Main corporations in Oman, Abu Dhabi and Saudi Arabia are planning to launch metallic buying and selling corporations, because the area faucets into rising demand for metals whereas it seems to be to diversify past oil and gasoline.

Abu Dhabi-based Worldwide Sources Holding, a mining firm that’s a part of a conglomerate chaired by highly effective Emirati royal Sheikh Tahnoon bin Zayed al-Nahyan, has already constructed out a 60-person buying and selling unit to deal with vitality and metals.

Minerals Improvement Oman, the state-owned mining firm, can be within the technique of hiring a prime govt to steer a 25-person buying and selling group, in response to MDO’s chief govt, Mattar Al Badi.

The buying and selling plans come as many oil-dependent Gulf states search to place themselves within the world provide chain for the metals wanted for the vitality transition, akin to copper, lithium and iron ore.

“These international locations wish to diversify from oil, and they’re exploring each alternative to take action,” mentioned JF Lambert, founding accomplice of consultancy Lambert Commodities.

Most of the world’s greatest oil merchants, akin to Vitol, Mercuria and Gunvor, have additionally just lately expanded their metallic buying and selling operations.

Over the previous 5 years, commodity buying and selling exercise has steadily shifted away from the standard hubs of London and Geneva in the direction of the Center East, notably Dubai, the place there was a surge of latest buying and selling places of work.

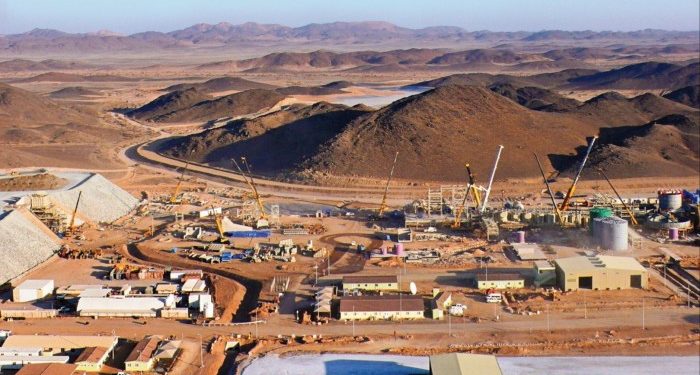

Oman, whose oil manufacturing is modest in contrast with neighbouring Saudi Arabia and UAE, will set up a buying and selling firm beneath MDO, which has just lately revived copper extraction from its Lasail mine after a three-decade hiatus.

Al Badi, MDO chief govt, mentioned the buying and selling firm would assist organise Oman’s fragmented exports of chromite and gypsum, and assist the nation get a greater value for its sources.

“Oman is among the greatest international locations in exporting gypsum, however the market shouldn’t be organised,” Badi mentioned. A buying and selling firm would assist Oman “make sure that we maximise the margin” from its items, he added.

MDO is in talks with six worldwide commodities companies — Trafigura, Glencore, Traxys, IXM, Mercuria and Gunvor — over a possible offtake association for its processed copper and partnership in its buying and selling unit.

In Abu Dhabi, one of many world’s prime 10 oil producers, IRH has already employed a buying and selling group in oil and gasoline, in addition to metals, and has been in discussions about potential buying and selling alternatives with worldwide merchants, together with Mercuria.

IRH mentioned it was buying and selling commodities from third events throughout base metals, vitality merchandise and iron ore, in addition to creating a “proprietary buying and selling portfolio spanning world commodities and structured transactions”.

A part of nationwide safety adviser Sheikh Tahnoon’s sprawling Worldwide Holding Firm, IRH burst on to the mining scene in late 2023, agreeing to purchase a 51 per cent stake in Zambia’s Mopani copper mine for $1.1bn.

In one other signal of the Gulf’s pivot in the direction of metals and minerals, Abu Dhabi upped its wager on mining final week. Sovereign investor ADQ introduced a $1.2bn three way partnership with specialist metals investor Orion Sources, which is able to give attention to copper, iron ore and different supplies. Each side will initially make investments $600mn.

Philip Clegg, managing accomplice of the three way partnership, mentioned on prime of shopping for stakes in miners, the investments had been being made to safe the long-term provide of vital minerals.

The Gulf was “changing into a way more dynamic place, and way more strategic in the way in which that gamers inside the area are desirous about easy methods to put money into the sector”, he mentioned.

Saudi Arabia, the area’s greatest economic system and the world’s largest oil exporter, is investing closely in creating its home mining sector, and the federal government sees mining as a 3rd pillar of the economic system, alongside oil and petrochemicals.

State-owned miner Ma’aden and sovereign Public Funding Fund have a collectively managed mining funding fund, Manara. Bob Wilt, Ma’aden chief govt, mentioned final 12 months that Manara was planning to construct a buying and selling group, and that Manara’s function was to “safe offtake of vital minerals” to fulfill the wants of Saudi Arabia.

Nonetheless, in response to a number of merchants, Manara couldn’t obtain metals produced in 2024 by Vale Base Metals, by which it owns a ten per cent stake, as a result of its buying and selling group was not prepared but.

Manara and Mercuria declined to remark.