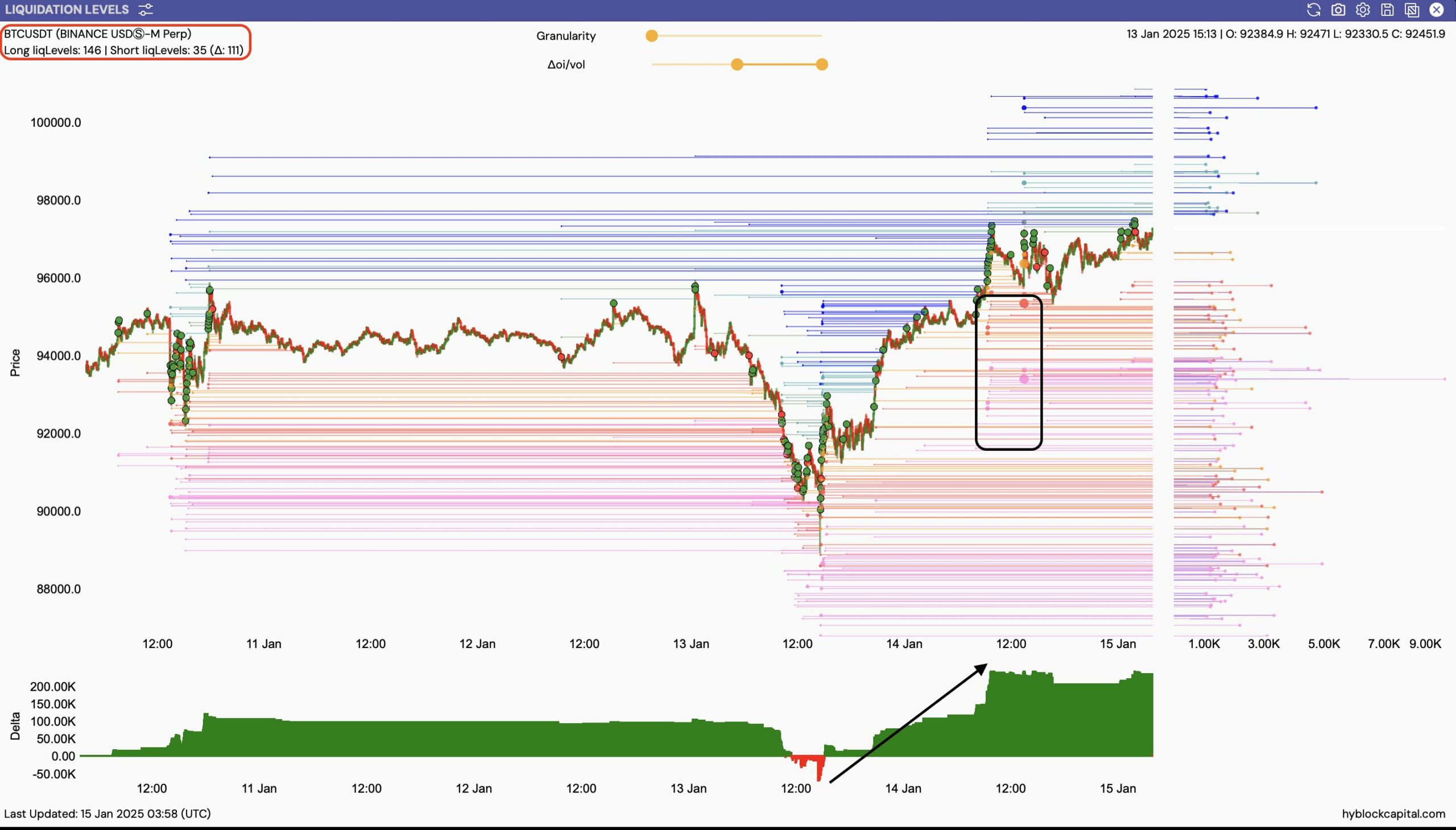

- Bitcoin has been seeing fewer quick liquidity, ranges in comparison with lengthy liquidity ranges

- BTC’s yearly excessive is one to interrupt for the bulls to make one other go for a brand new ATH.

Following Bitcoin’s latest uptrend on the charts, an evaluation of the liquidation heatmap revealed a major hike in lengthy liquidity ranges. The truth is, this was significantly evident across the $90,000 worth zone. This shift resulted within the basis of assist ranges extending to $88,800 that weren’t tapped into, reinforcing a powerful buy-in space for merchants.

Conversely, quick liquidity ranges had been much less prevalent – An indication of an absence of bearish conviction amongst merchants, indicating that the potential for decline could also be restricted.

