Juan Flores is professor of financial historical past on the College of Geneva. Mitu Gulati is professor of legislation on the College of Virginia.

When governments difficulty bonds they often have to offer loads of disclosure to entice buyers. As of late this typically consists of info on the nation’s environmental, social and governance requirements — the now-infamous acronym ESG.

However what about within the mid-Nineteenth century, when many international locations had been autocracies and a few had been going through civil wars over questions resembling whether or not to abolish slavery? As a logical matter, you’d assume that buyers would care about such issues.

In any case, home turmoil over an establishment resembling slavery — significantly the place slave labour was thought-about essential to manufacturing in necessary and politically-influential sectors of the economic system — ought to matter to bond yields. But there’s barely any point out within the analysis on slavery and sovereign debt of the views, not to mention involvement, of buyers within the decision of such issues. Was this a subject that buyers cared about?

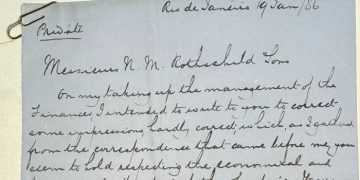

A letter from 1886 that we stumbled upon within the Rothschild Archive in London means that no less than some did.

Within the field for a Brazilian bond difficulty from February 26, 1886, there was a letter from a Brazilian authorities official, Mr. Belisario, to the Rothschild Financial institution in London, responding to the issues of British buyers concerning the progress being made in Brazil in the direction of abolishing slavery.

The clerks of the financial institution usually filed letters in packing containers labelled “correspondence”. However this one was not. It was, unusually, within the field for the bond contracts. (Archivists have a tendency to not disturb the unique submitting of fabric). This means that the Rothschild bankers thought it was necessary and related to buyers in Brazilian bonds, regardless of the funds of Brazil being in fine condition in 1886.

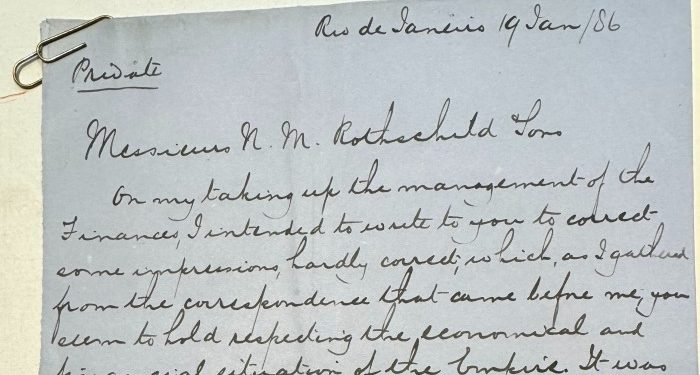

Right here’s the principle dialogue of slavery within the letter dated January 19, 1886.

To: Messieurs N.M. Rothschild & Sons:

On my taking over the administration of the Funds, I supposed to put in writing to you to appropriate some impressions, hardly appropriate, which, as I gathered from the correspondence that got here earlier than me, you appear to carry respecting the economical and monetary state of affairs of the Empire.

. . .

[An] apprehension indulged in by those that [study/watch] the affairs of Brazil [is the] the slave query, or the transformation of slave labour into free labour. This topic, which has agitated the general public thoughts right here as a lot throughout almost two years, has entered upon a state of calm and peaceable resolution, which we should regard as definitive, seeing that the legislation these days voted comprises in itself the technique of abolishing slavery utterly within the house of 14 years, a interval enough to let the change be effected with out confusion . . . or nice accidents. And because the conservative social gathering has simply assumed the path of public affairs, & it could be taken with no consideration that enough time can be reserved to impact the answer to the issue, nothing unexpected is to be feared on this enterprise, which in addition to, in some provinces is being significantly superior with out inconvenience.

What was happening? On the time, correct details about goings on in nations as distant as Brazil was arduous to acquire. One operate that the Rothschilds carried out for purchasers was to acquire and supply info — and their lengthy standing relationship with Brazil (one which began within the 1820s) meant that they had been a trusted supply of fine info.

Traders clearly needed to learn about what progress was being made in the direction of abolishing slavery, and the correspondence displays the Rothschilds trying to acquire this info.

