangers rising

- Silver fails to carry above $33.00, triggering consolidation and promoting stress.

- Worth assessments 100-day SMA at $31.20; subsequent key assist at 50-day SMA of $30.89.

- Break under $30.89 may expose 200-day SMA at $30.47 and January low of $29.70.

Silver ended the week on a decrease notice, down virtually 4%, as merchants booked income amid US recession jitters following the discharge of essential US knowledge. On the time of writing, the XAG/USD trades at $31.13, down 0.32%.

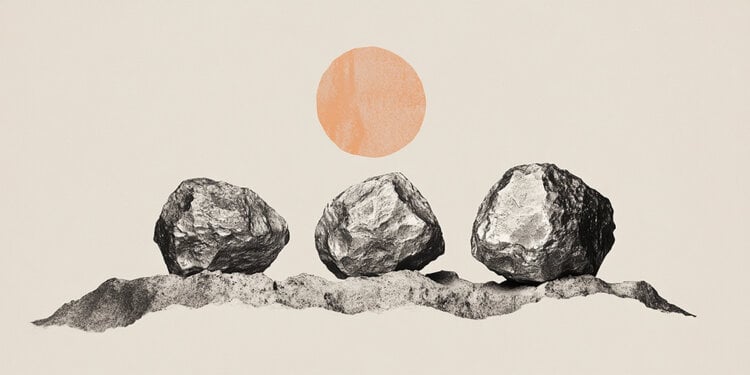

XAG/USD Worth Forecast: Technical outlook

The gray metallic had proven indicators of consolidation after failing to decisively clear the $33.00 on a every day closing foundation, which may’ve exacerbated a rally in the direction of the $34.00 determine. As an alternative, XAG/USD spot value cleared the 100-day Easy Shifting Common (SMA) at $31.20, opening the door to check the 50-day SMA at $30.89.

Though bears pushed costs decrease, consumers reclaimed $31.00. Nonetheless, the Relative Energy Index (RSI) exhibits sellers are gathering momentum.

Subsequently, XAG/USD’s first assist could be the 50-day SMA at $30.89 on additional weak point. A breach of the latter will expose the 200-day SMA at $30.47. If sellers conquer these two ranges, the development shifts downwards, and bears could be poised to problem the January 27 every day by means of at $29.70.

XAG/USD Worth Chart – Every day

Silver FAQs

Silver is a treasured metallic extremely traded amongst buyers. It has been traditionally used as a retailer of worth and a medium of trade. Though much less well-liked than Gold, merchants could flip to Silver to diversify their funding portfolio, for its intrinsic worth or as a possible hedge throughout high-inflation intervals. Buyers can purchase bodily Silver, in cash or in bars, or commerce it by means of automobiles equivalent to Trade Traded Funds, which observe its value on worldwide markets.

Silver costs can transfer attributable to a variety of things. Geopolitical instability or fears of a deep recession could make Silver value escalate attributable to its safe-haven standing, though to a lesser extent than Gold’s. As a yieldless asset, Silver tends to rise with decrease rates of interest. Its strikes additionally depend upon how the US Greenback (USD) behaves because the asset is priced in {dollars} (XAG/USD). A robust Greenback tends to maintain the worth of Silver at bay, whereas a weaker Greenback is more likely to propel costs up. Different components equivalent to funding demand, mining provide – Silver is rather more plentiful than Gold – and recycling charges may also have an effect on costs.

Silver is extensively utilized in trade, notably in sectors equivalent to electronics or photo voltaic vitality, because it has one of many highest electrical conductivity of all metals – greater than Copper and Gold. A surge in demand can enhance costs, whereas a decline tends to decrease them. Dynamics within the US, Chinese language and Indian economies may also contribute to cost swings: for the US and notably China, their massive industrial sectors use Silver in numerous processes; in India, customers’ demand for the valuable metallic for jewelry additionally performs a key function in setting costs.

Silver costs are inclined to observe Gold’s strikes. When Gold costs rise, Silver usually follows go well with, as their standing as safe-haven property is analogous. The Gold/Silver ratio, which exhibits the variety of ounces of Silver wanted to equal the worth of 1 ounce of Gold, could assist to find out the relative valuation between each metals. Some buyers could think about a excessive ratio as an indicator that Silver is undervalued, or Gold is overvalued. Quite the opposite, a low ratio may recommend that Gold is undervalued relative to Silver.