This imbalance between lengthy and quick positions may indicate a bullish outlook for BTC within the quick time period. If that is maintained, Bitcoin may problem its higher resistance ranges, additional empowering bullish merchants.

Important lengthy positions spotlight market confidence, probably driving the value in direction of greater benchmarks. In the meantime, fewer quick positions scale back the possibility of great worth drops, creating a good setting for additional worth positive aspects.

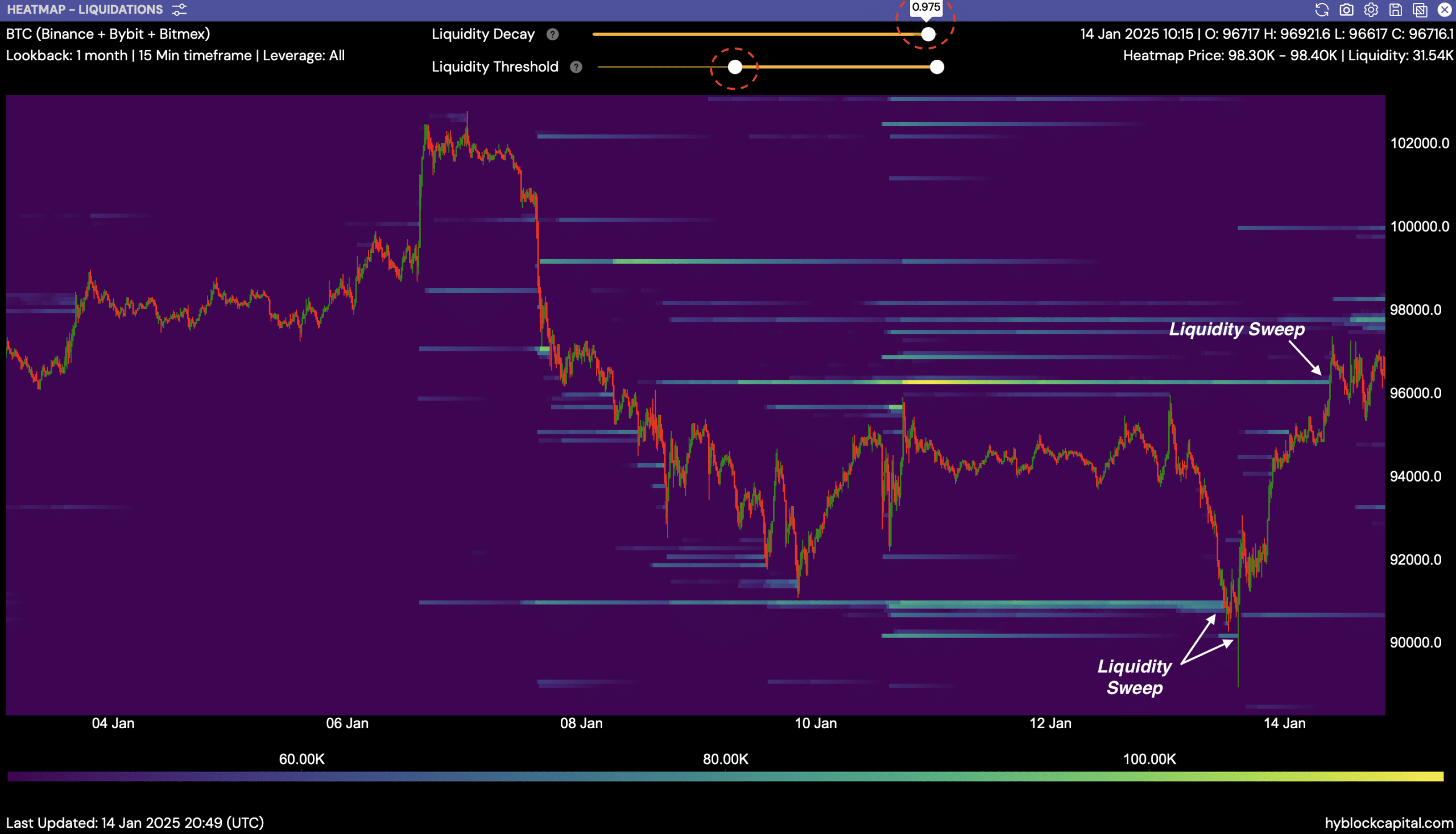

Liquidity sweeps on each side

Wanting on the habits of the value, BTC appeared to be sweeping liquidity clusters on each side of round $90k, the place vital shopping for occurred, prompting a fast hike to its present ranges. Notable worth ranges had been close to $98,300 and $96,700, as evidenced by a number of liquidity sweeps seen at these zones.