Why did buyers care? We can not inform from the letter, and we couldn’t discover something that spelt out the Rothschild issues that triggered it. One chance is that buyers had been merely anxious about how a lot it could price to compensate the landed elite, who had been professional slavery, to acquiesce to abolition. In any case, the £20mn price of the UK’s personal 1833 Slavery Abolition Act amounted to about 40 per cent of the federal government earnings that 12 months.

One other could possibly be that buyers had been anxious about attainable political strife over the query of abolition. Provided that this was 1886, reminiscences of the destruction attributable to the 1861-65 US civil struggle had been in all probability nonetheless contemporary. The Brazilian Emperor, Don Pedro II, abhorred slavery, however he confronted opposition from plantation house owners that had been the monarchy’s main help, so home turmoil was hardly unthinkable.

Lastly, one intriguing chance is that the Rothschilds’ primarily British purchasers merely disapproved of slavery, and needed it abolished to maintain shopping for the nation’s bonds.

On the time, there was appreciable hostility to slavery in Britain, together with from the British authorities particularly vis-à-vis Brazil. And because the historian Niall Ferguson has proven, the Rothschilds weren’t above utilizing the promise of bond issuance to persuade international locations into adjusting their insurance policies to raised attraction to the sensitivities of British buyers.

The primary instance was an 1818 bond issued in London on behalf of Prussia. To safe the issuance’s success, Nathan Mayer Rothschild, then the pinnacle of the highly effective London department of the banking household, insisted on a mortgage on royal lands, and influenced a subsequent debt decree that earmarked revenues to service Prussia’s money owed and enshrined a ceiling on them that would solely be modified “in session with and with the assure of” the Prussian Estates, the nation’s proto-popular meeting.

This arguably represented a refined imposition of British political requirements on Prussia — probably the primary ever instance of what we right now would name ESG. As Nathan Rothschild wrote to the Prussian finance minister:

[To] induce British Capitalists to take a position their cash in a mortgage to a international authorities upon affordable phrases, will probably be of the primary significance that the plan of such a mortgage ought to as a lot as attainable be assimilated to the established system of borrowing for the general public service in England, and above all issues that some safety, past the mere good religion of the federal government . . . ought to be held out to the lenders.

. . . With out some safety of this description any try to lift a substantial sum in England for a international Energy can be hopeless[;] the late investments by British topics within the French Funds have proceeded upon the overall perception that in consequence of the consultant system now established in that Nation, the sanction of the Chamber to the nationwide debt incurred by the Authorities affords a assure to the Public Creditor which couldn’t be present in a Contract with any Sovereign uncontrolled within the train of the manager powers.

By 1886, Nathan Mayer Rothschild had handed away, however his household had helped set up London because the dominant monetary centre and themselves because the world’s most influential financiers. Anybody who wanted to borrow massive sums of cash must do it in London, and doubtless by the Rothschilds.

Regardless of the core reason for the issues, the Brazilian letter author clearly noticed it as necessary to guarantee the Home of Rothschild that the transfer in the direction of abolishing slavery was progressing in an orderly and peaceable style. Furthermore, this wasn’t the one echo of recent disclosure requirements. The letter additionally stresses that Emperor Don Pedro II was in good well being and anticipated to proceed in workplace for a few years — an assurance of political stability for buyers.

So how did issues prove? Simply two years after the date of the letter, versus the 14 years contemplated within the letter, Brazil abolished slavery. However the promise of political stability proved much less dependable. In 1889 there was a coup d’état that swept apart the Brazilian monarchy, and Pedro II died in Parisian exile in 1891. Oops.

Nonetheless, whereas an outdated regime’s international advisers often get proven the door when governments falls, the Rothschild-Brazil relationship survived. In reality, when Brazil hit monetary turbulence within the Eighteen Nineties and was liable to failing to repay their prior bonds, the Rothschilds helped Brazil increase new cash to remain present with buyers.

What’s right now’s relevance of this? Nicely it reveals that buyers and funding intermediaries have lengthy cared about how debtors tackled the key social problems with the time, and will use cash to subtly affect behaviour.

The damaging response that bond buyers needed to president Donald Trump’s threats to fireside the chair of the Fed — and Trump’s subsequent U-turn — are an instance of this right now. (We’re prepared to wager that there are communications between the heads of huge monetary establishments right now and the Trump administration saying “we’re anxious about your periodic threats to fireside Jerome Powell”). For bond buyers, the Rothschild letter represents the 1886 model of ESG.

However most of all, we expect it’s only a enjoyable story, good for the lengthy weekend.