The latest upswing to only under $98,400, adopted by a retraction, underscored the pivotal function these clusters play in figuring out short-term worth actions.

The interactions round these worth factors, significantly the sweep close to $90k, illustrated how merchants capitalize on sudden worth drops to build up positions – Subsequently driving a rebound.

This sample pointed to potential for sustained volatility as merchants reply to liquidity thresholds, impacting the market’s directional bias. Proper now, the strategy is cautious, with the potential of additional checks of the liquidity bands.

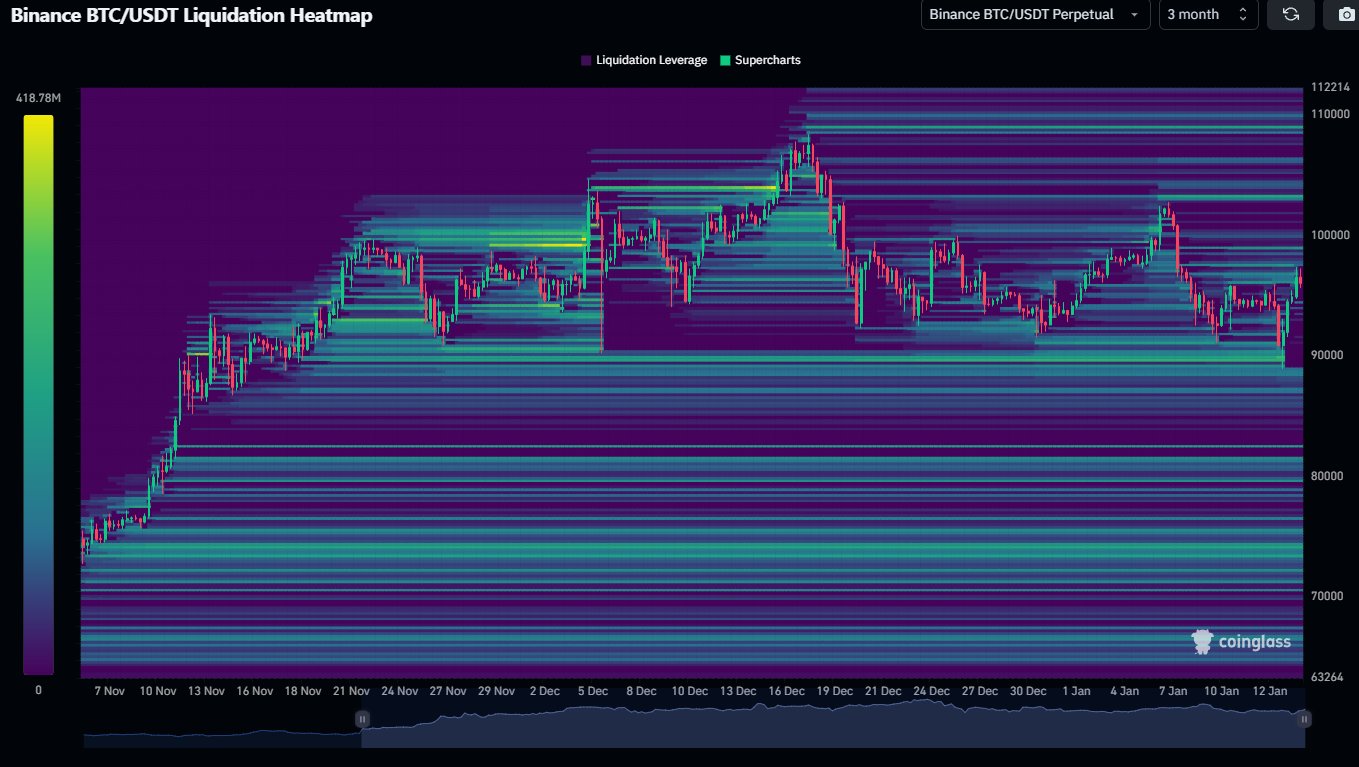

What does BTC want for a brand new ATH?

The liquidity sweep on the $90k-level was key for brief to mid-term worth actions. Sturdy upward motion instantly following this liquidity occasion affirmed it as a strategic level for worth restoration.

The $90k-level, specifically, additionally appeared as a frequent goal for each whale manipulation and retail cease hunts, furthering its function as a pivotal market zone. The extent has been key for Bitcoin’s current price. Particularly because it approaches the psychological degree at $100k.

Notably, the yearly excessive close to $103,000 stays a formidable barrier. A break above this degree may catalyze a surge in direction of a brand new all-time excessive. Merchants ought to take into account these liquidity zones when planning their market entries and exits.